Introduction – Raj Malhotra, Senior Mentor

I’ve been with the Institute since 2015, mentoring over 300 students. I’ve learned what works and what doesn’t. I’m here to share our process, as Anton emphasized.

Before starting the mentoring program, we ask students to send five trade ideas, long and short, putting in full effort. This helps assess their strengths and weaknesses, getting us off to a running start. With each trade idea, students learn and improve, trimming down pitch times to focus on essentials, like an elevator pitch.

In the initial weeks, we focus on creating a diversified watchlist of trade ideas, ensuring they’re not correlated. This diversity prepares us to execute trades swiftly, often within the first or second call.

We extensively cover trade structuring and risk management, recognizing that each trade is unique with its own catalysts. From weeks 5 to 8, we split our focus between new trade pitches and managing existing positions, refining the process as real money gets involved.

In the final sessions, we concentrate on maximizing existing positions, acknowledging that most students have more active trades by then. The goal is to refine each student’s process, tailored to their individuality.

Now, let’s talk about Shawn. When I reviewed Shawn’s initial trade ideas, I was impressed by his organization and thoughtfulness. He wasn’t just regurgitating information from online sources; he genuinely understood the companies and their revenue streams.

However, Shawn needed help with options trade structuring, a common area for improvement among our students. But with his diligence and willingness to learn, I was confident we could teach him effectively.

Throughout the program, Shawn demonstrated a willingness to learn from mistakes, a crucial trait for success. He wasn’t rigid in his views, allowing his perspectives to evolve with market conditions.

By the end of the program, Shawn’s process had become refined and consistent, generating significant returns. I’m optimistic about his future success, knowing that he now has a robust, self-sustaining process in place.

Sean’s Journey – Background

Today, I’ll talk a bit about myself. I’m based in Pennsylvania, just outside of Philadelphia. I attended Ithaca College in New York, majoring in journalism, which I don’t use now. My advice: don’t study journalism in college; study economics like Anton. From 2003 to 2023, I worked in various country clubs outside Philadelphia, primarily in the golf and trap shooting industries. There, I met many highly successful people, most of whom worked in finance. This sparked my interest in studying finance outside of college.

In 2015, I began working in the pharmaceutical industry for a contract research organization, leading their supply chain department. Interestingly, I got the job after meeting the company president on the golf course. Then, in 2017, I transitioned to a large publicly traded pharmaceutical company, where I currently manage global clinical trials and drug manufacturing campaigns.

Now, onto my journey with ITPM: In 2017, I first became interested in stocks and finance, dedicating a year to intensive reading and learning. In 2019, I stumbled upon Anton’s “10 Secrets to Achieve Financial Success” video, which was pivotal for me. Subsequently, I delved into other ITPM videos, adopting a new way of thinking about the world through finance.

During the tumultuous year of 2020, I subscribed to the PTM 1.0 and PFTM video series, immersing myself in study for a year. By 2021, I had opened and funded a TradeStation account as an Institute Trader. However, from 2022 to 2023, before mentoring, I struggled with trading, experiencing losses and discouragement.

Taking a step back, I subscribed to the PTM 2.0 video series in May of the previous year. This newer version was a significant improvement, providing better guidance on generating and conceptualizing trade ideas. After completing the course and examination, I enrolled in mentoring with Raj, which took place between October and December of last year. We had weekly Zoom calls, and since then, I’ve been trading independently with much more confidence and activity in the market.

Summary – 52% in 12 Weeks

I had no live positions open at the time, my initial account balance was $25,457. However, I made a deposit of $11,900 during the month. Why did I make that deposit? Well, it was due to a major mistake I made in October, resulting in a bad trade and a margin call from the broker. I had to deposit $1,900 to cover it. I’ll explain that in later slides, but for now, note the starting balance was $25,457. Adding the net P&L after commissions and fees, which was a negative $8,960.34, my market account value was $16,497.86. With the deposit of $1,900, the account balance for October totaled $28,397.86.

