The Fed might be unaware of looming issues in the banking sector. Both the ECB and the Fed talk about stable banking conditions, but beneath the surface in the US, there’s a mix of weak regulation and strange incentives.

It’s fair to question if authorities are too relaxed or if there’s more trouble brewing behind the scenes. Some big banks have already failed, hinting this might just be the start.

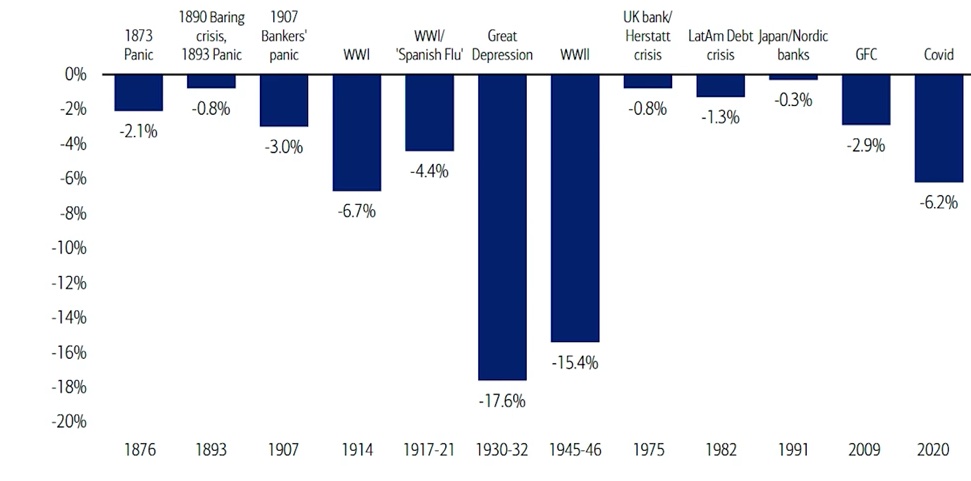

A recent survey on bank lending practices came out, giving us more insight. Looking back, big world recessions often stemmed from wars, pandemics, or banking crises. Whenever there’s a banking crisis, global GDP per person tends to drop by about 4%.

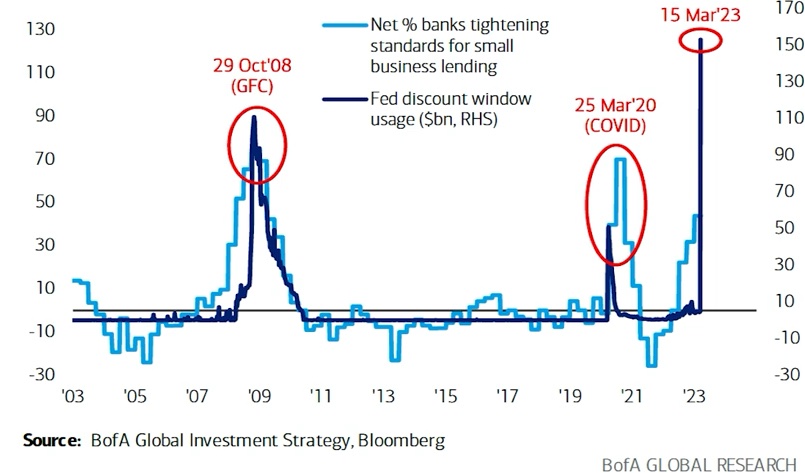

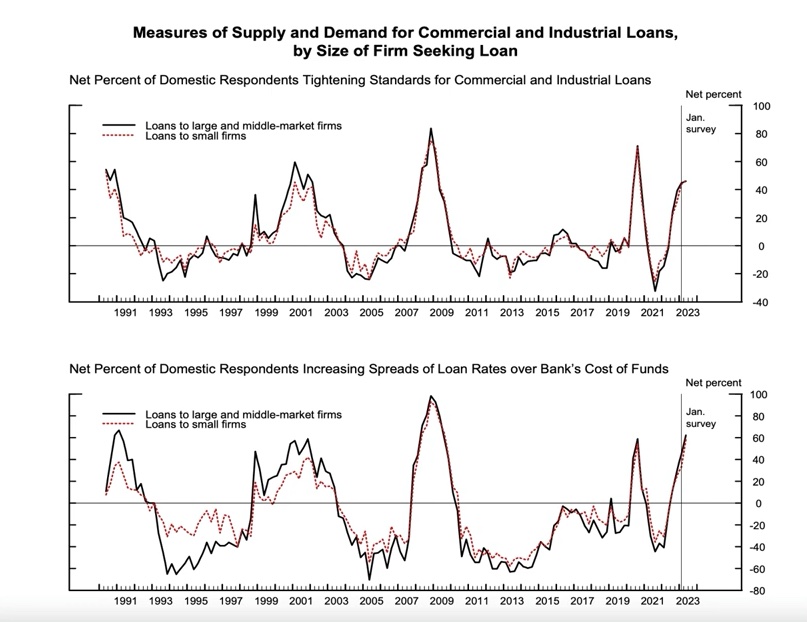

There’s a pattern: after banking crises, banks tighten lending rules. This mostly affects small businesses, as seen in a chart comparing bank usage of the Fed’s help and the tightening of lending standards.

