Chris: Today, we have Edward Shek and Anthony Iser sharing their expertise. Markets are tricky right now, especially for trading. Anthony, why don’t you kick us off?

Anthony: Sure thing. Last time we spoke, we were in the midst of a strong bear market rally. Since then, we’ve hit new lows. As of now, we’ve seen two consecutive strong days, up 5.73% combined. Throughout this bear market cycle, we’ve observed significant rallies after hitting new lows, sometimes more than 1,000% annually. But does this mean there’s more downside ahead? It’s likely. We’ll only know in hindsight whether this is the bottom or just another rally. I anticipate an earnings recession and advise against going against the Federal Reserve.

Let’s take a look at the housing market. With mortgage rates where they are, housing construction is slowing down. Searches for real estate-related terms have plummeted, indicating a downturn. Additionally, the US home purchase index has seen a 12% decline, a significant figure historically. These indicators suggest economic slowdown due to the Fed’s efforts to control the economy.

Despite these challenges, I remain cautious. While there may be downgrades in earnings forecasts, I don’t recommend going all-in with short positions. Instead, I’ve been focusing on long ideas, particularly in the tech sector. One stock I’ve been eyeing is Autodesk, a $40 billion company trading at 26 times next year’s earnings, with solid sales and earnings growth. Its low leverage and high profitability make it an attractive option in this market.

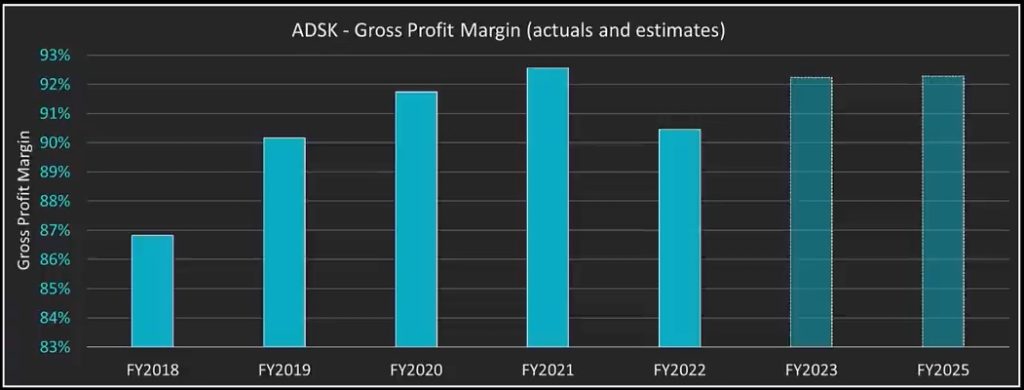

Autodesk, originally focused on computer-assisted design, has diversified into various sectors. Its main divisions, including architecture, engineering, and construction, account for three-quarters of its business. Despite the strength of the US dollar impacting earnings, Autodesk has shown steady revenue growth since 2008, with impressive margins and operational leverage. With a forecasted revenue growth of 14-13% over the next three years, Autodesk presents a stable outlook, generating significant free cash flow.

So, where’s the growth coming from? One big factor is the shift from products to services, especially in the cloud and digital workflow, which is widely adopted in construction and infrastructure. This trend is expected to continue for a long time.

Let’s talk about building information modeling (BIM). It’s a process that covers everything from initial design to construction and maintenance, all using specialized software. BIM, especially in the cloud, is becoming the norm globally, though adoption rates vary across regions.

This process has a huge market potential, with about $65 billion addressable market and growing. Most of this revenue comes from design, with the rest from construction. They’re also converting many non-paying users into subscribers, driving further growth.

Their key performance indicators (KPIs) are strong, with significant growth in contracted business and work. Their net retention rate is also solid, which supports their revenue guidance.

Overall, the industry trends are favorable, and the company is making strategic investments in R&D and acquisitions. However, macroeconomic factors like interest rate hikes could pose risks, though they’re manageable.

