Chris Quill: Welcome back to another episode of What’s On Your Mind. The festive season is almost here, and we’ve got US mentors Raj Malhotra and Ben Berggreen on the show. Great to have you both. I’m eager for some good trade ideas, so let’s dive in. Raj, why don’t you start?

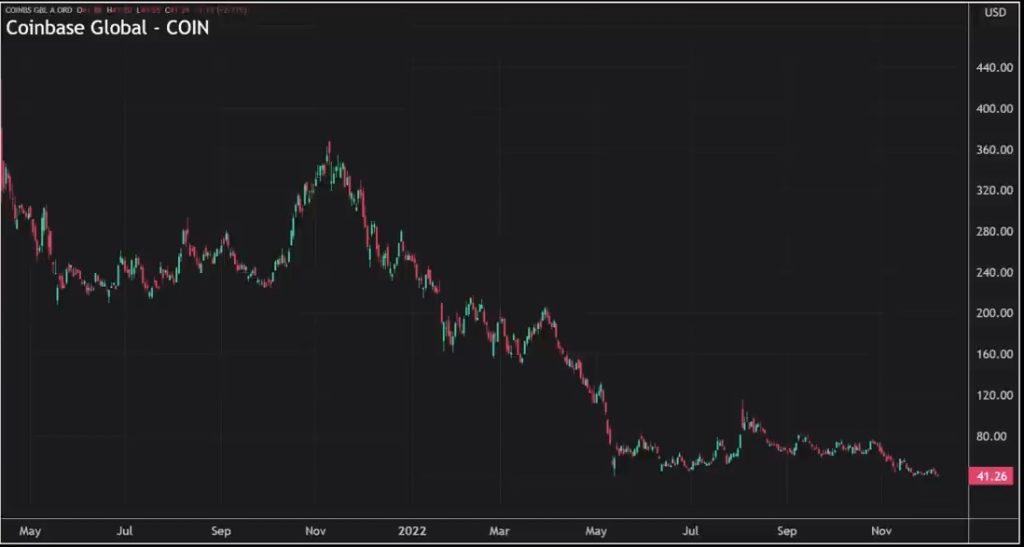

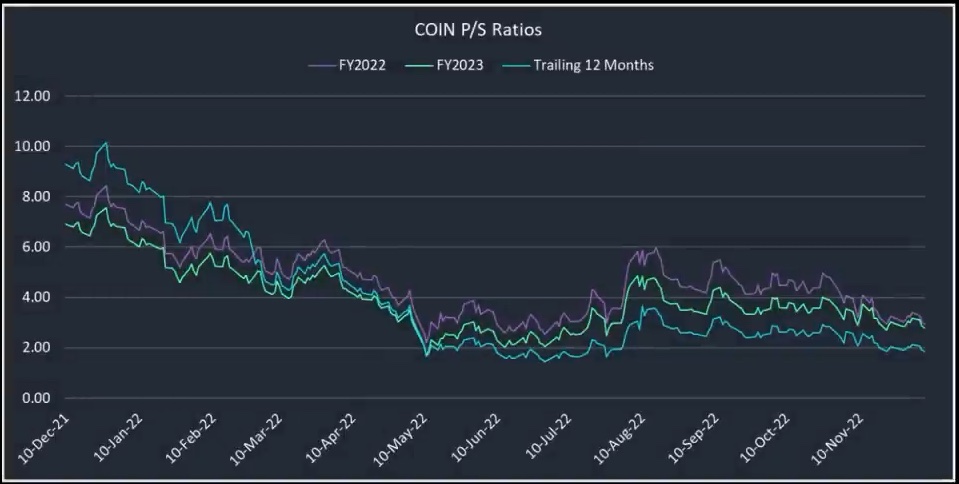

Raj: Alright, to kick off the festive season, I’m eyeing a short position on a company that’s in trouble. Despite recent volatility, the market has remained flat since September 1st. So I’m scouting for both long and short opportunities. Let’s begin with a short. Coinbase, ticker coin, is on my radar. It’s the largest crypto exchange in the US by trading volume, but its financial picture is bleak. The stock price sits around $44, with a market cap of about $10 billion. Even though it’s below my usual short targets, Coinbase stands out due to its grim financials. They’re losing money, with no dividends, and their stock has plummeted around 80% year-to-date. The recent earnings report on November 3rd was abysmal, missing both EPS and revenue expectations. This decline isn’t helped by negative headlines, including scandals and losses.

