Chris Quill: I’m delighted today to have Jason MacDonald and Anthony Iser joining. Always a pleasure to have you guys on. Anthony, let’s go over to you first and you can kick things off for us.

Anthony: Thank you, Chris. Glad to be here again. Let’s dive in. I’ll share a buy idea today. Finding good picks in this market isn’t easy with all the selling pressure and negative news.

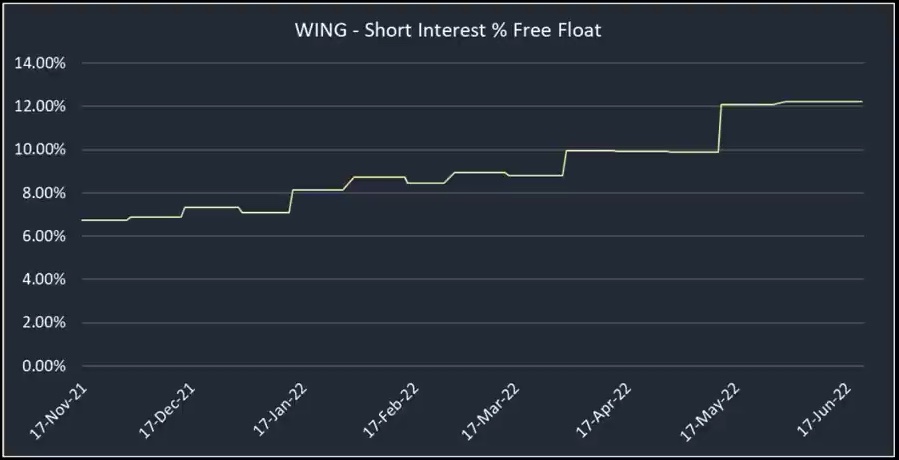

The company I’m eyeing is Wingstop. They specialize in chicken, particularly wings. It’s a sizable company, valued at $2.25 billion, with about 10% short interest. Despite the challenging environment, they seem to maintain stable margins and consistent top-line growth.

Wingstop operates 1,700 stores globally, adding a couple of hundred each year. Their key metric, same store sales growth, has seen eight consecutive years of increase, even during tough times like COVID and the financial crisis. Their business model revolves around three divisions: franchising (44%), advertising (30%), and company-owned stores (25%).

Franchisees enjoy healthy returns, around 70% cash on cash unlevered returns. Last quarter, they saw a 12.5% increase in system-wide sales, opened 60 new stores, and achieved a 1.2% same store sales growth. Digital sales are a significant driver, constituting 62% of total sales.

Looking ahead, Wingstop anticipates solid top-line growth, with forecasts indicating 24%, 17%, and 16% growth over the next three years. Despite market concerns about margins, they seem to manage costs well, especially with stable chicken prices.

Currently trading at $75, down from its peak of $172, the stock has experienced multiple contractions. However, with growing sales and earnings, I expect positive momentum. While there was a slight downgrade in expectations last quarter, I foresee improvement.

In summary, Wingstop’s straightforward business model, coupled with controlled costs and robust sales growth, presents an attractive opportunity in a challenging market. It’s not a highly discretionary purchase, so it’s relatively resilient. I suggest a structured play around their next earnings report, anticipating continued growth and cost management.

Considering buying $75 calls for around $8 and selling July $75 calls for about $5 in a two-for-one ratio. Ideally, the stock stabilizes until July, leading to a strong performance in early August. It’s a rare find in today’s market, but one worth considering.

Chris: Yeah, I agree. Definitely hard to to find some buy ideas, but that one sounds fantastic. So thanks for that, Anthony. Jason, let’s go over to you.

Jason: I’ve got a short idea on Moody’s, the well-known rating agency. Their market cap is around $47 billion, with a share price closing at $268-$260 last night. They provide credit ratings, research, software solutions, and risk management services to banks and financial institutions.

Moody’s has two main divisions: Moody’s Investors Service, which accounts for 61% of revenues and 80% of operating income, focusing on credit ratings for various instruments, and Moody’s Analytics, contributing nearly 31% of revenues, mainly offering financial risk management solutions.

While Moody’s Analytics has been the growth driver, Moody’s Investors Service remains dominant in income. They compete with S&P in a duopoly, with Fitch trailing behind. Analysts expect a 15% earnings drop this year, rebounding by 16.5% next year.

Their price-earnings ratio is 24.4 for this year and 21 for next year, slightly lower than the sector average. They offer a small dividend yield of 1.1% and minimal short interest. The decline in fixed income issuance and the rise of private credit markets could impact their revenue.