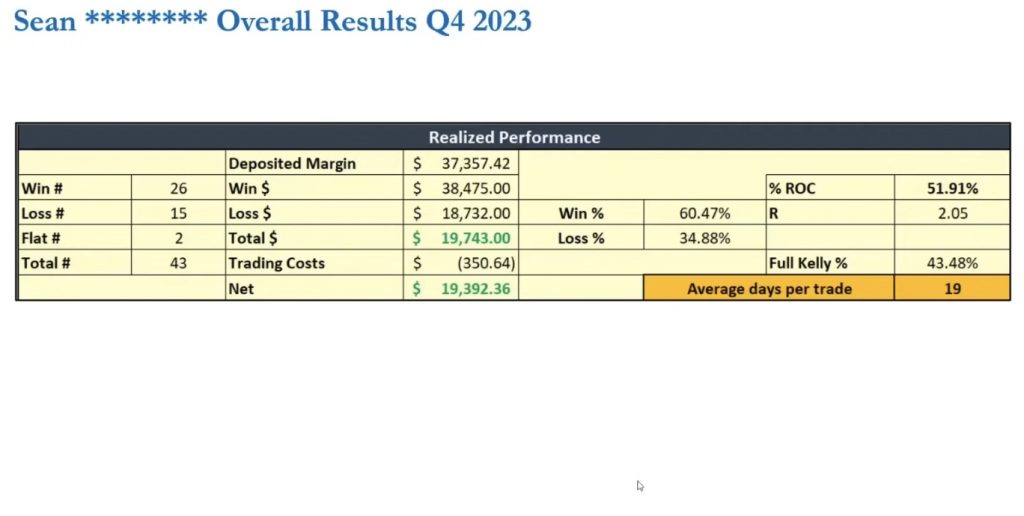

By December 22, 2023, the last day of mentoring, my cash balance had increased to $33,978. I had $13,988 in live positions at the time, making my mark-to-market value on the account $53,778. The total margin deposited between my starting capital and the margin call was $37,357.42.

In total, my percentage return on capital during mentoring was 52%, and my portfolio index return, including deposits but no withdrawals, was 45%.

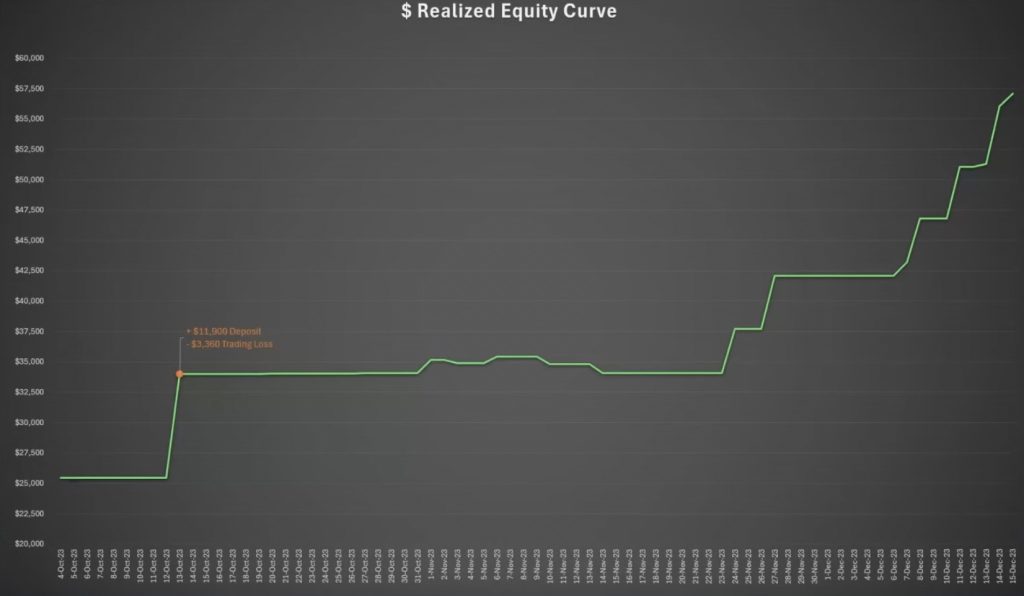

My realized dollar equity curve: it started just above $25,000 in early October. I had to make a $1,900 deposit due to a $3,360 trading loss, which I’ll explain soon. My equity curve traded flat around $35,000 for the next month, after which it really started taking off in mid to late November.