The core issue is Coinbase’s flawed business model. Despite some claiming that competitor bankruptcies could benefit Coinbase, I disagree. Their trading volume spike post-bankruptcy is likely due to panic selling, not sustainable growth. Furthermore, there are serious doubts about the safety of customer assets in case of bankruptcy, as stated in their 10-Q. Coinbase’s costly operation, coupled with a shrinking market, paints a grim future. Even if you’re bullish on crypto, investing in Coinbase seems unwise. Their earnings report in February could confirm this downward trend. I recommend buying downside puts, as there’s potential for rapid decline, similar to what we’ve seen with other companies.

Chris: Thanks for that, Raj. Now, Ben, over to you. What’s your take?

Ben: I’m also leaning towards a short position, echoing Raj’s sentiments on Coinbase’s bleak future. I’ll discuss another short I recently exited, PGNY, a fertility solutions clinic. Despite claiming a holistic approach, their financials paint a worrisome picture. With a $3 billion market cap and earnings due in February, PGNY appears fragile in this volatile market. Revenue seems stable, but earnings per share has plummeted, indicating underlying issues. In today’s market, such companies struggle to survive without strong financial backing.

Companies are focusing a lot on making more money, especially now. Before, even if a company didn’t earn much, it could still do well if it had good sales. But that’s not the case anymore. Companies nowadays need to show that they’ll make good money in the future, and that’s not happening much.

