Chris Quill: I’ve got two veterans of the financial markets on the call with me, Jason McDonald and Ben Berggreen, and couldn’t be happier to have these guys on the show. So I’ll hand it over to you guys. A pleasure to have you both on. Jason, why don’t you kick things off?

Jason McDonald: Thanks, Chris. Everyone should be aware of recent events in the regional banking sector in the US and the Credit Suisse situation in Europe. Here’s a quick summary:

So, last Sunday, UBS had to take over what’s left of Credit Suisse. Meanwhile, the Fed and five other central banks announced daily US dollar swap auctions until at least the end of April to ease global funding market strains.

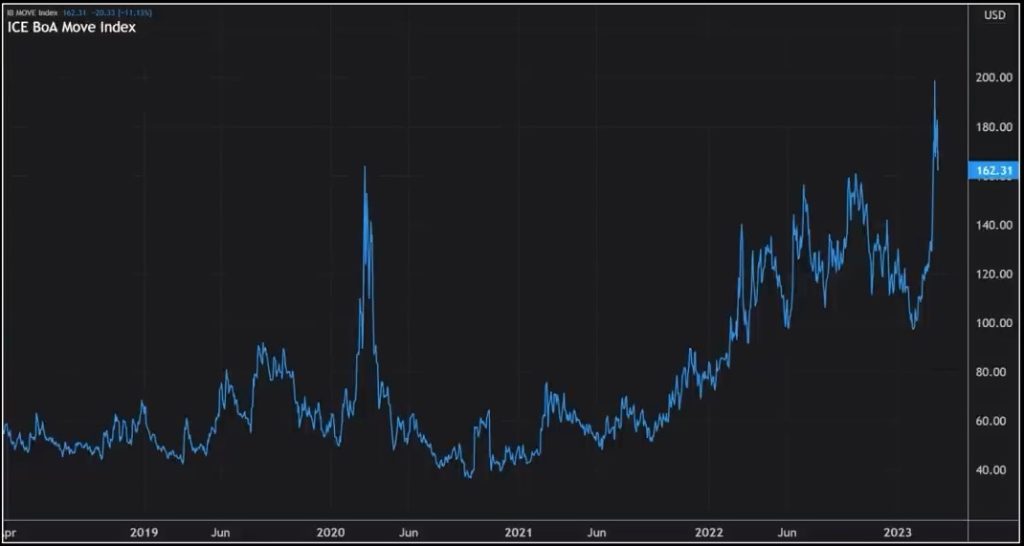

These actions reflect ongoing stress. Even though stocks have been relatively stable this week, indicators like the ICE Bank of America MOVE Index show persistent volatility. The two-year US Treasury yield had an unprecedented range last week.

Before recent events, there was already a slowdown in US corporate credit activity. Last week, not a single investment-grade deal was priced for six trading sessions, the longest since June last year. Also, a Fed survey revealed tightening credit standards for commercial and industrial loans.

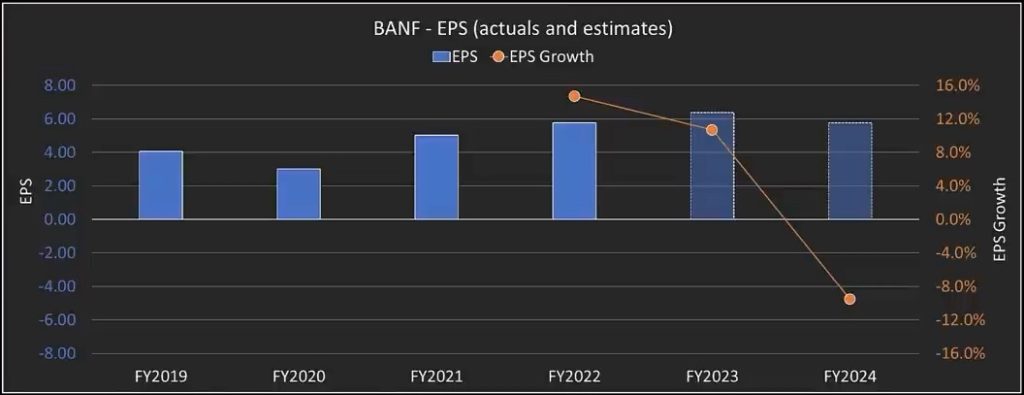

These issues are significant, but there’s optimism. The OECD chief economist believes the situation isn’t as dire as 2008. Let’s hope he’s right. Now, let’s talk about a banking stock: Bank First Corporation.