The realized portfolio value index to 100 had a significant drop-off in mid-October due to the margin call, trading low below 100 for about a month, around 85-87, before starting to rise again as the portfolio improved and winners started coming in.

A Big Mistake

I want to discuss a significant mistake I made, which Raj also mentioned, because it was crucial for me to learn from it and correct it. The mistake involved a position in Builder First Source (BLDR). I saw it as a potential short trade idea. BLDR manufactures and supplies building products for home builders. After doing the pre-work for the trade idea and consulting with Raj, I structured a calendar put spread for November and October.

During the discussion with Raj, I aimed to buy two contracts of the November $125 strike put while selling October calls to raise credits. This strategy is known as a calendar spread. However, impatience got the better of me. In calendar spreads, it’s essential to buy the long contracts and then opportunistically wait for better strike prices. Unfortunately, I rushed through it.

The correct calendar ratio spread I should have made involved buying two of the $125 strike puts for November and selling two of the $115 strike puts for October, maintaining a one-to-one ratio of contracts bought versus sold. My price target by November 17th was to have the stock at $110. However, when I initiated the trade, the stock was trading around $123.

The mistake led me to create an inverted ratio spread, with a ratio of 1 to 8, completely misunderstanding how calendar ratio spreads work and their utility. Trying to lower my total trade cost, I ended up with short optionality instead of long, which is not what traders aim for.

As a result, I was left in a vulnerable position when the stock price dropped significantly. I received a margin call from the brokerage platform, indicating that I needed to deposit more capital into my account to cover the losses. The position became a complete loser, leading to significant losses.

When I noticed this, I panicked and reached out to Raj for guidance. The short puts had exploded in value, and I was unsure what to do next. It was a terrifying experience, but I was determined not to let it define my mentoring program and trading journey. Despite the setback, I learned from the experience, and my trades and ideas started improving.

Turnaround

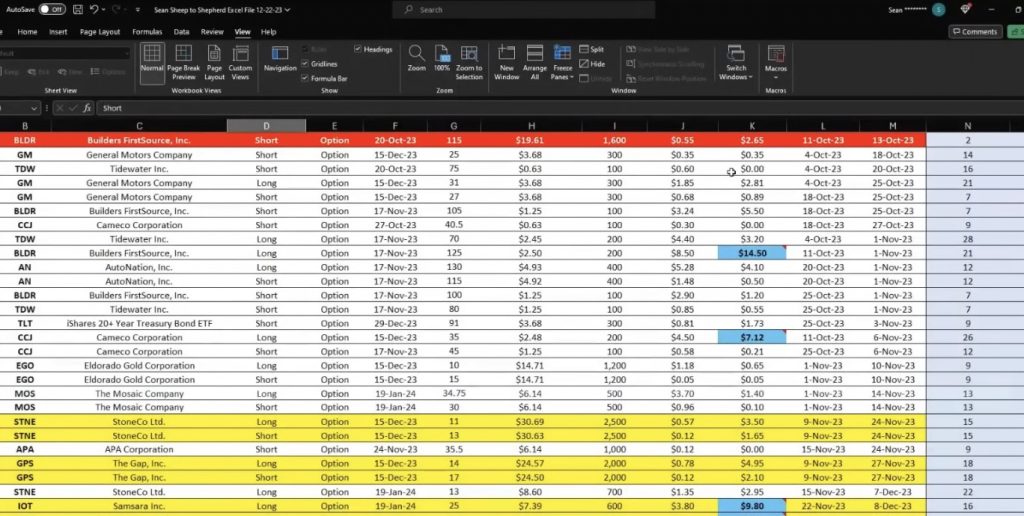

This is the raw data extracted from the TradeStation brokerage platform. All brokerage platforms provide such data based on your account. This data spans from the beginning of mentoring in early October to its end in late December. It’s crucial as it shows the trades you executed, their prices, and commission fees. Moving on to the My Equity Curves tab, it tracks all my profit and loss (P&L) and my realized P&L curve, along with my portfolio index. Although mentoring has ended, I continue updating this spreadsheet.

