Yoda: “Fear is the path to the dark side. Fear leads to anger. Anger leads to hate, and hate leads to suffering.” How does this relate to the market situation? We can actually benefit from it, especially in our trading activities. Let’s explore that.

Currently, there’s major geopolitical uncertainty. There’s concern that the world is moving closer to the possibility of war. Fear is seeping into the market, becoming the primary driver of market prices. In the past, it used to be about inflation, then economic growth. Now, fear is becoming a significant factor. This means decisions are driven by emotions rather than logic. When people are afraid of losing money, especially when they’re already losing, it’s a powerful motivator that can lead to irrational actions.

Decision making can get irrational and jaded. The dark side is when the fundamental rationale goes out the window. Creating fear-based feedback loops leads to a snowball effect. The continuous collapse in the Middle East is scary, especially when Iran, China, North Korea, and Russia are thrown into the mix.

However, everyone involved understands the consequences of a nuclear showdown. We need to consider the likelihood of heading down that path. It’s unlikely to happen. The ongoing Gaza conflict is the main change on a large scale lately.

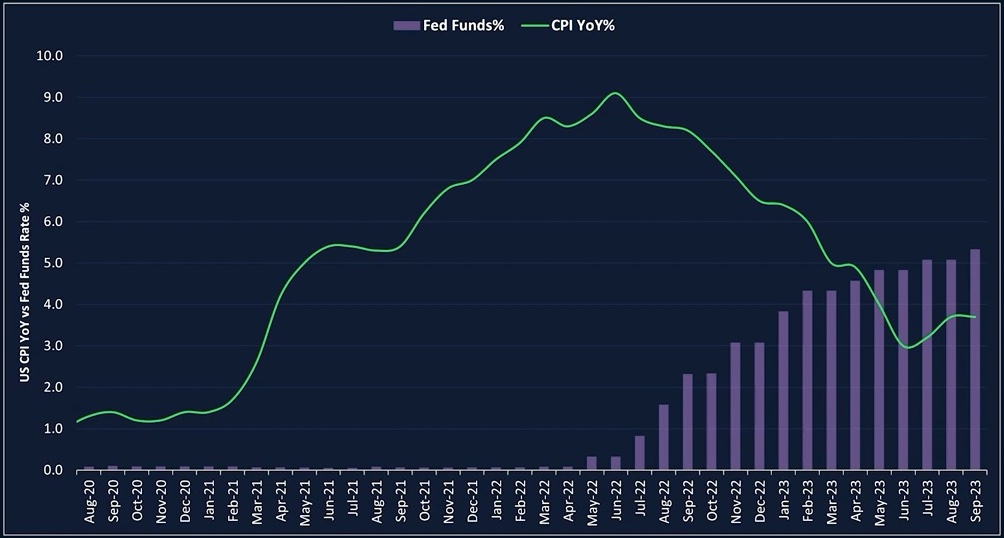

The biggest concern until recently was inflation. The latest US inflation rate has been decreasing every month for the past year, bottoming at 3% until June, then slightly rebounding. Gas prices have stabilized at 3.7% CPI growth, halving in the past four months.

