Chris Quill: Hi everyone. We’ve got Ed Shek and Raj Malhotra here with me. Always great to have you both on. Raj, why don’t you kick us off?

Raj: Sure thing. I’ve had this view for a while now, and while it’s been surprising to some, I still stand by it. Europe has been outperforming the US and other developed markets for the past 3 to 6 months. Looking ahead, I see more potential in Europe, especially with positive earnings revisions there.

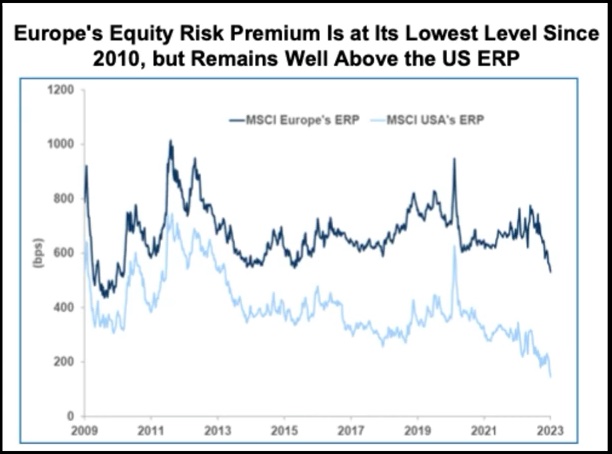

Europe’s performance has been quite a surprise, considering recent geopolitical tensions involving Russia and Ukraine. However, the China reopening has been a bigger boost for Europe than for other regions. Looking at investor sentiment, it’s become less negative in Europe recently. The equity risk premium in Europe is now at its lowest since 2010, although it’s still higher than in the US.

The US market has been resilient despite challenges like declining margins and earnings estimates. Liquidity remains ample, which has covered up some cracks in the economy. While the Fed’s stance has shifted from dovish to hawkish, I believe the economy isn’t as strong as it appears. Corporate profitability isn’t improving significantly, and there’s a risk of rates softening in the near future.

