Industry experts are starting to doubt if the SEC will give the green light to Spot Ether ETFs in May, a Reuters report says.

Recent discussions between ETF creators and the SEC have been one-sided. The SEC staff hasn’t talked much about the proposed products, according to four people involved.

This is different from the thorough talks before the SEC approved spot bitcoin ETFs in January. These discussions were detailed and involved both parties, but recent meetings lack this depth.

Before the historic approval of bitcoin ETFs, the SEC had rejected spot BTC ETF filings for over ten years. They changed their stance after Grayscale Investments won a court case against the SEC in August 2023.

Many experts think the SEC will likely delay approving Ether ETFs further. Todd Rosenbluth, a data analyst at VettaFi ETF, said it’s probable that approval will be pushed back to later in 2024 or even later because the rules are still unclear.

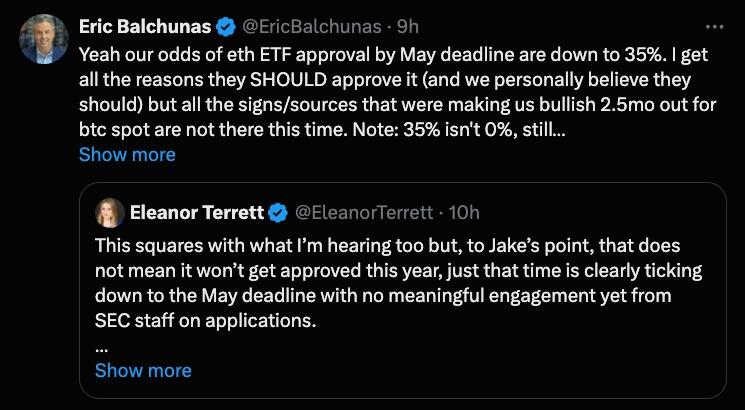

Eric Balchunas, an ETF analyst at Bloomberg, estimated in March that there’s only about a 35% chance the SEC will approve a spot Ether ETF in May. He suggested the SEC might be purposely not communicating with ETF creators.

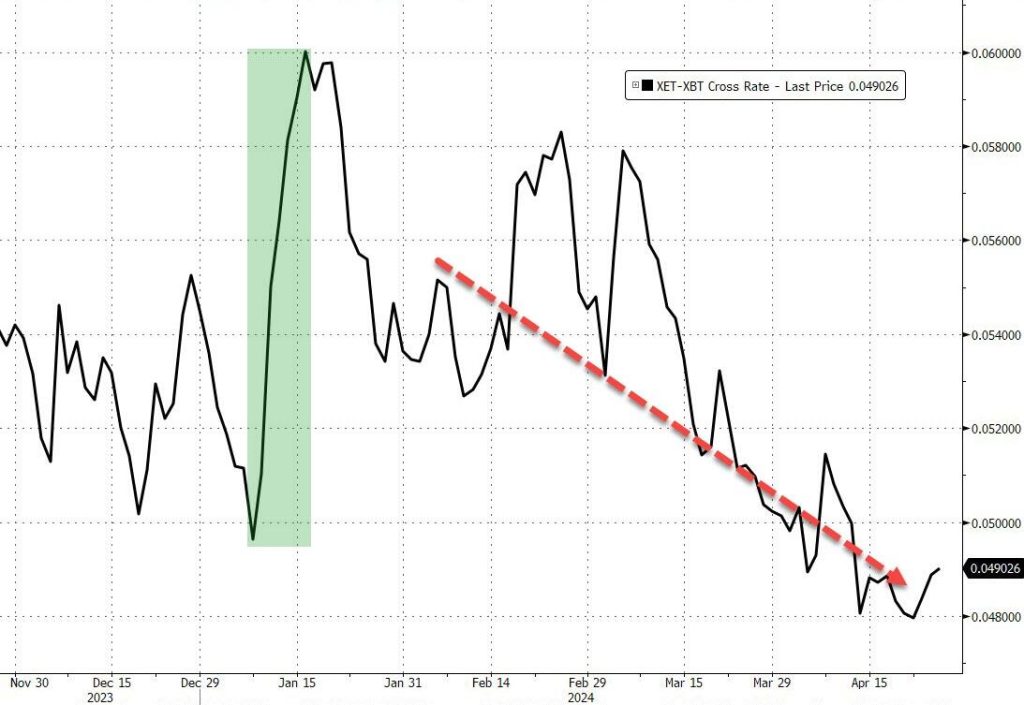

Since the introduction of spot bitcoin ETFs, the price of Ether has been relatively lower compared to bitcoin, as hope fades for Ether’s approval as an ETF… for now.

Balchunas also pointed out that SEC Chair Gary Gensler’s opinion on Ether could affect the decision. Gensler has not clarified whether Ether is a security.

Recently, Consensys, a major supporter of the Ethereum blockchain, filed a lawsuit against the SEC in Texas federal court. They want the court to declare that Ethereum’s digital token, Ether, is not a security.

The lawsuit argues that if the SEC takes control over Ether, it would harm the Ethereum network and Consensys. This could stop people from using Ethereum in the United States, affecting one of the internet’s greatest innovations.

Gensler’s actions have upset many in the crypto industry. They argue that the SEC hasn’t provided clear rules or considered the unique features of blockchain technology.

The debate over Ethereum intensified since the SEC has previously stated that Ethereum’s tokens, like Bitcoin’s, are not securities. However, recent actions by Gensler suggest otherwise.

The release of ‘Hinman documents’ last June revealed that network decentralization plays a role in the SEC’s decision on whether a digital token is a security.

If the SEC doesn’t approve a spot Ethereum ETF in May, it could lead to legal action afterward, according to Panigirtzoglou, an expert interviewed by The Block.

Consensys founder Joe Lubin criticized the idea that staking makes Ethereum a security. He believes Gensler’s position is an attempt to hinder crypto’s growth.

The Consensys lawsuit is part of a broader strategy by the crypto industry to challenge the SEC’s decisions in court. Winning a favorable judgment could lead to an appeal to the Supreme Court.

Meanwhile, Hong Kong’s Securities and Futures Commission approved the first batch of spot Bitcoin and Ether ETFs, which are expected to start trading on April 30.