Instead of looking at big picture stuff, let’s focus on how real-life events affect human behavior. Understanding this can give traders good ideas. Even after events end, behavior can stick.

For instance, events like 9/11 or COVID changed society in lasting ways. Currently, what’s on most Americans’ minds is the situation at the southern border. It’s the top concern for voters.

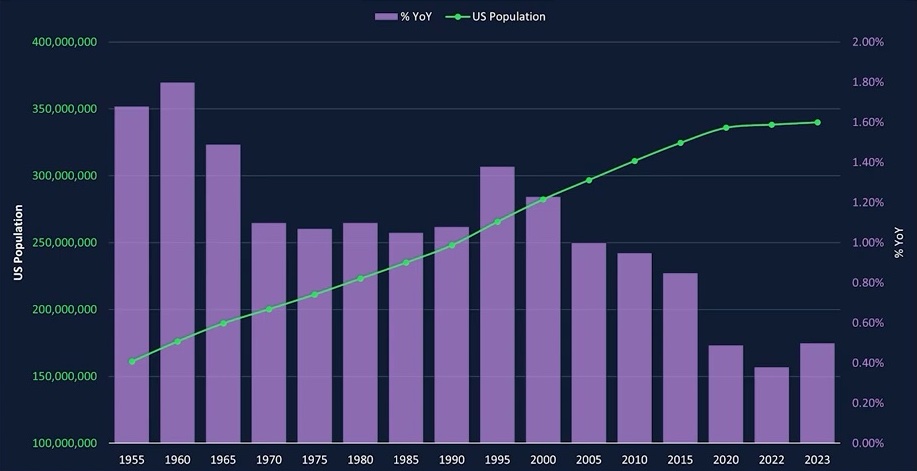

Before diving into the impact of this disaster on human behavior and related stocks, let’s check some stats. The U.S. population, excluding illegal immigrants, was around 3.5% in 2023, roughly 1.75 million people.

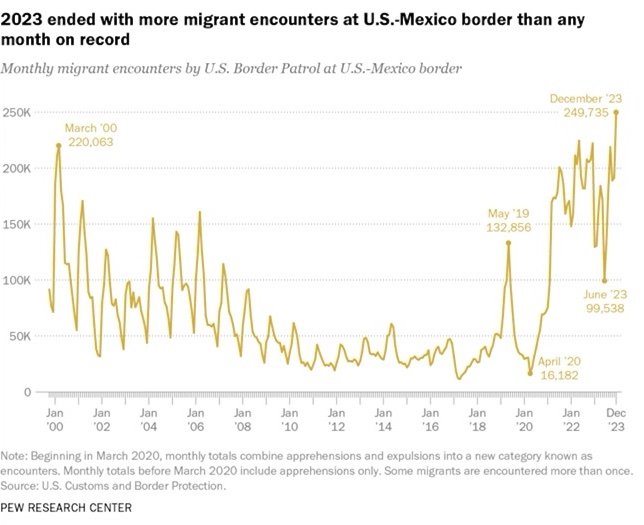

However, in 2023, over 2.5 million illegal immigrants entered the country, surpassing the official population growth. In the last three months, this surged to over 250,000 per month, totaling around 3 million in 14 months. There seems to be no end in sight.

The consequences? Even liberals in big cities are frustrated with the migrant issue. It’s hitting close to home, costing cities billions to accommodate and manage this influx with funds they don’t have. What’s the likely outcome? Well, it’s increasing the odds of Joe Biden losing, despite his claims blaming Republicans. This could lead to stricter measures against illegal immigrants, possibly including criminalization, as I mentioned in my geo idea a while back.

A company managing prisons saw its stock surge by 33% since then. But, that event is still years away. A more immediate trend is brewing. People are growing fed up with big cities. They’re likely to move to rural areas. Crime and filth in cities, along with leniency towards criminals, are pushing citizens away. Rising taxes, funding non-citizens, while neglecting law-abiding, especially lower-income folks, add to the frustration.