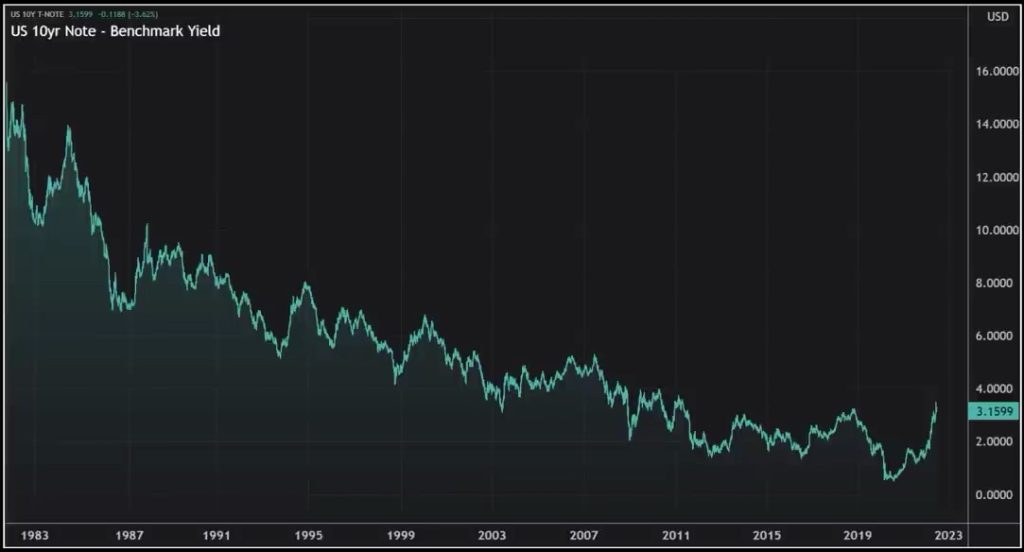

Moreover, the end of a prolonged bond bull market and a potential decrease in market access for leveraged borrowers might further challenge their earnings. Despite expectations of a quick rebound next year, prolonged market closures for highly leveraged borrowers could negatively affect Moody’s.

The lack of recent corporate bond issuances and slow activity in the municipal debt market hint at potential challenges. Downgrades in recommendations and earnings projections could occur, possibly as early as August. Given the volatile market, timing is crucial for trading Moody’s stock, which is currently a bit oversold.

I’m waiting for a rally to sell into and considering a combination of stock and options for my trade strategy, depending on the price at the right moment. So, I’m on the sidelines, awaiting a good opportunity to emerge.

Chris: Thanks a lot, Jason. I think it’s an interesting point that you bring out that you have to be more price sensitive when there’s more vol as well. That’s a good, good lesson for everyone to take away, I think. Anthony, let’s go back to you. What have you got for us?

Anthony: Well, I’ve also got a brief note on Dillard’s, as Jason pointed out, there was a strong day in the pre-market on Wednesday. So Tuesday was strong, with everything up aggressively. I think the outlook for this company is much more negative than what’s currently priced in. Therefore, I’m considering shorting Dillard’s now.

Dillard’s is a large department store company, family-owned for about 80 years. It has 280 stores across the US. Department stores worldwide have mostly closed. Macy’s went into Chapter 11 during COVID and is still under pressure. This sector will likely struggle in the current tough economic climate.

The stock is trading at $275 to $276, with a market cap of about $5 billion. It’s family-run, with the majority of shares held by the family. There’s not much information available, as they don’t do investor calls or presentations. Therefore, there might not be many new buyers interested.

Previously, the stock traded between $65 and $75 for a long time but surged to nearly $400 post-COVID. Dillard’s focuses mainly on apparel, with 14% of sales from cosmetics, 36% from women’s apparel and accessories, 11% from kids, 19% from men’s, and 15% from shoes.

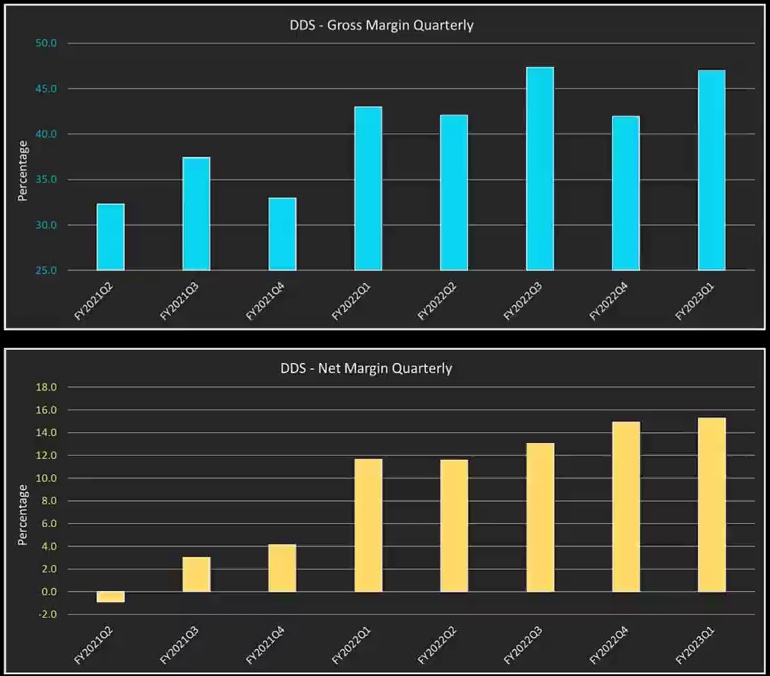

They have a significant private label merchandise offering, mostly from China. Their recent performance has been strong, with retail sales up 23% and gross margin at 46%. However, I doubt these record margins can be sustained, given the competitive landscape and supply chain issues.

