Chris Quill: We’re here to give you insights into how traders view markets and manage their portfolios. Today, we’re joined by Ben Berggreen and Raj Malhotra, senior trading mentors. Raj, what’s on your mind today?

Raj: Today, we’re discussing the highly anticipated Fed meeting and its impact on markets. Despite concerns, I have a different take on inflation. I believe it’s peaked in Q4 and might decrease in Q1 2022 due to supply chain issues causing potential deflationary pressures. Stable prices are key for businesses and traders. I think rate hikes might come sooner than expected, possibly in March, with more front-loaded increases than the market anticipates. Despite this, 2023 might not be as bullish as previous years. I’m focusing on reasonably valued stocks and considering pair trades.

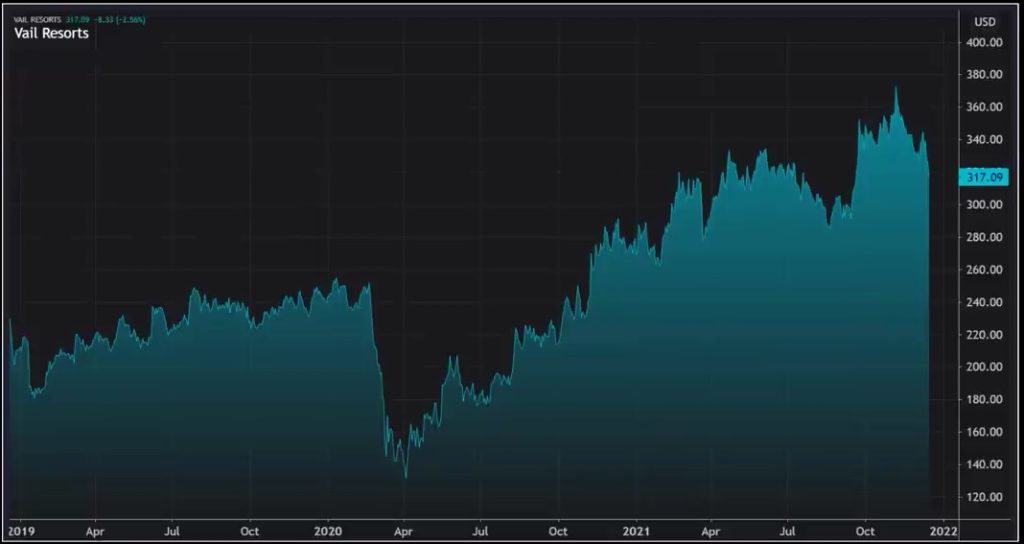

Ben: I agree with Raj about the uncertainty surrounding the Fed meeting. Considering recent market volatility, I’m looking into pair trades myself. Also, I’m eyeing Vail Resorts (MTM) as a potential long trade. Before COVID, their earnings were strong, and they’ve shown resilience post-pandemic. Their growth outlook seems promising, with solid earnings projections and the success of their Epic Pass.

In summary, Vail Resorts is thriving despite past challenges, especially with the success of their Epic Pass, which allows access to multiple ski resorts across the US, capturing a shift in consumer behavior.

There’s a change happening in Europe and the US ski industry. More people are opting for passes over individual tickets, shifting towards a subscription model. Premium services are attracting customers, with over 2 million passes sold this season.

Prices have been lowered to offset losses due to COVID. Pass sales are up by 76%, around 900,000 more than before. Despite usual optimism in earnings calls, the CEO admitted they surpassed expectations.

Currently, there’s a 50/50 split between ticket and pass sales, aiming for 75/25 in favor of passes. This shift ensures a more stable revenue and encourages more frequent visits with unlimited access.

Unusually cold weather is benefiting ski resorts, with forecasts of heavy snowfall. Ticket sales are limited due to high demand and COVID restrictions, posing some risks but also opportunities.

As a pass trader, I’m considering these factors alongside technical analysis. Recent trends suggest potential growth, possibly reaching $390 by Q1.

I prefer to invest in strong companies whose stock prices are rising, even if they’ve had a temporary dip. These setups usually work well. Let’s talk about an example using options.

For a $3,000 trade, I’m considering a vertical spread expiring in mid-April. There are two options chains available. Yesterday, the April calls at $330 were $26 per contract, and shorting the April $390 calls cost $12 each, above the resistance level.

The aim is for the stock to reach $390 but not much higher. So, the potential gain is $14 per share, or $1,400 for two contracts, totaling a $2,200 max spend. If the stock stays below $330 at expiration, or above $390, the max loss is the premium paid.