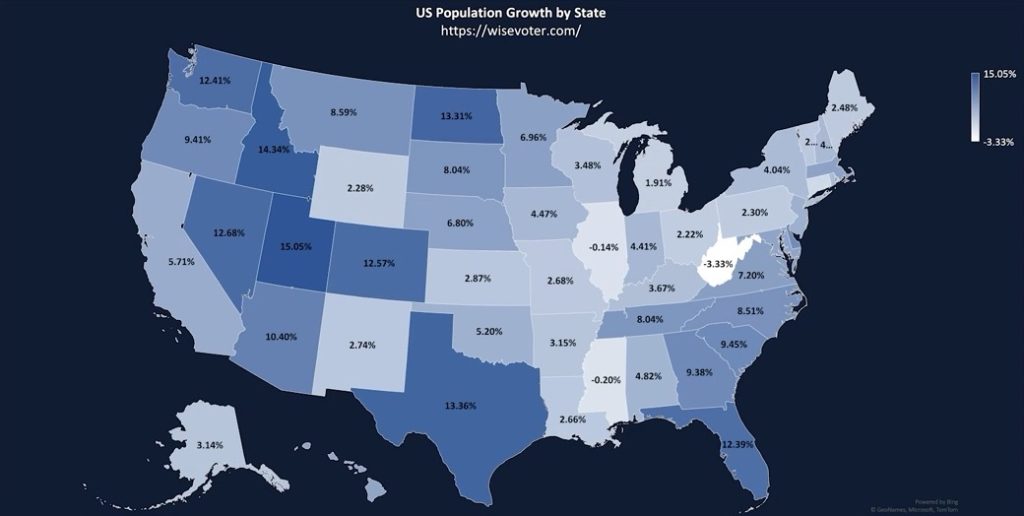

This frustration may lead to more migration to rural areas, as seen in recent years. States like Texas, Florida, the Midwest, and the mountain states witness significant population growth. However, some of these states are becoming too costly, especially for lower-income individuals, pushing them to seek cheaper alternatives.

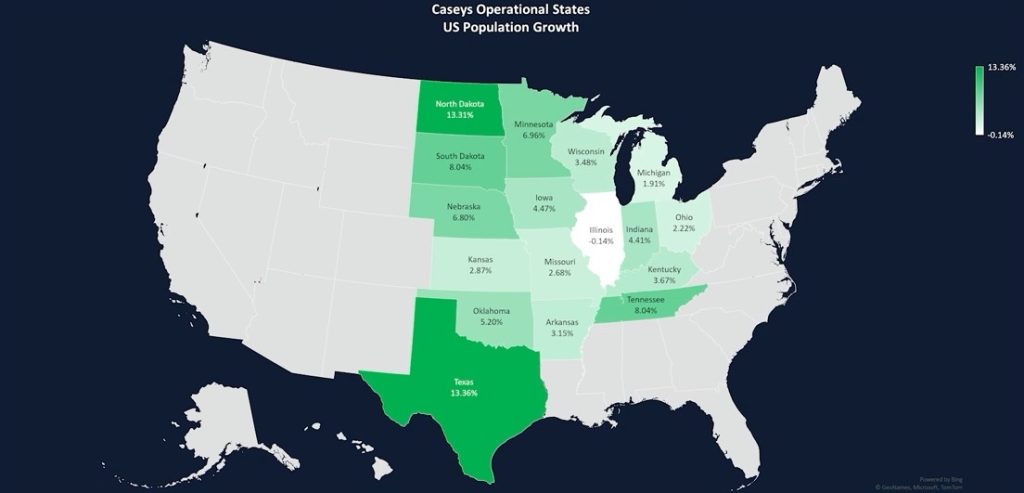

Considering this landscape, which companies stand to benefit? Casey General Stores is one such company. With an $11 billion market cap and a reasonable valuation, it’s the third-largest convenience store chain in the U.S. This revelation surprised me.

They’re actually the fifth largest pizza chain in the country, even though they only sell at their own stores. They mainly focus on small towns. So, I believe the growth assumptions in the market are too conservative, given what I anticipate. Plus, considering their locations, they essentially have a monopoly.

These companies target areas overlooked by giants like Wal-Mart. As you can see on the chart, their current operations are primarily in the Midwest, with significant growth in Texas. The growth rates in these states are all positive, except for Illinois.

Now, if we exclude Chicago, which lost over 80,000 residents last year, the rest of Illinois actually saw population growth. It’s worth noting that they don’t operate in Chicago. So, it seems people are leaving Chicago for other parts of the state, which explains the overall decline, or unfortunately, the other possibility is they’re becoming victims of crime.

In areas where they have stores, customers have limited alternatives, making their stores a one-stop shop. They offer food to go, including pizza, and have recently added groceries and breakfast items. Essentially, it’s a fast-food joint combined with a grocery store. Additionally, they provide services like gas, car charging, car wash, tobacco, and alcohol – all essentials. Operating in smaller towns also means lower rent and labor costs. Their strong customer loyalty stems from being the primary option in town. They plan to open 250 new stores in fiscal year 2024, 40 more than initially planned, and an additional 350 stores by 2026.

They’re also eyeing expansion into states like Colorado, with nearly 13% population growth, and the Southeastern U.S., including the Carolinas, Virginia, Alabama, and Georgia. These states benefit from an influx of people moving from major cities like New York, Boston, Atlanta, and D.C.

Their cash flow should allow them to increase dividends or buy back shares if they decide not to open more stores. Their stock is considered recession-resistant since they offer essential goods. Another growth strategy involves acquiring and improving smaller, poorly managed stores under their brand.

Regarding trading, their stock reports earnings next week, but it might take some time for their strategy to fully unfold. Looking at the options, you could consider paying $10 for the May $300-$360 call spread, potentially yielding a 5-to-1 payoff if the stock rallies by 20%.

So, my advice is to think creatively and understand human behavior. Doing so can lead to great ideas.