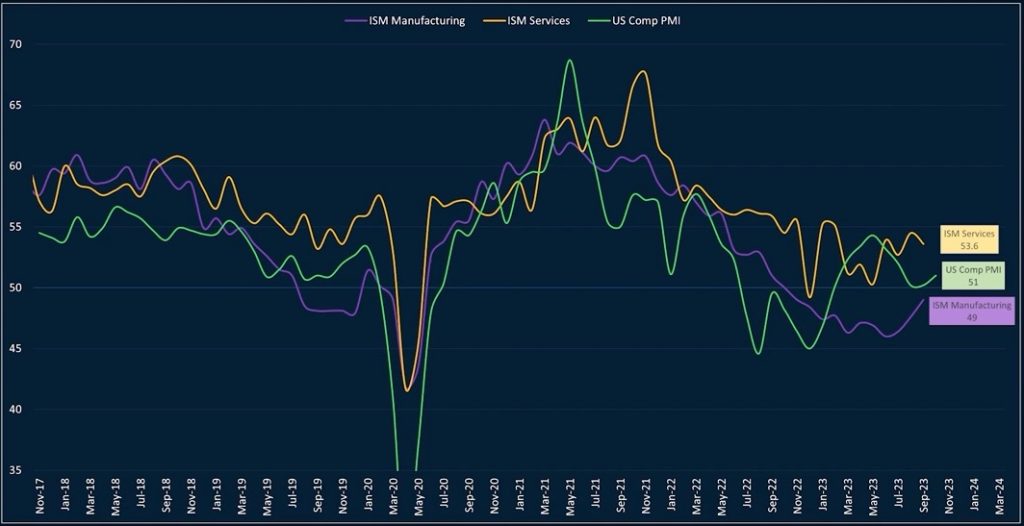

Inflation is under control at this point. Looking at economic growth, the latest manufacturing PMI is still below 50, indicating contraction, but showing signs of improvement. The services PMI has been above 50 for some time, remaining stable. The US composite PMI flash recently came in at 51, slightly above 50, indicating stability. Despite talks of recession, the economy is holding up fairly well.

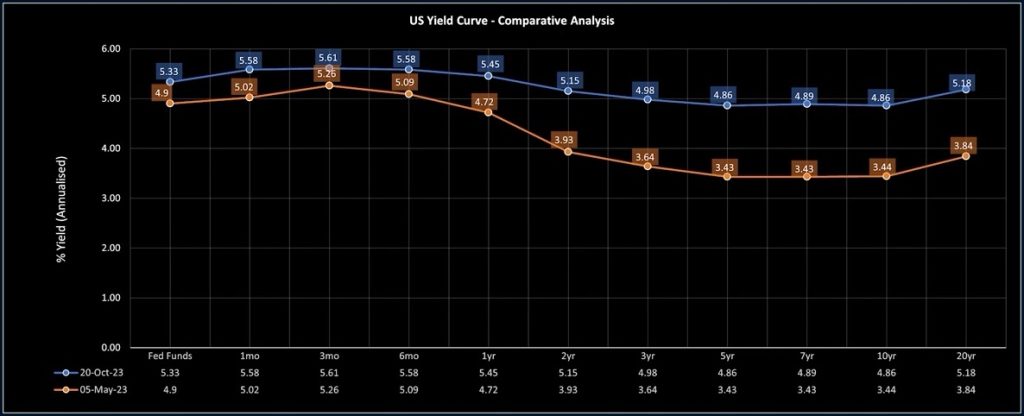

The yield curve has been steepening dramatically, being inverted for over a year. It’s now close to neutral levels last seen in the summer of 2022, though still technically inverted.

There are several macro releases and indicators we monitor. Mixed signals persist, but the overall health of the economy hasn’t worsened recently. It might even be in better shape. The Gaza conflict could affect the Fed’s stance, possibly reducing the likelihood of rate hikes this year and prompting discussions on measures like quantitative easing.

If that happens, markets could rebound. While the S&P 500 remains above key support at 4200, the Russell 2000 small cap index has fallen below multi-year lows. The VIX is around 20, and there’s been a significant rally in gold. These indicate that fear is now the main driver of market movements.

When fear dominates, it leads to irrational moves both up and down, affecting even fundamentally strong stocks. This presents opportunities for new trading ideas that could yield substantial returns if approached calmly and rationally. Identifying solid companies trading at irrational prices becomes crucial in such times.

The focus should be on companies with strong fundamentals trading at extreme prices, as these situations often revert to the mean. Properly timed and structured trades in such scenarios can yield excellent returns. To succeed in the market, it’s essential to stay informed and educated. Stay tuned for more insights in our next episode.