Now, let’s delve into my realized P&L. Starting with the deposited margin of $37,357.42, I had 26 winning trades, 15 losing ones, and 2 trades that broke even, totaling 43 trades. Wins amounted to $38,450, losses to $1,732, making a total of $1,743. Deducting trading costs of $350.64, the net profit was $9,392.36. The win rate was slightly above 60%, loss rate just below 35%, with a percentage return on capital of 51.91. The R score exceeded 2, at 2.05, and the average days in trade was 19, falling within the acceptable range of 20 to 25 days.

Moving on to the Trade Ledger, where we track statistics for each trade. Since we mainly trade options, we categorize the trades accordingly. For instance, one notable trade was a put structure that resulted in a significant loss due to impatience and attempting to rush. Consulting with Raj helped refocus my strategy, leading to better ideas and a shift from short to long positions as the market trended upwards. Highlighted yellow are my big winners during mentoring, all being long calls.

Starting with Stone, a December vertical call spread, it yielded substantial profits due to a favorable risk-reward ratio and the stock’s surge after earnings. Similarly, GPS, a December vertical call spread on The Gap, capitalized on the company’s turnaround prospects. I also had success with samera, a technology company, and EBR, B ring brands, utilizing December vertical call spreads. These trades offset the initial loss, contributing to a positive overall performance.

Finally, the active portfolio tab displays my current positions, but I won’t elaborate to discourage copy trading. Reflecting on my realized performance, I achieved a solid win percentage, an R score over two, and maintained trades within the optimal time frame. Transitioning to success stories during mentoring, November marked a turning point as I capitalized on market trends and favorable macroeconomic indicators.

For instance, The Gap presented a compelling turnaround opportunity, while Stone exhibited promising growth prospects. These trades, along with others, contributed to my success during mentoring.

Breakthroughs & Lessons Learnt

In December, I had a significant breakthrough in understanding the importance of credits for the portfolio. Throughout the month, I had four credits that expired worthless, resulting in 100% gains, which amounted to over $1,000. Additionally, there was one credit that expired down 90%, bringing the total gains from these five credits to nearly $1,500. This not only boosted the cash flow but also provided downside protection. Having credits expiring close to worthless or with significant gains is crucial for safeguarding the portfolio during periods of losses or when other positions aren’t performing as expected.

Another significant trade during this period was with B Ring Brands (BRBR), a consumer staple company known for products like Premier Protein shakes and nutrition bars. I chose this position to balance the portfolio, as it operated in a defensive sector amidst a mix of cyclical stocks. BRBR boasted exceptional fundamentals, being a positive outlier in its sector with premium valuation—a favorable condition for going long. The trade, a December vertical call spread, boasted a risk-reward ratio of 3.76 to 1 and yielded a profit of $4,200.

Another notable position was with Sam Sara IoT, a large-cap tech company specializing in application software. Their above-average revenue and earnings, along with sequentially improving key performance indicators (KPIs), made them a compelling choice. Opting for an outright call without a short leg due to timing around earnings, the trade resulted in a profit of $3,600.

Reflecting on lessons learned during mentoring, risk management emerges as a central theme. Understanding the implications of a market downturn on the portfolio’s P&L and maintaining a diversified portfolio are crucial. Analyzing each position’s movement and adhering to predetermined exit strategies help avoid impulsive decisions and minimize losses.

Maintaining patience, discipline, and a structured approach to trading are essential. Position sizing, profit-taking strategies like scaling out, and continuous generation of high-quality trade ideas based on fundamentals and technicals contribute to long-term success. It’s vital to maintain a watchlist by sector, evaluate trade ideas based on portfolio benefits, and collect credits monthly to offset losses.

Furthermore, staggering expertise by spreading trades across different expiration months and considering timing and structure are key. Objectivity and continuous tracking and analysis of trading statistics are critical for identifying strengths, weaknesses, and areas for improvement. Trading is a journey of continuous learning and improvement, requiring diligence, adaptability, and a commitment to excellence.