Bank First operates in the southwest US, with subsidiaries like Bank First and Pegasus. They focus on commercial and retail lending across different areas. Despite solid earnings growth, their price-to-book ratio is high compared to the industry average.

Bank First stands out due to its conservative credit culture and strong asset quality. With a lower loan-to-deposit ratio and healthy liquidity, they’ve weathered market challenges well. Their stock has outperformed industry indexes significantly.

Regarding future prospects, Bank First looks promising for a rebound. I anticipate its share price to recover to the mid to high nineties in the next one to two months.

Moving on, let’s discuss Harley-Davidson, ticker HOG. Known for its iconic motorcycles, Harley-Davidson has seen its stock drop due to recession fears and high-interest rates.

Harley’s target market is affluent individuals seeking leisure. During economic downturns, people tend to cut back on luxury spending, affecting Harley’s sales.

However, recent PMI reports indicate a potential economic turnaround. If the economy improves and interest rates drop, Harley’s fortunes could change.

Despite revenue stagnation, Harley-Davidson has focused on improving unit profitability. They’ve streamlined operations and focused on their core products.

Their electronic motorcycle brand, Livewire, hasn’t taken off yet, but there’s potential for growth in the future.

In summary, both Bank First and Harley-Davidson present opportunities for investors, with Bank First poised for a rebound and Harley-Davidson potentially benefiting from economic improvements.

Long term growth looks strong in the financial services part, but it’s been hurt by higher rates. Higher rates are tough for companies. They’re focused on cutting supply chain costs, which were down by $50 million last year. The goal is to lower them another $140 million in 2023. So, things are tough now, but improving in the long term.

Looking at the stock chart, it’s taken a hit but found support around $37, which was a gap from October. Timing is crucial when trading options. Fundamentals matter, but so do technical aspects. If the stock retraces about half its move, it could reach $45, aligning with future EPS estimates.

Considering options, I’m looking at a vertical spread: buying a $40 strike at $2.47 and a $45 strike at $0.80, totaling $1.60. Risking $5,000 on this trade, aiming for over $10,000 profit by May expiry. It’s a high probability trade with a target of at least a two for one profit.

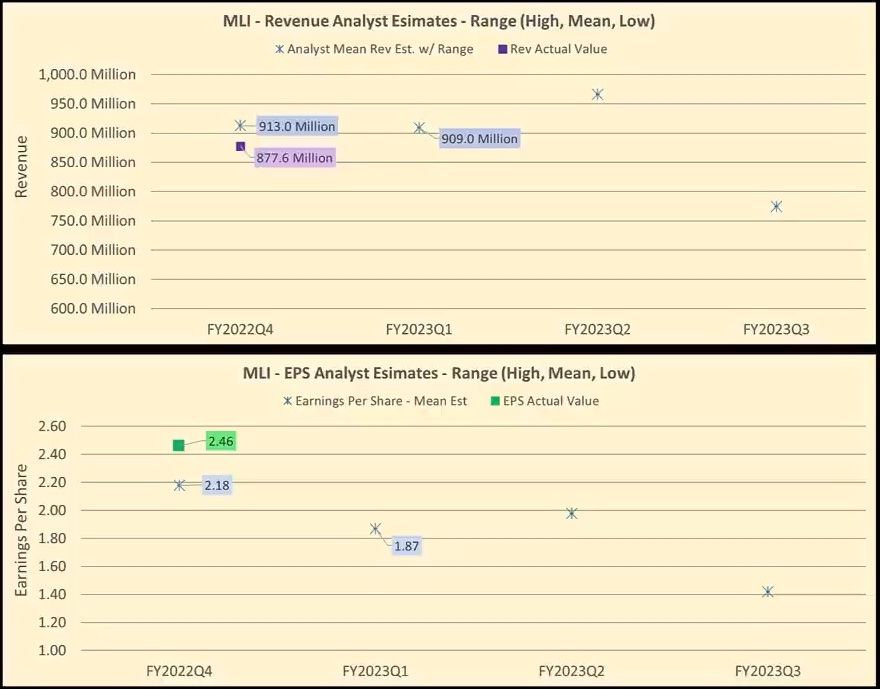

Ben: my short side is a company called Meuller Industries, a mid-cap with a $4 billion market cap. Since it’s a small company, we’ll use options to avoid potential takeover risks.

