President Lincoln suspended the gold standard in December 1861 during the American Civil War. This led to the introduction of Greenbacks, which began trading on what later became the New York Stock Exchange on January 29th, 1863. The price of gold fluctuated wildly during the summer of 1862. To address this, the NYSE initially prohibited future deliveries (time sales with settlements deferred up to 60 days) in a patriotic move. However, speculation persisted, leading to a complete ban on cash sales. This heavy-handed restriction proved untenable and was lifted in less than a month. Nevertheless, international business still relied on gold.

Lincoln faced a dilemma. While declaring Greenbacks legal tender domestically, they couldn’t be used internationally, necessitating an exchange rate between Greenbacks and gold. Attempts to curb speculation included taxing gold sales with settlements longer than three days. Traders quickly caught on to the government’s measures, prompting them to create a new exchange solely for gold trading on October 12th, 1863. Spearheaded by Samuel S. Gilpin, this new operation, known as the “Gold Room,” was housed within the Merchants’ Exchange building at 26 Exchange Place. However, the lack of regulatory oversight led to the formation of the New York Gold Exchange by dissatisfied traders, including James Boorman Colgate, son of Colgate-Palmolive’s founders.

The historical pattern is noteworthy. Lincoln’s actions during the Civil War, followed by Roosevelt’s gold confiscation in 1934, illustrate a trend of government intervention in financial markets. Looking ahead, the rise of Central Bank Digital Currencies (CBDCs) poses risks such as government control over political donations and spending, potentially including bans on gold and cryptocurrencies.

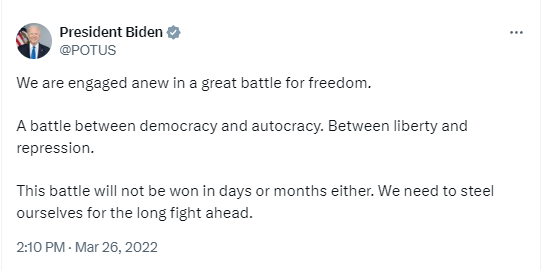

Recent events, including Biden’s actions on March 26th, 2022, raise concerns. By bypassing Congress to effectively declare war on Russia, Biden’s actions may constitute covert treason, orchestrated by figures like Victoria Nuland. The Neocons’ animosity towards Russia and their influence on policy decisions reflect a dangerous disregard for potential consequences. As government aggression increases, expect widespread restrictions and even food rationing in countries like the USA, Canada, Japan, Australia, New Zealand, and Europe. This autocratic approach contradicts accusations against Putin’s regime and undermines citizens’ rights to substantive decision-making.