Chris Quill: Today I’m delighted to have Anthony Iser and Jason McDonald joining me on the call. As always, we’re going to have the benefit of listening to these guys’ insight about financial markets and equity ideas they’re looking at for their portfolios. Great to have you on the show again. Jason, why don’t you kick things off today?

Jason: Yeah. Hi, guys. Good to see you again. I’ll dive right into my idea: going long on Phillips 66, a sizable company with a market cap of $51 billion, closing around $107 per share yesterday. They’re primarily a refiner with additional midstream and specialty chemicals operations. Phillips 66 was formed in 2012 through a spin-off from ConocoPhillips, focusing on downstream businesses. They process, refine, transport, and sell fuels and related products globally, divided into four segments: midstream, chemicals, refining, and marketing and specialties.

Their midstream business contributed about 14% of earnings last year, mainly gathering, processing, transporting, and selling natural gas and liquids, primarily in the U.S. The chemicals business, a joint venture with Chevron, accounted for about 6% of profits, manufacturing and selling petrochemicals and plastics globally. Refining dominates their earnings, comprising 61% last year, operating 13 refineries across the U.S. and Europe. Marketing and specialties, about 18.5% of earnings, involves buying, marketing, and manufacturing refined products and specialty items.

Their earnings per share (EPS) for 2022 was $18.79, with a consensus of $14.87 for this year and $51 for next year, signaling a decline. This translates to an earnings drop of -20% for this year and -16% for next year, with a price-to-earnings ratio (P/E) of 7x for 2023 and 8.6x for 2024. They offer a dividend yield of just under 4%, with negligible short interest.

Compared to sector peers, Phillips 66’s earnings are expected to decline due to narrowing crack spreads and falling gasoline and chemical prices, despite favorable sector comparisons. However, their exceptional free cash flow yield of around 17% and shareholder-friendly policies, including debt reduction, dividend payouts, and share buybacks, make them appealing. A recent insider purchase further reinforces confidence.

In their last earnings report, they missed EPS estimates by nearly 8% but exceeded revenue expectations by 19%. The stock has remained flat since then, with next earnings expected in early May. While the recent rally has pushed the stock higher, entering near $100 seems prudent, aiming for a modest 15-20% gain over the next three months.

Chris: Cool. Good stuff. Anthony, over to you. What’s your take?

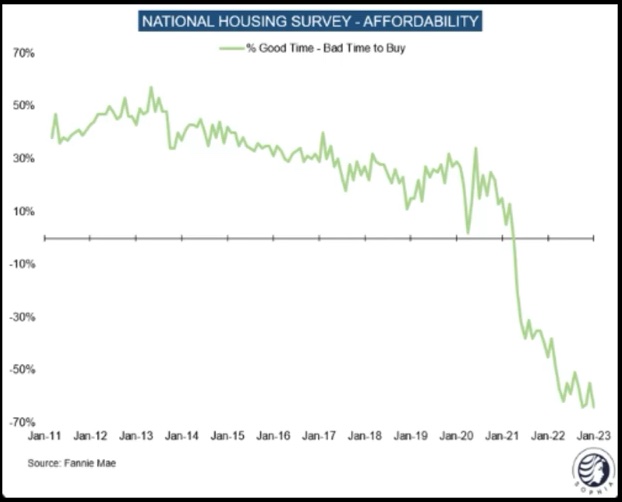

Anthony: I’ve got a short idea based on recent housing trends in the U.S. National surveys indicate a significant downturn in sentiment towards home buying, with over 70% considering it a bad time to buy. Pending home sales reflect this sentiment, down 30%, albeit with a slight uptick.

Additionally, analyzing new home sales by price reveals a decline in the lower price segments over the past two decades, exacerbated by rising interest rates. With nearly 9.5 months’ worth of new housing supply, the market faces a significant inventory challenge.

My short idea focuses on LGI Homes (ticker: LGIH), currently trading around $117. Despite a 26% year-to-date increase and 60% rise since October, earnings projections continue to decline. This surge is mainly driven by multiple expansion, not improved fundamentals.

LGI Homes’ strategy of building homes on speculation, rather than pre-selling, exposes them to market fluctuations. While advantageous in high-demand scenarios, it leaves them vulnerable during downturns. Sales are expected to drop by 23% for 2022, with a corresponding 20% decline in earnings.

Short interest in LGI Homes is high at 12.6%, reflecting skepticism towards their performance. Their reliance on speculative building amplifies risks, especially as sales and earnings projections continue to deteriorate.

From an October low of $76, the stock has surged to $117 based on expanded multiples rather than improved earnings. However, with earnings nearly halved and multiples inflated, sustained growth seems unlikely. A decline in sales and earnings, coupled with increased competition, poses significant downside risk to LGI Homes’ stock price.

I think the company’s outlook will be worse soon. People may realize it wasn’t smart to support a struggling company by buying its shares multiple times. Inflation is stubborn, keeping mortgage rates high.

Expect more rate increases. Until rates drop, sales won’t improve. It’s hard to see past low earnings and envision growth in sales and prices. The upcoming report might make this clear.

I’m aiming for a $95 target price, undoing the gains this year but still above last October’s low of $75.76. One approach is a bear put spread: buy March $115 puts and sell $95 puts. This costs $4 per unit, break-even at $111, with a 4-to-1 payoff if it hits $95.

I’m extending my position, buying March $115 puts and selling $85 puts. Costing $6, break-even is $109, with the same 4-to-1 payoff but three extra months.

This sector faces a tough reality: demand exceeds supply due to rising interest rates.

Chris: I agree. Jason, back to you.