***

Q&A Summary

Question: What’s the requirement for someone who did the original PTM1 to participate in the remote program? Answer: If someone did the original PTM1 and wants to participate in the remote program, they need to do PTM2 because the standards are higher now compared to 2014-2015.

Question: Are there plans to increase the number of students for the Thailand program? Answer: The program already takes a lot of people, with close to 100 participants in 2022.

Question: How much time do you spend on trading per week, and what’s your approach to generating trade ideas? Answer: I spend between 10 and 12 hours per week on trading, aiming to come up with two new trade ideas to keep the watch list fresh and have replacements if needed.

Question: What’s the difference between PTM2 and PTM1? Answer: PTM2 offers much more detail and higher quality due to seven years of feedback, covering all aspects of trade idea analysis, including timing, technicals, and company analysis.

Question: How do you judge whether a position is too big for the underlying stock? Answer: It depends on the amount of capital in the account and the risk one is willing to take, typically about 70% of risk capital is sufficient.

Question: What’s a reasonable timeline to complete the starter online training? Answer: About three months, but it can be shorter for those with more time to commit.

Question: How do you balance trading with a full-time job? Answer: Being well-organized and having a set plan each week is crucial to balance trading with other commitments.

Question: What are common traits among successful and unsuccessful students? Answer: Successful students diligently follow the provided plan and execute the tasks as instructed, while unsuccessful ones often deviate or resist the process, hindering their progress.

Question: What advice do you have for those participating in mentoring programs? Answer: Fully commit to the program and follow instructions diligently to see successful outcomes, as resistance or half-hearted efforts can impede progress.

Question: How long does it typically take to complete the courses according to the website?Answer: The website mentions 12 months access to the online programs, but it’s not necessarily meant to take 12 months to finish. It’s more about accommodating different circumstances. You can complete it in two to three months if you’re focused.

Question: When does the mentoring program start? Answer: The mentoring program starts at the beginning of every quarter. Applicants need to apply one to two quarters in advance, and they have the flexibility to choose their start date and mentor.

Question: Is 34 years old considered too old to start trading? Answer: No, 34 is definitely not too old. There are traders in their 70s participating in the programs. Age isn’t a barrier, and trading isn’t like being sent to battle in Medieval Times.

Question: Can one achieve a 400% ROI by the end of the year if they make a 50% return in 12 weeks?Answer: Returns in trading are not linear, and focusing solely on returns is not advisable. It’s more about following the process and not forcing trades to meet specific return targets.

Question: What is emphasized in the trading process at itpm? Answer: The emphasis is on trading stocks based on a plan, rather than trading based solely on price movement. Understanding and trusting the process leads to a calmer and more successful trading experience.

Question: Was the 50% return achieved with a Delta neutral portfolio? Answer: No, the return was achieved with a long bias. While having a bias is acceptable, being flexible and adaptable is essential in trading.

Question: What is the policy regarding taking multiple mentorships at itpm? Answer: While it’s possible to take multiple mentorships, it’s limited to a maximum of two. The purpose of the mentoring program is to enable traders to become self-sufficient, and relying too much on mentors defeats that purpose.

Question: Is a financial background necessary to succeed in trading? Answer: No, a financial background is not necessary. Many successful traders at itpm come from various non-financial backgrounds, and having a brain and being able to think critically are more important.

Question: Are there differences between the remote and in-person mentoring programs? Answer: While both programs cover the same content, the in-person program in Thailand provides additional classroom time, allowing for deeper understanding before starting the 12-week program. However, the remote program is still effective, and both options have their merits.

Question: Is it overcrowded at itpm with its growing number of students? Answer: No, itpm has scaled its operations effectively, ensuring that the quality of education and outcomes remain consistent despite the growing number of students.

Question: Is it possible to succeed in trading without a financial background? Answer: Yes, many successful traders at itpm come from non-financial backgrounds. Having critical thinking skills and following the process are more important than a specific educational background.