The potential max gain is over $9,000 if the stock hits $390 by expiration. That’s $4,600 per contract, totaling $9,200. It’s a high-probability trade with a 3:1 reward-to-risk ratio.

Considering the current situation with COVID, it’s wise to pair this trade with another in a similar industry. Carnival Corp is a suitable choice. They operate cruise ships, similar to others in travel and leisure.

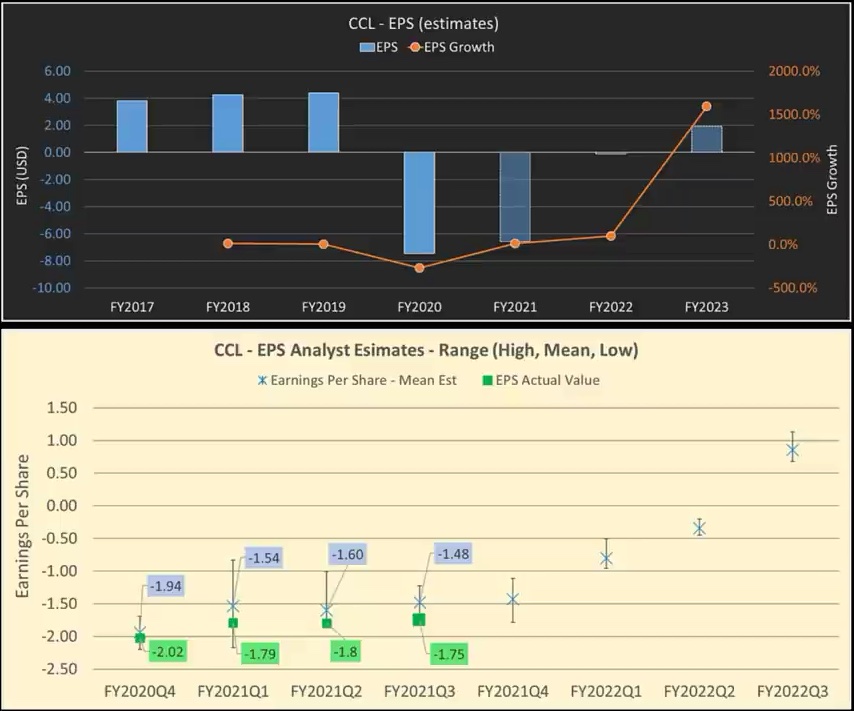

With a $28 billion market cap, Carnival Corp has struggled financially for years, especially since COVID hit. Unlike some competitors, they haven’t bounced back. Their revenue-based valuation is 30 times due to significant revenue loss.

The outlook isn’t optimistic. Estimates are worsening, and ongoing travel restrictions are adding pressure. With $32 billion in debt, double the shares outstanding, and $2 billion quarterly losses, their financials are alarming. The stock has been on a downtrend, failing to recover to pre-COVID levels.

Considering all this, it’s prudent to steer clear of Carnival Corp. The company’s financial woes were evident before the pandemic, and the current situation only exacerbates them.

Okay, so when a stock has a bear flag, it usually bounces a bit before dropping more. This stock’s support is around $10 to $12. If it breaks below that, it could go down to $10 soon.

Now, looking at a $3,000 trade, I see a vertical put spread expiring in April. I’m combining $17.50 puts with $12.50 puts, spending about $0.60 each. That makes a total of $2,990 risk if the stock goes above $70.50 by expiration.

If the stock stays at or below $12.50, the gain could be around $8,510. These trades can work separately, but together they summarize well. The max risk for both trades hitting their worst outcome is $5,790.

If both trades reach their best outcome, the gain could be $7,710. But the most likely scenario is a mix of both. These trades can stand alone, but they also work nicely together.

So, that’s the deal. These trades can fly solo, but they’re a good match as a pair.

Chris: Yeah, I think that’s a smart sort of pair to look at. There’s lots of reasons, like you said, that even though they’re in the same kind of sector, there’s plenty of reasons why Vale will outperform Carnival Cruise, you know, given given COVID and everything. And Raj, let’s let’s go over to you. You mentioned at the beginning of the episode that you had a stock you were looking at that kind of tied in with your your macro as well.