Jason: I’ve shorted United Rentals (UR). They’re the world’s largest equipment rental company, with 1500+ locations in North America and Europe, serving various customers like construction companies and homeowners.

Their revenue is divided into general rentals (74%) and specialty rentals (26%). General rentals include construction and industrial equipment, while specialty focuses on specific products like trench safety gear.

Their expected earnings growth is strong, outperforming the sector. Despite this, their stock is trading at a discount compared to the sector.

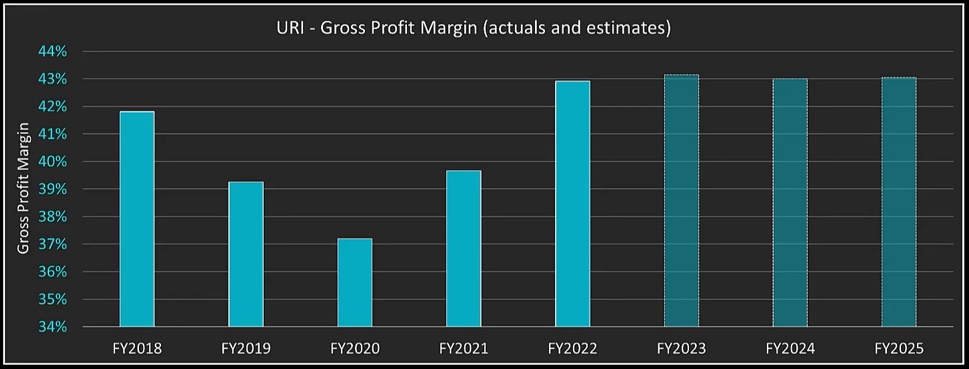

The short idea is based on the belief that United Rentals’ current success may not last. Their high margins were boosted by the 2020 rebound, and upcoming government spending may not sustain it.

The stimulus bills could delay rather than boost United Rentals’ business, as funding mechanisms take time to materialize. Bottlenecks post-COVID created a perfect environment for them, but those have cleared now.

As a result, equipment availability will increase, leading to lower fleet utilization and pricing pressure. This could impact their used machinery sales, which have been lucrative recently.

High margins seen in the past may not continue, especially if industrial demand weakens. Even without a recession, customers may opt to buy rather than rent equipment, unlike in previous years.

Now, the stocks have performed much better than the S&P since late 2019. They’re up 174% compared to the S&P’s 35%. This shows that the equipment rental business has been doing really well. But even without a recession, is this good run coming to an end? I think the government stimulus next year will play a big role.

I expect used equipment prices to drop and less demand from industrial customers, even if there’s no recession. After such a great run, there might be some balancing out. Last earnings report in Q4 showed a small miss on earnings, about 4%.

They reported $9.74 compared to the expected $10.12 per share. Revenue was as expected at $3.3 billion. Since then, the stock price has gone up by 17%. Next earnings report is due at the end of April.

I’ve taken a contrarian approach here. Instead of shorting the stock, I’ve bought some long-dated puts. Specifically, I’ve gone for the June 16th, $440 puts, which cost around $30 each. So my break-even point is around $410, which is about 10% lower than the current share price. It’s a bit of a gamble, but that’s the strategy.

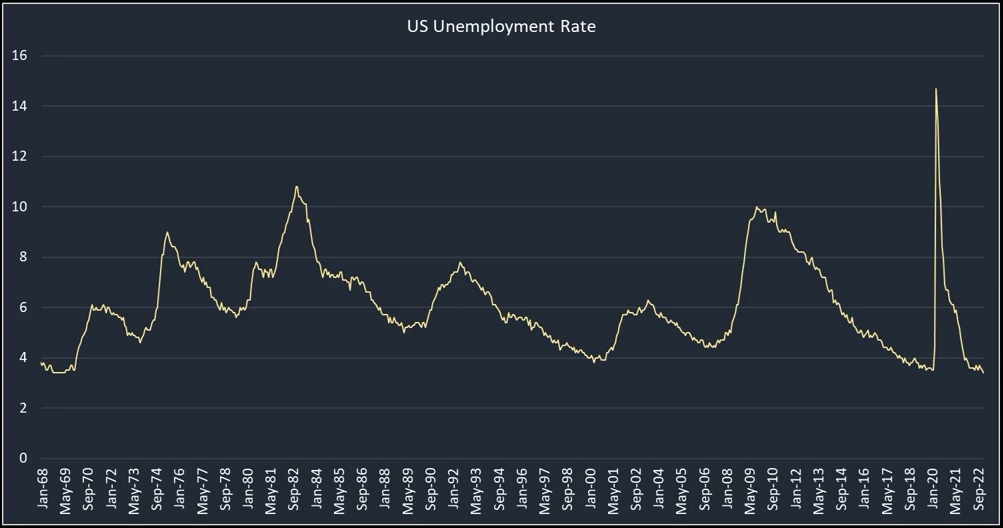

Regarding the macroeconomic situation, things are a bit confusing right now. While the job market is showing strong numbers, there’s also rising inflation. Powell’s recent comments about the possibility of raising rates further if these trends continue add to the uncertainty.

The bond market and the equity market seem to be sending different signals, which is interesting. On one hand, we see record-low unemployment rates and a hot job market. On the other hand, many people are feeling financially strained, and consumer spending has seen a decline.

This mixed data makes it hard to predict what’s next. The recent strength in the stock market suggests optimism, but we can’t ignore the potential risks, especially considering historical patterns with Fed tightening and inflation.

There’s also been talk of a soft landing, but whether that’s achievable remains to be seen. Some indicators point to a possible recession, which would impact market lows. It’s a complex situation, and we’ll have to keep a close eye on how things unfold.