MLI specializes in copper piping, mainly in the US. They have three segments: piping systems, industrial metals, and climate. With only two analysts covering it, EPS is forecasted to drop 44% this year, then bounce back slightly next year.

Despite the drop in EPS, the PE multiple is reasonable, around 11 times this year and just below 11 times in 2024. Short interest has increased to 7.5% of the float, indicating some bearish sentiment.

Mueller’s fate is closely tied to the construction and homebuilder markets. Homebuilders are facing margin pressures and cost-cutting measures, which could impact suppliers like Mueller.

They dominate the US copper piping market but face competition from Chinese companies like Hai Liang, who are building a factory in Texas to circumvent anti-dumping laws. This could significantly increase copper tube capacity in North America.

Each stage adds 10% more copper sheet capacity to North America. With the market slowing and customers cutting costs, earnings could drop more than expected.

The stock may seem cheap, but if EPS falls further than predicted, it’s not. Last year’s EPS was triple that of 2019.

Their recent earnings report beat EPS by 13% but missed revenue by 4%. Next earnings are expected on April 17th.

I’m using options for this trade due to the company’s size and potential takeover risk. The furthest out I can go is September.

My strategy is a put spread: buying Sep 75 puts and selling Sep 60 puts. The breakeven is around $70.30, offering a good risk/reward ratio.

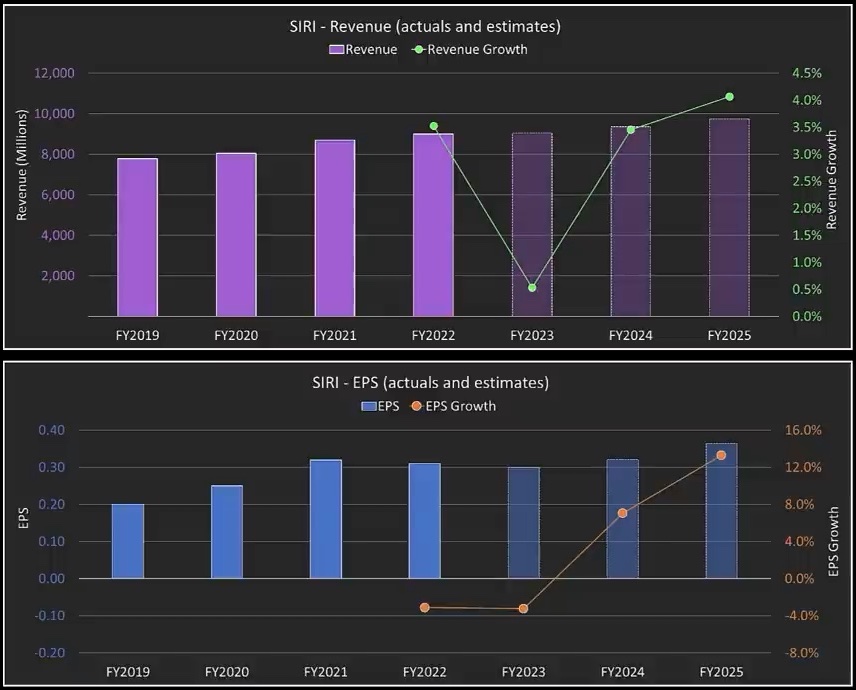

Now, let’s talk about a trade on Sirius Holdings. They operate XM Satellite Radio and Pandora. The stock’s down 35% since February 1st due to a revenue miss.

But if interest rates drop later this year, car sales should rebound, benefiting Sirius. The stock’s valuation is now half its norm, with significant short interest.

I’m going long on Sirius with June 16 calls. This trade offers limited risk and unlimited profit potential.