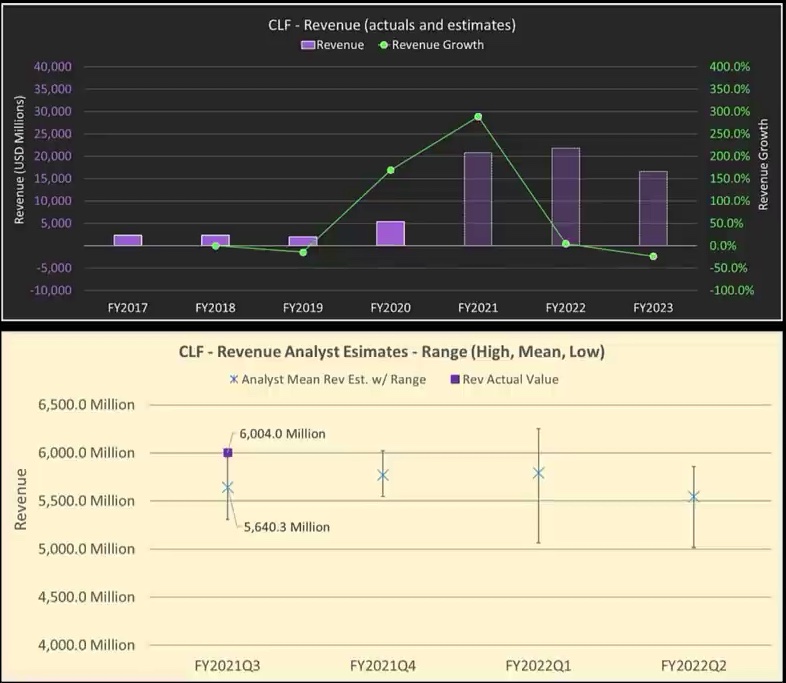

Raj: Yeah, sure. I have a great stock idea. Before I get into that, I want to mention that I really like Benz Paris’ idea of going to a mountain instead of a ship for vacation. So, even if you don’t like the stock idea, I definitely like that vacation idea. Now, onto the stock I do like, it’s called Cleveland-Cliffs, symbolized as CLF.

It’s a company that deals with mining and natural resources, specializing in mining iron ore, steelmaking, stamping, and tooling. Their main focus is being the largest producer of flat rolled steel in North America, which makes them well-positioned in the auto market. Another thing about this company is they face some ESG challenges compared to their competitors.

This should appeal to investors interested in the market. The company has been very profitable this year and is expected to continue next year. The issue is the long-term concerns beyond 2023. But I believe some of those concerns are exaggerated.

Let’s look at the most recent quarter. Currently, the company has a market cap of a little over $10 billion and a low price-to-earnings ratio. Their earnings per share this quarter were $2.03, beating expectations. Their revenue for the quarter was $6 billion, also beating expectations. The most impressive number was their revenue growth, which increased by 265% year over year.

Looking ahead to 2022, there’s a wide range of analyst estimates for earnings per share, from $3 to $7.50. This variability presents an opportunity, especially for options traders. The company is attractively priced, has low debt, and stands to benefit from recovering automotive production in Mexico.

Despite concerns about high steel prices, I believe they will remain elevated longer than expected. Even if they soften, increased sales volume should compensate for any decline in price. Wage growth at the lower end of the consumer chain will likely continue, providing more disposable income for big-ticket purchases like new cars.

Overall, I think the market is underestimating the company’s preparedness for the future. Their strategic M&A deals and offensive moves position them well for long-term success. Insider buying by key executives further supports the idea that the stock is undervalued. Additionally, the company’s decision to redeem their convertible notes early is a positive signal for investors.

So, if we look at how this works for a company’s structure, reducing debt will decrease its share count. This, in turn, will boost their EPS, making the stock seem even cheaper, especially considering its value. With the reduction in share count, the company aims to eliminate its debt soon. This move would be advantageous, particularly if interest rates rise, as they’d be debt-free and in a position to acquire struggling companies or strengthen their own position. While other companies struggle with debt, the demand for steel remains high due to ongoing infrastructure projects. These strategic moves create competitive advantages that are hard to replicate, potentially driving the stock higher.

Regarding the trade structure, I was considering buying April 20 calls twice and selling one January 23 call. This creates a 2-to-1 ratio. The April calls can be bought for around $2.35 each, while the January calls can be sold for approximately $0.35 each. With a budget of $9,000, you could purchase 40 April calls and sell 20 January calls.

If the stock reaches $30, which aligns with many analysts’ estimates, the risk-reward ratio is around 4 to 1. Considering you’re buying more April calls, the ratio is even better. This trade seems favorable for a stock with low P/E and current value trends, which are popular in the market right now. It’s wise to include such value trades in your portfolio, and this one looks promising to me.

Chris: Nice. Well, gents, I think I think with that, we will get to the end of the show here. Thank you both for kind of sharing your thoughts and ideas once again on the episode.