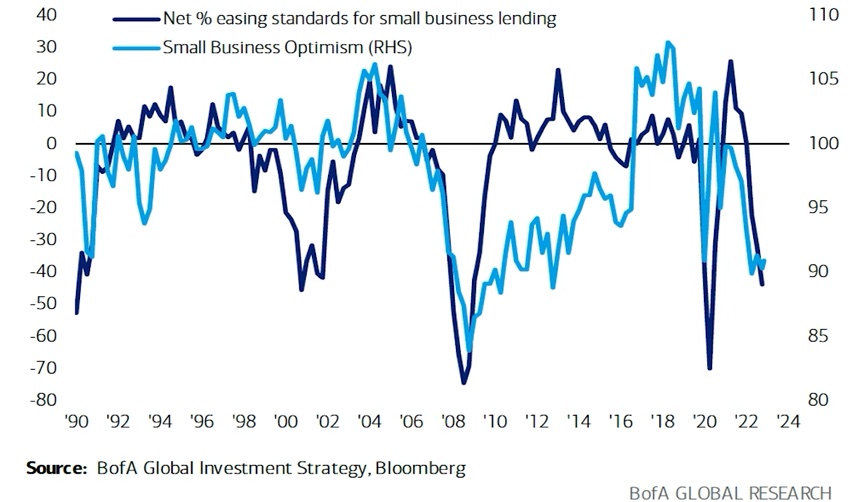

When banks become more cautious, small businesses lose confidence. This leads to less optimism and eventually job cuts, as shown in another chart correlating loan availability with unemployment claims.

The aftermath of banking crises is consistent: stricter lending and less risk-taking. Small businesses suffer the most, and they’re vital for American job creation.

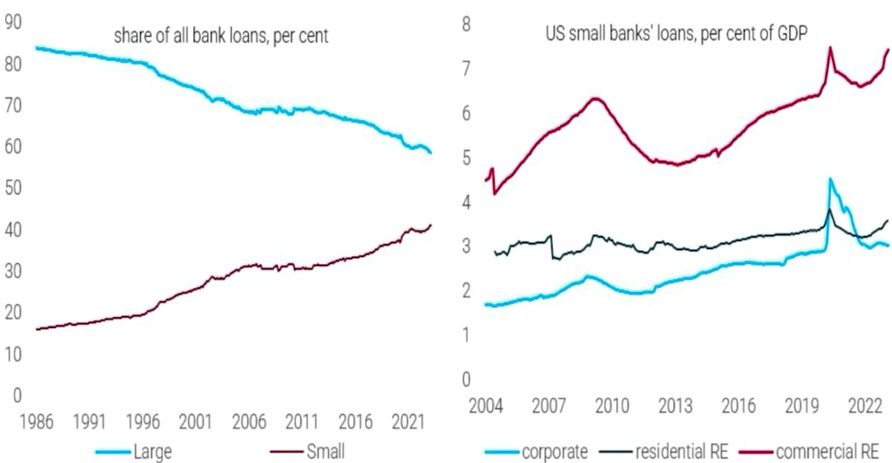

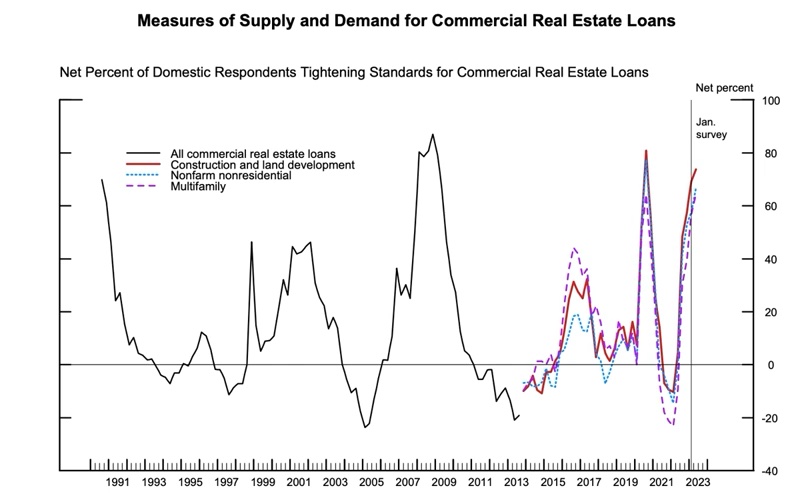

Less credit available means more job losses for businesses. Most real estate lending comes from banks with less than $250 billion in assets. High office vacancy rates at the end of last year hinted trouble, and now commercial real estate is expected to suffer.

Smaller banks don’t have to follow strict liquidity rules like larger ones. They can invest in riskier assets for higher returns. Despite having sizable balance sheets, they’re not considered small banks.

Unlike Europe, the US lacks proper stress tests for interest rate risks. Small banks have stepped up their lending, filling the gap left by stricter regulations on big banks. Their share of total loans and GDP has risen significantly.

The recent survey on bank lending shows a negative trend across all loan types. Banks are tightening standards and seeing weaker demand due to economic uncertainty and higher costs.

Loan terms are getting stricter, and banks are lending less. The charts illustrate this trend for various loan categories, indicating a challenging lending environment.

Looking ahead, banks expect to further tighten standards, citing concerns about loan quality and collateral values. Mid-sized banks are particularly cautious, foreseeing tougher lending conditions.

This paints a bleak picture for the economy, especially for the banking sector, suggesting more challenges ahead.