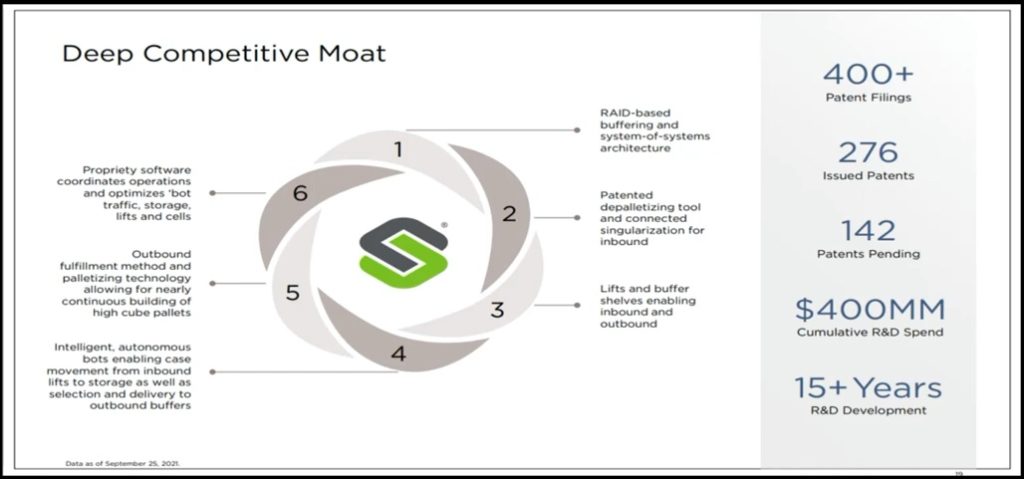

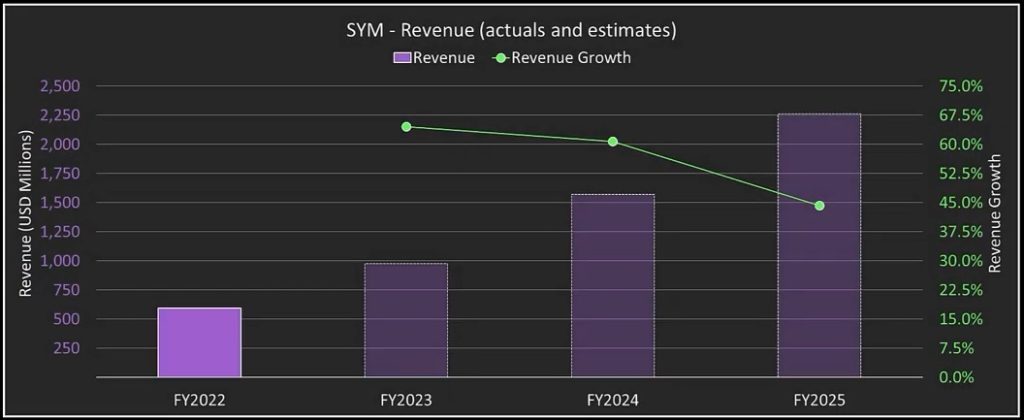

Ed: Regarding investment ideas, I’m looking at Symbiotic, a $7 billion industrial machinery company trading at around $17.50. They specialize in AI-enabled robotics automation technology for supply chain operations. Despite recent volatility, they have a strong market position, with clients like Walmart. They’re set to benefit from increasing efficiency and cost reduction in supply chain management.

Symbiotic has a $12 billion backlog, mainly from Walmart, and they’re expanding their product suite and client base. While they’ve been loss-making, they’re expected to turn free cash flow positive soon. With a strong market demand for their products and services, they have significant growth potential. Their current capacity constraints are being addressed through partnerships to meet growing demand.

For me, it’s all about execution. They need to build more stuff, have more people who can fit their stuff. This is where the earnings leverage will come from. It’s like having more demand than supply. They need to scale production capabilities, have enough people to make it happen, and they’re doing that with the capital they have.

They’ve been a bit light on detail, but now the outsourcing partners are starting the forward deployment process from manufacturing and installation. This will drive earnings. They have about $10 billion of business with Mart, but it will take years. Even new clients may have to wait two or three years.

Management’s focus needs to be on making more, making them quicker, getting scale, and reducing costs. This will shorten the deployment time and open pathways for new clients. It’s very simple and not related to AI.

It’s about coming through the pipeline. They’ve won customer positions and are getting better at it. They need to work 24 hours to expand the supply chain for that business. In terms of structures, their next statements are made of nice. I’ve got an aggressive price target of 25. I think that’s probably a bit too high, but they’re clearly not going to announce that they have all these partners and productions online. They need to show progress and give some data.

This is a stock that I can imagine staying on for quite a while if the management executes that. It’s a company that could grow multiple times over the next three or four years. If you bought it at $17 and sold it at $25, you could make a good profit. 25 is quite an aggressive price target. So this is really the beginning of what I hope will be a tradable situation, and that’s Symbiotic.

Chris: awesome. Good stuff. Let’s go back to you, Raj. You were talking earlier about some macro and you kind of thinking about relative valuations. Does your idea tie into that?

Raj: Yeah, it does. One thing I wanted to mention, an anecdote from what Ed was talking about in terms of the high-end consumer low. In terms of housing right now, I’ve been actually looking for a house, and there’s no supply. Everything’s still a bidding war. So there’s not a bear market, at least in existing home sales right now.

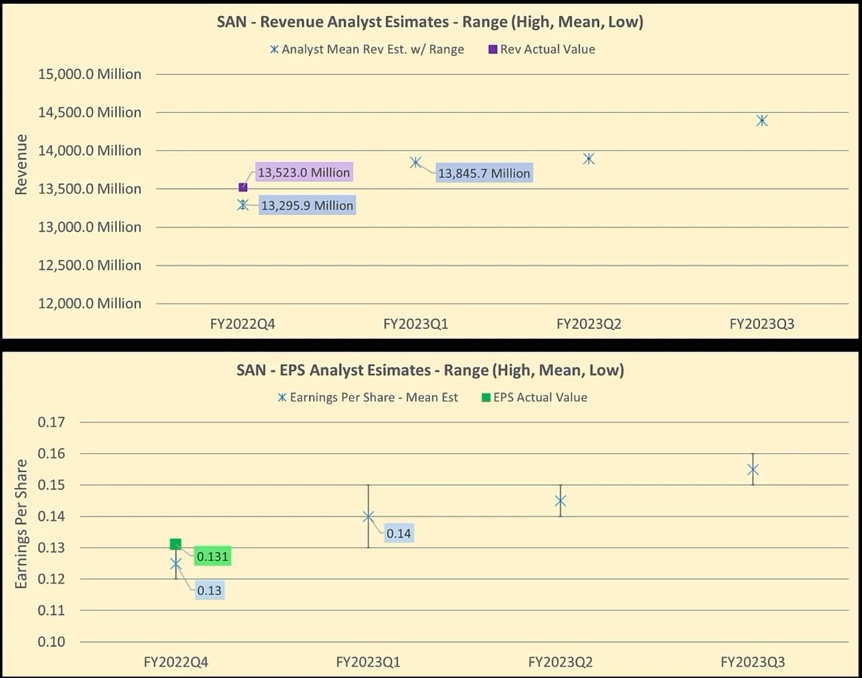

So just keep that in mind. Anyway, back to what I was talking about. Yeah, one idea that I have is a big boring Spanish bank. Remember, what’s on your mind becomes a lot more boring in my older age, and boring can be good. So it is. This bank is Santander S.A. They had lower expectations, but they still delivered record profits in 2022. They’re trading at around $4 a share, with a market cap of around 67 billion.

