I’m Raj Malhotra, a senior trading mentor. Today, I want to discuss recent market developments that caught my attention. There’s been a flurry of activity this week with economic data and earnings reports. Yesterday, the FOMC met and hinted at potential future rate cuts.

The market, however, seemed impatient, hoping for immediate action starting in March. Perhaps the Fed is waiting for more evidence of lower inflation or factoring in political considerations during an election year. Regardless, the market’s impatience is evident. Amidst this, frustrated bears are voicing their discontent, as seen in the hate mail I’ve been receiving.

Despite the pessimism, I fail to see a strong bear case, especially given recent data. As traders, it’s crucial to analyze objectively. Looking back over the past two years, we’ve experienced a fairly typical and controlled correction.

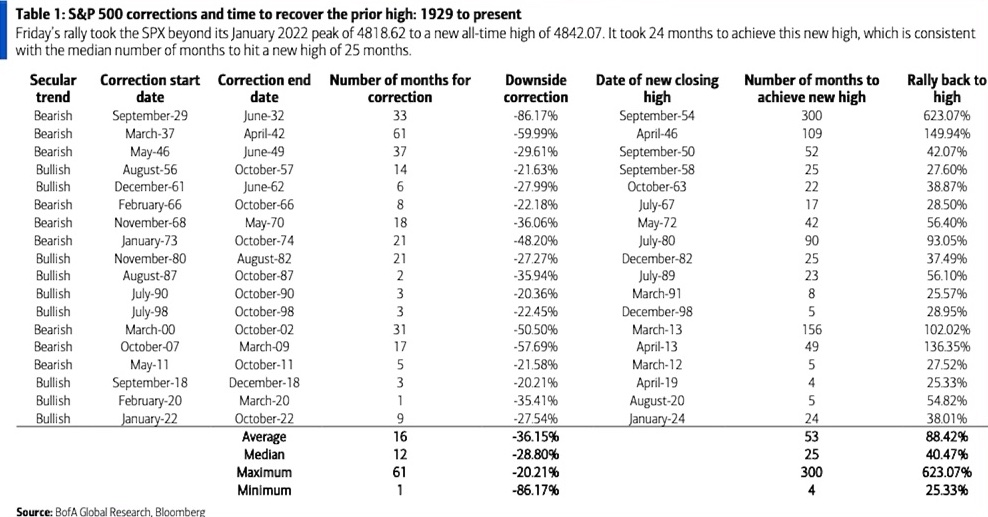

Referencing this chart, after reaching its peak in January 2022, the market underwent a nine-month correction, declining by 27.5%. Subsequently, it took 24 months for the S&P to bounce back, surging by 38% from its low point. This pattern of recovery exceeding the previous decline is expected.

Following this rebound, the market not only surpassed its previous high but also reached a new all-time high. Historically, it takes around 25 months for a correction of 20% or more to fully recover from its peak. So, the current situation aligns closely with past trends.

So, this situation isn’t new or unexpected. The 38% surge from the low in October 2022 is in line with the typical rally of 40.5%. It’s exactly as anticipated. Comparatively, this correction isn’t as severe as previous ones, which saw an average decline of 36%, with some plunging by as much as 86%.

Perhaps this is why bears are frustrated—they were anticipating a larger decline. However, what sets this correction apart is that we didn’t actually enter a recession, unlike previous sell-offs. It wasn’t even close. I believe the initial rally after COVID was unprecedented and may have misled the market.