Looking ahead, retail sales are forecasted to be flat this year, then decrease by 2% next year and 11% in 2026. While sales numbers haven’t changed much, profit margins have expanded dramatically, but they’re expected to decline significantly in the coming years.

There are various risks, including supply chain disruptions, inventory issues, and consumer behavior changes. Customers may resist price increases, impacting sales and profitability. Therefore, I anticipate a significant downward adjustment in their performance.

I’m considering a spread trade, buying August puts at $270 and selling July puts at $250 to take advantage of potential declines post-earnings. Additionally, I’m selling August calls at $350 to hedge against any unexpected price increases.

Despite the risk, I believe Dillard’s is vulnerable to margin pressure and may face challenges in the future, potentially leading to further declines, especially in a recessionary environment.

Chris: Thanks for that, Anthony. We’ll go back to you again. Jason, if you’ve got any more ideas or any sort of market macro commentary you want to touch on.

Jason: Yeah, I’ve got some general comments before the Q2 earnings season starts next month. I agree with what Anthony said about Kroger’s recent performance. Even though Q2 is around the corner, Kroger, the fourth largest US grocery chain, reported last week with declining gross margins.

Their margins dropped from 21.9% to 21.6%. It might seem like a small decrease of 30 basis points, but the Street expected an increase to 22%. Supply chain issues and what they call strategic price investments, which really means slashing prices, are to blame. Microsoft also gave a profit warning due to US dollar strength, as Anthony mentioned.

Target slashed their guidance twice in three weeks due to increasing inventories. I’m not as optimistic as analysts about earnings or margins. From a bottom-up perspective, as of two weeks ago, FactSet compiled analysts’ estimates. The Street expects a 4% year-on-year growth rate in earnings for Q2, down from 6% estimated in March.

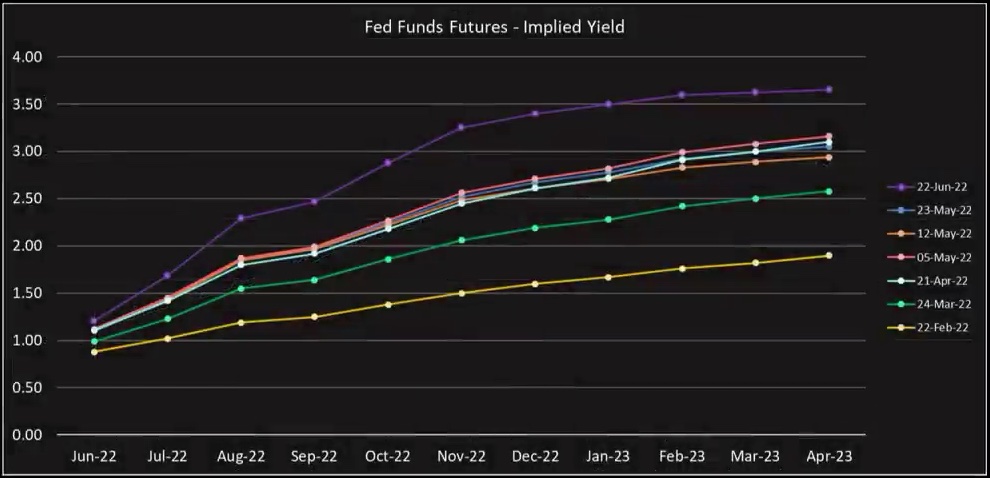

However, expectations for the second half of the year have been rising. Analysts now predict a 9.6% full-year earnings growth for the S&P this year, compared to 8.8% in April and 8.4% at the beginning of the year. That seems optimistic, considering the risk of the Fed over-tightening, possibly leading to a recession and risking profit margins.

Analysts believe S&P 500 net profit margins will be around 12.4% this year. That’s down from 13.5% in Q3 last year and 13.4% in Q4 last year, but still higher than the long-term average of 8.2% since 1993. Corporate America is struggling to pass on rising costs, with the producer price index up 9.4% in the last 12 months compared to 6.7% for the consumer price index (CPI).

To put it in perspective, in the decade leading up to last year, pay rose by an average of 1.6% compared to 2.1% for CPI. These are significantly higher numbers, indicating that margins may not be sustainable. This aligns with what’s been said about Dillards.

Chris: That’s a really interesting way to frame it, sort of pivot CPI relating to profit margins. Guys, it’s been a pleasure.