The PE is just around seven, which is very low compared to peers, and the dividend, I’ll cover that later, because I think that’s important. They delivered record profits in 2022, with net €2.3 billion, and their earnings per share grew 23%, and revenue grew 12% year over year. Their stock is up 35% year to date and about 45% in the last six months.

It’s a global bank, not just a Spanish bank. They have great loan exposure to the rest of the EU, the US, the UK, Latin America, and they have a great risk culture. They’ve always been good at managing risk. They announced that they plan to return half of its profits over the next three years to their shareholders in either higher dividends or buybacks. So in terms of price target, I think this company can easily rally another 50% and get to a $100 billion market cap.

Chris: I like the idea a lot. And you know, the way that these European banks can trade, it’s how you can sometimes trade like supertankers. They get a bit of momentum and they’ve got nothing spectacular, but before you know it, they’ve put in a top. Even this topspin rallying from the two and a half level as recently as October. So idea for and as you say, there’s nothing on the quotes that’s going to worry you. So it could be just a nice grind and it’s putting in some big moves, although it tends to happen a bit under the radar, doesn’t it? Right?

Ed: So, let’s talk about a stock called ELF Beauty. It’s not cheap right now, but it’s doing really well. Out Beauty sells makeup and skincare products. They’re a big company, worth about $1 billion. Each share costs around $75. They have different brands and focus on making cruelty-free cosmetics, meaning they don’t test on animals.

Out Beauty sells its products in many places, like Walmart and Target. They also sell online. Most of their sales are in the US, but they’re growing in other countries too. They’re doing a lot of their marketing on social media, especially TikTok.

Their business model is interesting. They don’t spend much on traditional ads like TV or print. Instead, they use social media and work with influencers. This seems to be working well, especially with younger customers.

ELF Beauty is doing great financially. Their sales and profits are going up. They’re able to sell their products at lower prices than some competitors. They’re also good at quickly making new products based on what’s popular.

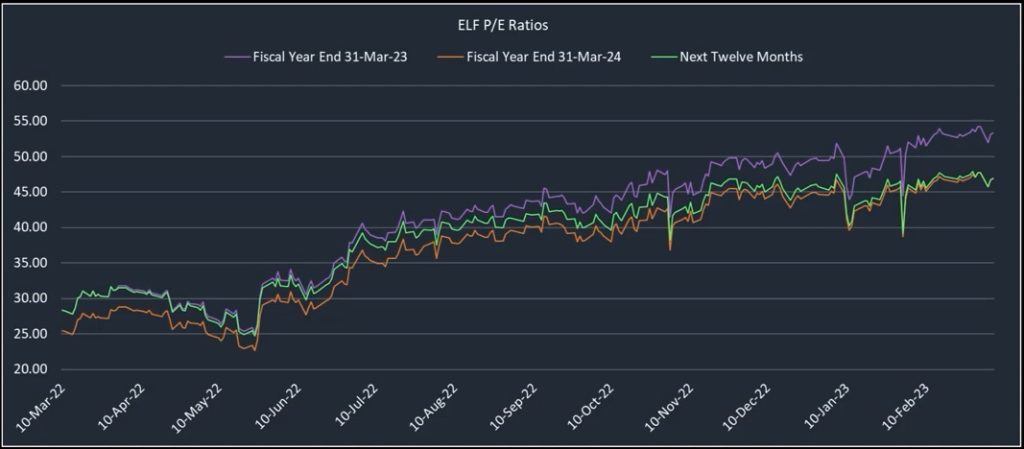

Their stock price has gone up a lot recently. Some people worry that it might be too expensive now. But if you believe they’ll keep growing, it could still be a good investment. They’re expected to make even more money in the next few years.

Out Beauty mostly sells makeup, but they’re trying to sell more skincare products too. Right now, they’re not as popular in that area, but they could improve.

Overall, Out Beauty seems like a solid company with potential for more growth. However, there are some risks, like competition and changes in social media trends. So, it’s something to keep an eye on.