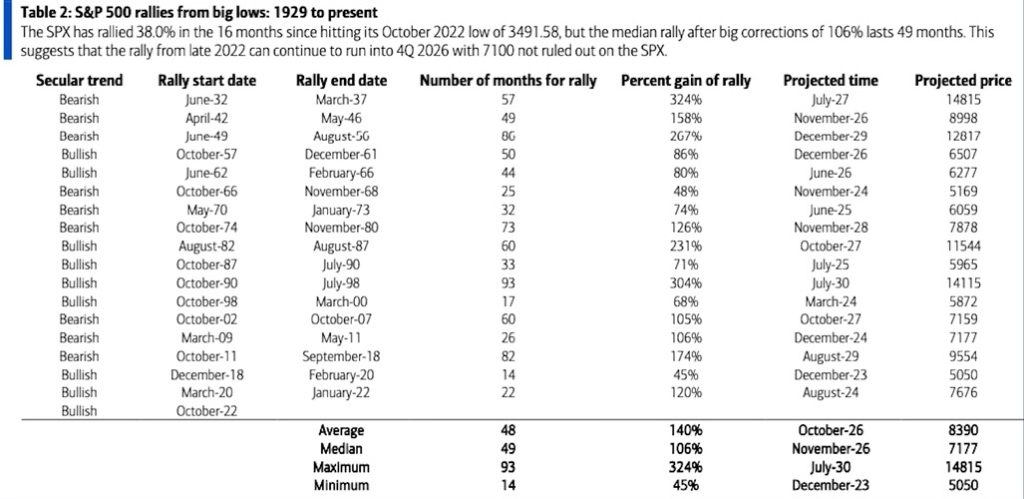

Further analysis of past data reveals the potential for a significantly higher S&P 500. Looking at historical rallies, the median surge after significant corrections is 106% over 49 months, slightly over four years. If the market follows this trend, it suggests the S&P could surpass 7000 by the end of 2026.

Now, considering the average rally rather than the median, history suggests we should be above 8000 by the end of 2026. I know it’s a lot to take in, and some of you still doubt those numbers. But that’s what history tells us. There’s no guarantee history will repeat itself, but it’s possible.

I’ve been consistently calling for a big rally since 23, especially in Q4, and into early 2024. Despite some disbelief, I see potential for another near-term surge to quiet the skeptics.

Some keep repeating the same pessimistic views from 2023. If we see this rally, it might continue into Q1, and perhaps FOMO will kick in when they give up. Maybe that marks the end, maybe not. We could witness another strong rally, triggering FOMO and changing sentiment.

One thing I’ve noticed is a shift in leadership from 2023, already evident in recent earnings reports. Despite strong numbers from Microsoft, Google, and others, their stocks remained flat or dropped. These big tech names may have limited upside now. I’m not saying they’ll fall, but they might not soar either.

I’m saying they won’t lead and likely won’t outperform the S&P as they did in 2023. The focus now seems to be on smaller and mid-sized companies that haven’t gotten much attention. Sectors like finance, utilities, and consumer goods, among others, have been overlooked.

Looking at this week as an example, companies like General Motors, despite average performance and uncertainties, saw their stocks rise by over 10%. It seemed overly pessimistic.

Cleveland-Cliffs, a major steel producer, also saw double-digit growth despite low expectations. There’s potential for significant rallies in these stocks, maybe even 30%, 40%, or 50% increases. The market seems to be broadening.

There’s a chance to make good trades with low downside risk and high potential rewards, especially with the fixed trading around 13. So, even if I’m wrong, the risk-reward balance looks favorable.

Here’s an example of a small-cap stock I’ve been eyeing in the consumer discretionary sector, which isn’t getting much love. Groupon, an e-commerce company, offers discounts on various services. Despite having well-known brands like Groupon and LivingSocial, it’s been undervalued.

This company tends to do well even in tough times because people love a bargain. With a market cap below $500 million, it wouldn’t take much for it to reach a billion again. While it’s up 56% in the past year, it’s still down a whopping 82% over five years.

After a rough earnings quarter, where the market misunderstood a rights offering, the stock has bounced back as the details became clearer. With any positive news, it could soar higher.

I believe it could easily hit $21, a 50% increase, even with just average earnings, considering the negativity and high short interest. You could make a good profit with the right options strategy. Even my $21 target might be too conservative, causing short sellers to scramble.

Consider buying the stock outright or with some upside calls for a potentially great risk-reward ratio. If it pays off, you might not need Groupon for deals anymore—you’ll be able to afford full price. Thanks, everyone. Happy trading!