One concern is the significant issuance of stock to employees, which dilutes shareholder value. While it’s not a major issue now, it’s worth keeping an eye on.

Looking ahead, upcoming results and conferences could serve as catalysts for the stock. I’m setting a price target of $260, considering various options strategies to capitalize on potential movements.

One approach is a calendar spread, selling October contracts and buying November ones. Another option is buying January contracts and selling November ones, providing more flexibility. This strategy accounts for potential market volatility while maintaining upside potential.

Ed: I agree with Anthony about the market. I’m very negative about business profits. It’s not because I think inflation or rates will get worse, but because I’m pessimistic about business profits.

If the terminal rate is three and a half, it’s likely to stay there. The market hasn’t had a regular recession for over 20 years. We’ve seen crashes met with lots of QE. Rates haven’t been sensible for long, except briefly from 2016 to 2018.

I agree with Anthony about trading in the market. The market’s response, which I call the Pavlovian Pivot, excites me. The recent big rally shows how the market still reacts strongly to QE, but also quickly retreats at the slightest hint of trouble.

Even if rates fall a bit in the short term, the next move is likely down. The bond market’s been inverted for a while. But thinking a rate drop will boost risky assets is silly.

The market’s rise is fueled by 15 years of cheap financing, not increased productivity or better jobs. When trading in a bad market, expect downward pressure. Watch earnings closely and be ready for bond market movements.

The deeper the market falls, the bigger the risk rallies will be. If you’re caught off guard, you’ll regret it. Economic data slowing down and lower yields might sound okay, but it could lead to stagflation.

Instead of focusing on short-term moves, think about the bigger picture. Prepare for potential shifts in the market’s narrative.

Now, onto my investment idea. I’m balancing my portfolio with a tech stock. It’s not a bullish move, but it adds some excitement. The stock is Akamai, a $12.8 billion company that provides cloud and security services. I see it more as a cybersecurity play than a traditional tech stock.

Akamai operates a network of servers that deliver internet content quickly. It’s not web hosting; it caches data close to users for zero latency. With its vast infrastructure, Akamai plays a crucial role in delivering content from the cloud to billions of devices worldwide.

But here’s the point. It handles 30% of the world’s internet traffic, a huge network. It serves many big companies, banks, governments, and gaming platforms. Despite its reach, last quarter’s earnings were bad. Revenue stayed flat, earnings dropped 21%, and seating revenue fell 11%.

Why did this happen? Well, there are a few reasons. First, there’s trouble in Europe, a recession’s looming, and gaming is weak. Second, competition has increased from nontraditional players like Netflix and Amazon, driving down prices and volumes.

This spells trouble for profits. When you multiply two small numbers together, profits plummet. That’s exactly what happened here, leading to three downgrades overnight. Despite its tech image, it looks more like a staple stock.

The stock’s performance reflects this. While revenue is up, earnings are down. But next year, revenue’s forecasted to rise. When I bought in, the stock was down 18%. Now it’s at its lowest.

The company’s security business is growing faster than its legacy business, which is declining. This shift is why I’m bullish. The cybersecurity market is expanding, and Akamai is well-positioned to benefit.

But maintaining such a vast network requires ongoing investment. Akamai’s security business is growing at 20% annually, outpacing the market. If it continues, the stock’s valuation could rise.

Compared to competitors like Cloudflare, Akamai’s valuation seems low. With its potential for growth in the cybersecurity sector, it could command a higher price-to-sales ratio.

Despite challenges in its legacy business, Akamai stands to benefit from the growing Internet of Things. While its legacy business faces headwinds, the cybersecurity sector could drive future growth.

I’m betting on Akamai’s security business to lift its stock price. With projected revenue growth and a low valuation, I see potential for significant upside. My target price is $120, representing a 35% increase.

Of course, there are risks. Market conditions could change, and the stock could underperform. But from a risk-reward perspective, it seems like a no-brainer to me.