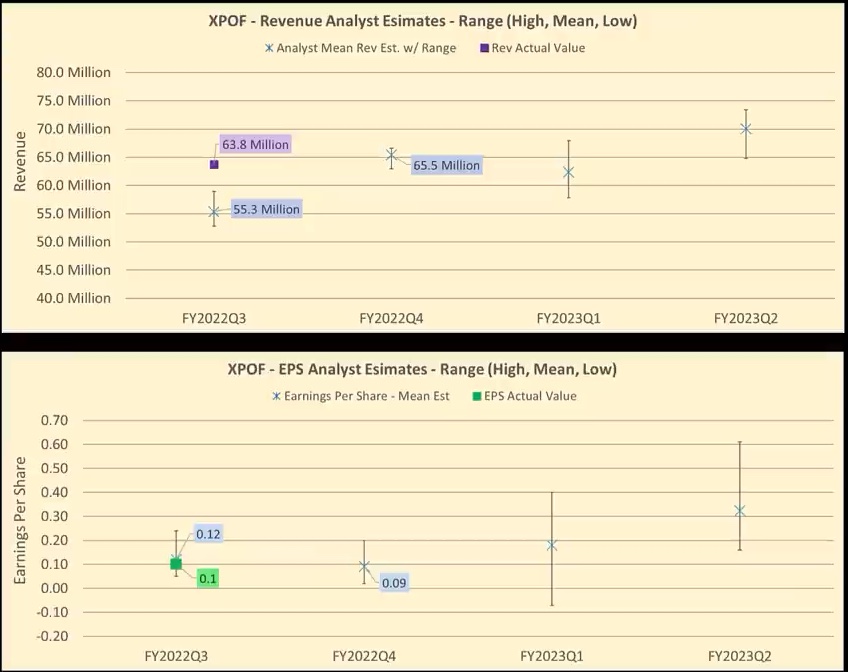

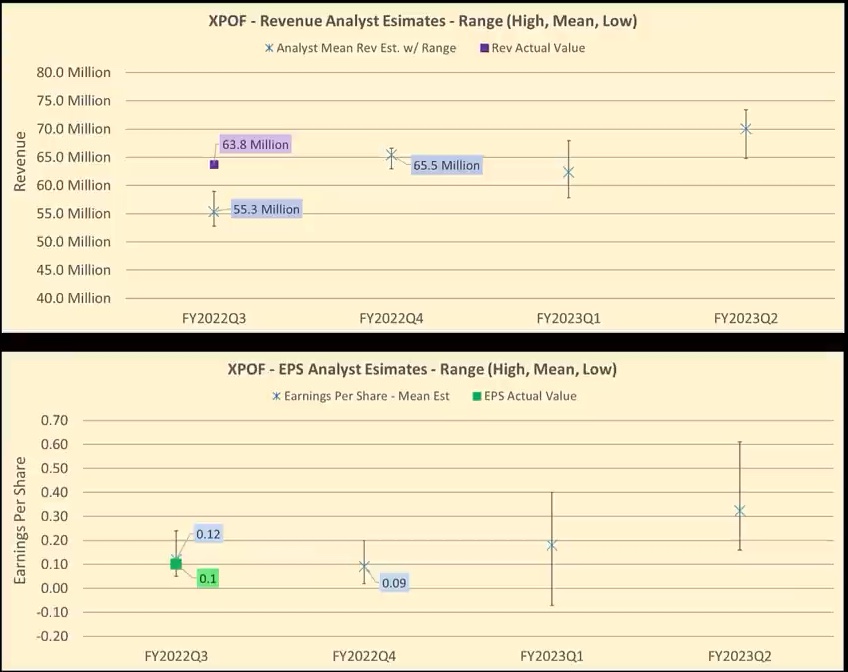

I’m looking at a chart showing how people expected a certain company to earn money per share in the fourth quarter. Earlier this year, they thought it would be about 27 cents, but now it’s down to just 2 cents. That’s a big drop. Last quarter, the company’s numbers were mixed. They did okay in some areas, but not as well as people thought.

Sales have been good lately. Last quarter was the best ever for the company, with over 200 million in sales. They also got more customers. So it’s not all bad, but if you look closer, you’ll see their overall profits and how much money they’re making are shrinking.

That’s why it seems like the company’s value might go down. I’m showing you a graph of something called return on equity investment, and it’s not looking great. Even though their total profit went up by 61% from last year, they also spent a lot more on things like stock compensation. That means their profit margins are getting squeezed, and the company’s leaders think they won’t make as much money in the future.

Also, the company’s stock is expensive. In a market like this, where prices matter a lot, their price-to-earnings ratio is over 84.64. That’s really high. And even though the stock price has been dropping lately, it’s still not a good deal when you look at how much they’re selling compared to how much money they’re making.

In tough times like these, people tend to stick with what they know works. They’re not too interested in trying new things. Last week, I looked at some options for this company’s stock and ended up buying some. I got in on Friday and sold this morning, making a 100% profit in just a few days. I might buy more next week if things look good.

So, that’s what’s been going on with this company lately.

Alright, moving on to another topic. Someone else was talking about a different company. They said it’s a good company, but that doesn’t mean it’s a good stock. They mentioned something about a recession and how that might affect things. Then they talked about a company called Exponential Fitness, which owns a bunch of different fitness brands.

This company runs a lot of different fitness gyms, like Pilates, cycling, and yoga. They have over 2000 gyms all around the world. They’ve been doing pretty well financially, especially compared to other companies in the same market. Their stock price has even gone up a bit this year, which is surprising given how tough things are for most companies.

In their most recent earnings report, they made a profit for the first time ever. They made more money than people expected, and their revenue went up by 56% compared to last year. They’re also expecting to make even more money next year, but it’s hard to say exactly how much.

Their stock price could go up a lot or down a lot, depending on how much money they end up making. But even if they don’t make as much as people hope, it’s still a good company to invest in because it’s growing fast and has a lot of potential. They’re expanding into new countries and coming up with new ideas all the time.

They’ve formed partnerships with companies like Lululemon, energy drink companies like Celsius Holdings and C4, and Princess Cruise Lines. These deals are still new, but they’ll bring growth, brand awareness, and keep customers engaged. The risk seems worth it to me because they’re growing fast, opening new studios, and have strong franchise economics. They’re in a good position compared to other fitness companies, with higher margins and faster profit growth.

XP Off is in the fastest-growing sector of the fitness industry, and even in a recession, they’re likely to keep their customer base because their workouts aren’t widely available elsewhere. The variety of workout concepts they offer helps hedge against trends fading out. With their broad range of brands, even if one declines, others can pick up the slack. Their market potential is huge, and I expect their value to increase significantly in the long term.

Their next earnings are in February, so I might be early in getting into this stock, but I’m planning to buy calls for April. Options for this stock aren’t very liquid, but I’m still interested. I’m considering buying August 22.5 calls. If the stock rallies to $35, it could be a great return on investment. I’ll monitor it closely, and if the stock starts rallying, I might take some profits, but I see potential for both short and long-term gains.

Nucor steel looks promising with solid fundamentals and increasing demand for their products. Rising iron ore prices and a weakening dollar are positive indicators for the company. I expect them to have a record year financially, and technically, their stock seems poised for growth. I’m structuring my investment with April calls to hedge against time decay and to take advantage of potential upside. It’s a longer-term play, but I see good potential here.

Antero Resources, on the other hand, seems like a short opportunity. Falling natural gas prices and uncertain fundamentals make me bearish on this stock. I’m buying puts with a price target of $20 by June. It’s a limited risk trade with potential for significant returns. Pairing these trades helps mitigate risk and takes advantage of trends in the commodities market.