Today, I’ll talk about what happens when smart people fail repeatedly. Specifically, I’ll discuss bond traders, who often see themselves as the brainiest in the business. Over my years on Wall Street, bond traders have held themselves above stock traders, especially those from public schools.

They often boast Ivy League backgrounds and believe they focus on data, while equity traders are all about stories. I’ve taken pleasure in outperforming these traders financially. The issue with many bright but unsuccessful traders is their narrow focus on numbers, missing the bigger picture.

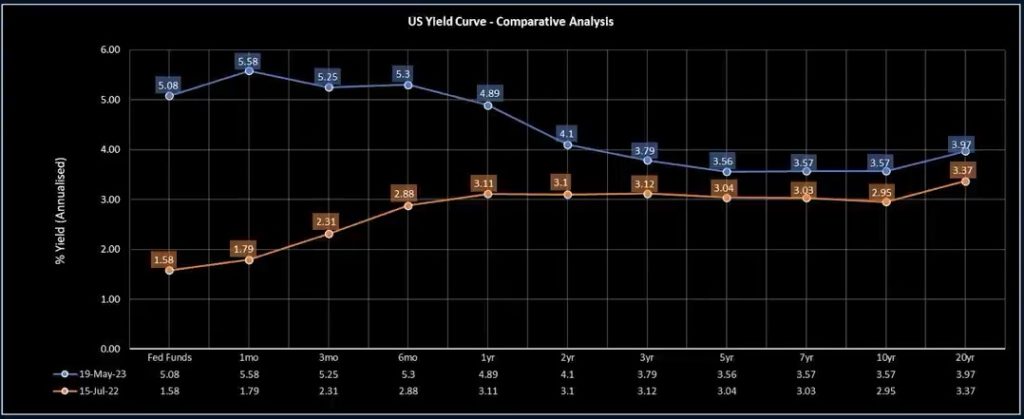

Let’s consider what the bond market indicates. A downward sloping yield curve suggests a looming recession. Despite this, the market has priced it in for about a year. Even if stocks and inflation remain steady, I doubt there’ll be a rate cut this year, as indicated by Powell’s recent statements.

Powell has hinted at being cautious with rate hikes, which might not favor stocks. However, a swift change in policy would mean admitting a mistake, something Powell wants to avoid. In the next meeting, they might pause but won’t discuss rate hikes further.

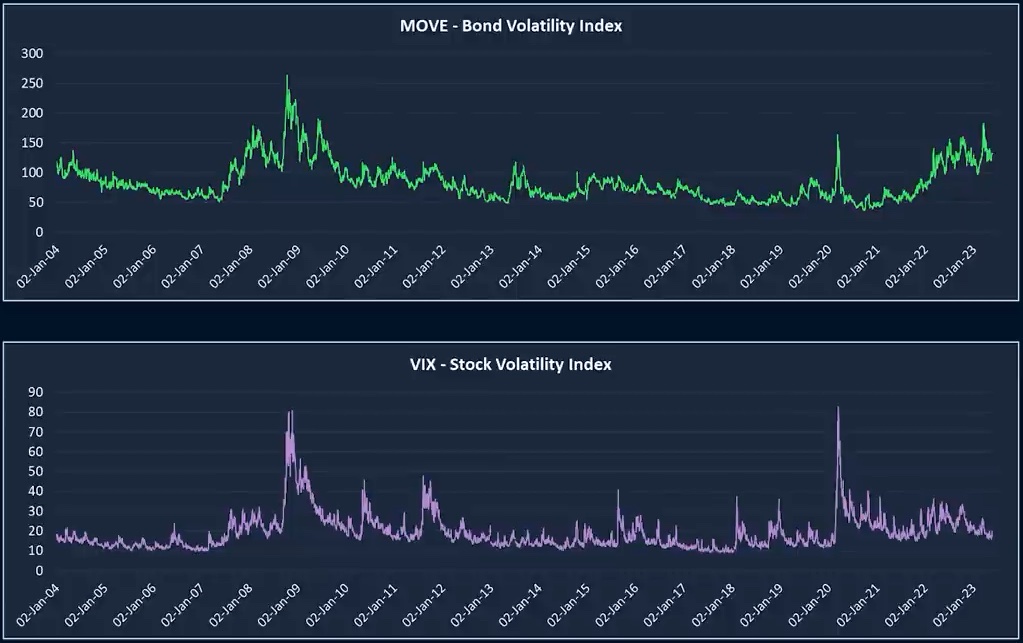

Now, let’s look at bond market volatility, measured by the MOVE Index. This index, akin to the VIX for stocks, reflects the expected volatility in Treasury options. Bonds generally show less volatility than stocks. When bond volatility surpasses equity volatility, it signals trouble in the bond market, often dragging stocks down, as seen in past crises.

During recent market turbulence, the MOVE Index spiked, reflecting bond traders’ unease. Despite this, stocks recovered, frustrating bond traders who blamed equity investors. Currently, the MOVE Index is high compared to historical averages, suggesting ongoing uncertainty.

Even amidst debt ceiling concerns, I foresee lower volatility. Someone’s analysis has been off, and looking at the VIX, levels below 20 typically indicate moderate risk, historically bullish for equities.

Last week, the VIX traded below 16 for the first time since November 2021, hitting a one-year low. Despite a recent rebound, it’s still down about 30% over the past year. On the other hand, the MOVE index is in the middle of its range, up 25% over the same period.

This divergence shows there are risks in the equity market, but the S&P staying at these levels and trending upward is frustrating for bond bears. Overall, the MOVE index is a negative indicator for stocks. The consensus has been to short the MOVE index and equities, but that strategy hasn’t panned out.

Now, fear-mongering is being used to push a bearish stance on stocks, but this tactic has been consistently wrong for the past several months. Essentially, they’re advising to ignore equity volatility and focus on bond volatility, but they’ve been incorrect so far.

The long-term trend shows a negative correlation between the S&P and the VIX or the MOVE index. However, this trend has worked for the VIX in the last year but not for the MOVE index, resulting in bond market traders being at peak bearishness.

Looking at positions, the CFTC S&P 500 net position is at its most bearish since 2011. If the debt ceiling debate gets resolved, which it likely will because lawmakers prioritize their summer vacations, it could squeeze the shorts.

Recent data shows no imminent recession. For instance, travel numbers are back to pre-COVID levels, and housing remains strong. Despite some economists predicting a recession in Q3, the data doesn’t support this claim.

While the market could crash at some point, the same bearish narrative is tired. It’s time to admit being wrong and move forward, which is what good traders do. The pain trade suggests higher levels, and unless labor markets significantly weaken, a recession in Q3 is unlikely.

There’s a new narrative emerging that once the debt ceiling deal is done, it will lead to a sell-off. However, if a softer lending narrative gains momentum, we could see a broader market rally.

In the last month, rates have crept higher, and stocks have held strong positions. Short positions and bond trades are feeling the pain. Winners and losers in the market are determined by wins and losses, not by educational backgrounds.