Amazon has been performing exceptionally well in the markets lately. There have been significant movements in 2024, particularly in large-cap tech, semiconductors, and anything related to network content or APIs. But it’s not just big-cap tech that’s thriving. Let’s take a look at the top ten stocks with the best performance in the S&P 104 this year.

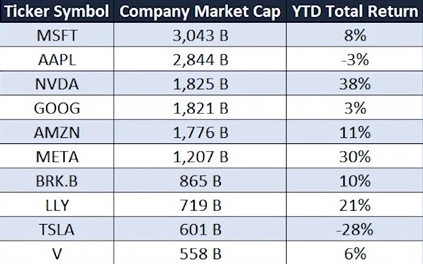

When we examine the movers (this data is from last week), the market took a hit from the CPI prints earlier this week. It didn’t meet expectations, but it wasn’t a significant deviation either. We’ll delve deeper into that shortly. Despite this, we saw a decent rebound today, so it’s not a major concern. Now, let’s see what’s happening. Microsoft is up nearly 10% year-to-date. Apple has faced some challenges, down a few percent. Amazon is up by 11%. Google saw a slight increase, and Nvidia is up by almost 40% and remains resilient despite recent market pullbacks. Meta is up by 30%. Additionally, Berkshire Hathaway is doing well, Eli Lilly is up by about 5%, and Tesla has struggled, down by roughly 30% year-to-date. Payment processing companies like Visa and MasterCard are also trading up today, continuing their strong performance. Clearly, there have been ample opportunities to profit if you know where to look. Next, we’ll analyze some earnings reports and take a closer look at these companies. But first, let’s touch on the macroeconomic data.

Macro trends are crucial, and we’ve heard a lot about them. Remember the recession fears from last year? Many experts predicted a market crash, but it never materialized. Despite technically being in a recession, according to some definitions, major indices have reached near all-time highs. Sector ETFs, particularly industrial ones, have also reached new heights. Many are still anticipating a recession or market downturn, but we’re currently in a bull market. Barring any unexpected events, there’s no reason for a sudden market collapse, and the data supports this.

Let’s check out the recent macroeconomic data. The non-farm payroll numbers came in strong for the past few months. In January, it hit 170,000, and in February, it was 353,000, both surpassing expectations.

The labor market is tightening, which usually sparks inflation fears. However, this time, the market rallied after the data release. Retail sales also showed strength, exceeding expectations.

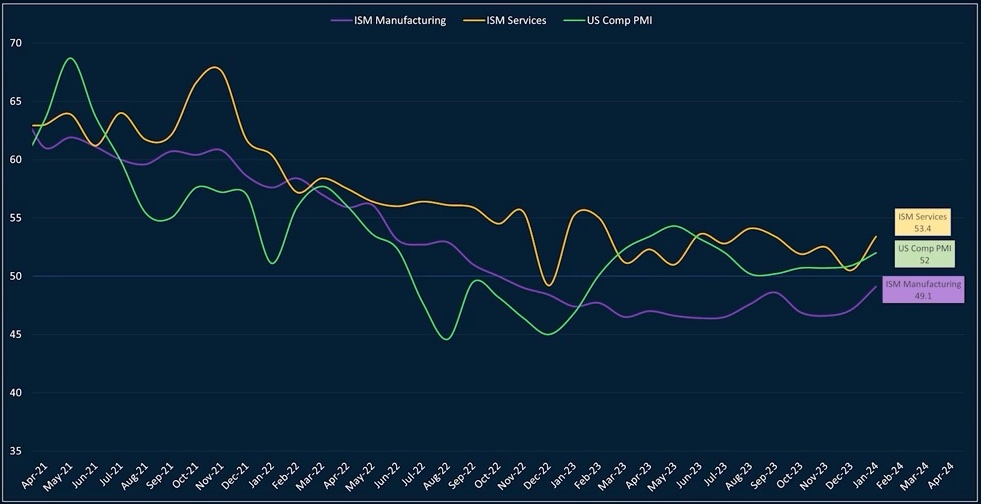

The GDP growth rate for Q4 was 3.3%, surpassing the estimated 2%. Although it fell short of Q3’s 4.9%, it still exceeded expectations. Additionally, both ISM manufacturing and services PMI came in strong.

I closely track the S&P Composite PMI, which has been increasing since last October. These are some of the key indicators showing the economy’s improvement.

While there’s more to consider, these numbers confirm the economy’s momentum. Despite slightly higher CPI prints, inflation remains around 3%.

So, currently, GDP growth and inflation are both around 3%. This paints a good macroeconomic picture with stable inflation, which benefits companies as they can earn more money. Looking ahead, how does this data affect the stock market and future earnings?

Well, it’s worth noting that the Fed’s decision to backtrack on expected rate cuts has surprised many. It seems these cuts won’t happen anytime soon, possibly not until after summer or even after the election. Is this bad news for the market? We’ve seen the dollar strengthen recently, along with a sell-off in ten-year notes due to robust US CPI figures.

Overall, when you have GDP growth and stable inflation, it indicates a healthy economy. While 3% inflation is typical historically, it becomes more concerning when paired with sluggish economic growth, as seen in Europe. Despite this, the European stock market has performed well, indicating some resilience.

This market isn’t just about every stock rising with the tide. It’s more selective, favoring certain stocks. Take the recent earnings reports from major companies, for instance. Just a couple of weeks ago, some companies like miners saw their stocks surge by 20% after reporting strong earnings.

So, while some argue certain mega-cap stocks are overvalued, their earnings reports tell a different story. They’re surpassing revenue expectations by significant margins and showing strong forward-looking indicators, reflected in their balance sheets with impressive cash reserves.

These positive earnings reports have led to substantial upgrades in EPS projections. With a solid economic foundation and rising stock prices hitting new records, it’s hard to see why these stocks would suddenly falter. Amazon, for example, not only beat revenue expectations but also saw a notable increase in operating income.

So that’s a 60% increase, folks. It’s not surprising that the stock has been doing well. Their cash position has doubled in three years, reaching $73 billion. It’s surprising that the stock is still below its all-time highs at 188, but I think it’ll reach that soon.

Now, it hasn’t all been good news in Megacap tech land, with Tesla falling short in both earnings per share and revenue. The stock is down about 30% this year. This has led to significant downward revisions in earnings per share by analysts.

Understanding how stocks move is crucial for traders. We focus on identifying stocks likely to make significant moves soon, regardless of the direction. Most major companies have reported earnings, which have generally been good. NVIDIA is yet to report, and its stock is up 40% year to date. Are expectations too high?

While estimates for NVIDIA’s revenue and earnings are conservative, the stock is priced for perfection. It needs to beat expectations significantly to keep rising. However, there’s a good chance it might.

There have already been significant moves in the market. If you’re not profiting from these movements, you might need to reassess your strategy.