Chris Quill: I’ve got Ross Williams and Raj Malhotra joining me on the call today. These guys are going to be talking about their views on markets and also some ideas that they’ve been thinking about for their own portfolios. It’s going to be great to hear from them. And gents, fantastic to have you on. And Ross, why don’t you take things away today?

Ross: Good to be here. Chatting about markets, etc.. I’m going to preface everything by saying that we’re filming this ahead of the Fed’s interest rate decision. So if some stuff blows up in the next 24 hours, then I’ll take a pass on that. We’re in the middle of earnings season.

Normally that would dominate most people’s time and energy. But we’ve got a big CPI print, a GDP print, and probably the biggest interest rate increase we’ve seen in more than ten years. So, there’s a lot going on.

The one thing I was trying to maintain is, if you’re unsure of what’s happening, go read the earnings releases of the biggest companies in each sector. There’s been a lot said this season, some really divergent stuff, which creates trading opportunities. The question is, has the equity market bottomed out or is it about to? Can we move into a period of taking risk more aggressively?

I typically don’t try to call the market, but it’s important to have some kind of view. Bank of America has $2.9 trillion of assets under management, mainly in retail equity accounts, with 62% in equity. So they have a good look at how people are positioned.

Looking for a market bottom, you need some kind of big recession, a central bank pivot, or capitulation from retail investors. Then you can be more proactive on the long side. Bank of America looked at equity outflows during crises and found interesting trends.

In the financial crisis, for every $100 that came in, $113 left. They all capitulated in March of 2009, when the market bottomed. Similar patterns were observed in subsequent crises.

In 2022, the headline market isn’t down a lot, but many stocks are. Surprisingly, retail outflows were zero for every $100 that came in. Hedge funds are washed out, but retail investors haven’t sold anything yet.

Institutions are in job preservation mode, taking a forward view on the markets, while retail investors invest based on current feelings.

There are positive signs in the US consumer market, with companies like Visa and LVMH reporting good numbers. We’re at an interesting juncture, unsure of how things will play out.

The market could rally if institutions come back aggressively, or we could trade sideways until a bearish market ends. The key is to have longs and shorts and not worry too much until we see what happens.

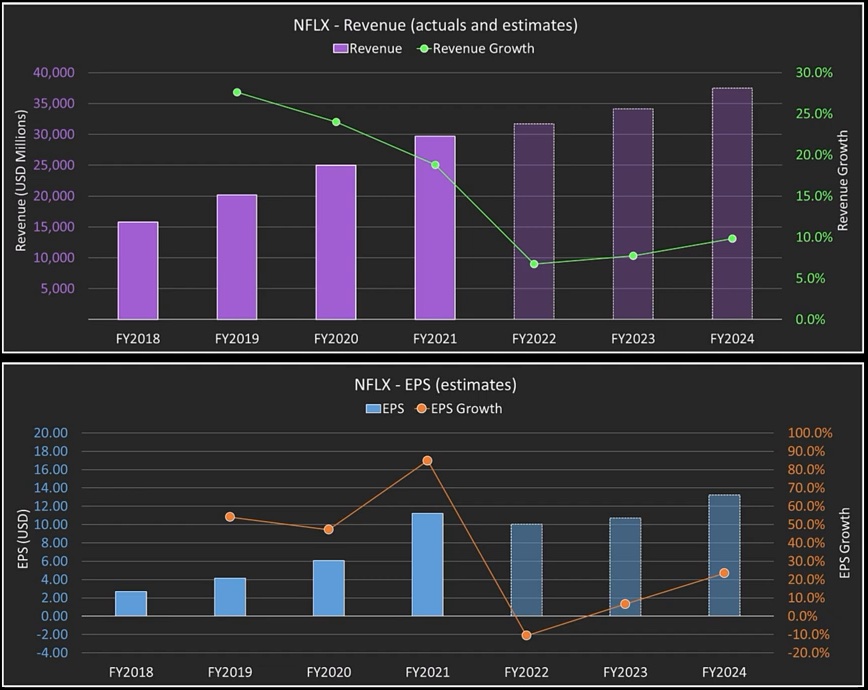

My biggest long at the moment is Netflix. It’s down 65% year to date, trading on 20 times 2023 earnings, which I think is reasonable for a growing company.

Interest rates have stabilized, which is good for equities sensitive to rate changes. Netflix might trial an advertising model, which could boost margins. Also, a weaker dollar could uplift earnings.

So, I see limited downside and a couple of catalysts that could push Netflix up by 20% without much effort in the next few months. That’s my long idea.

Chris: Awesome. Would you look at options or is there anything structurally that you’d want to comment on?

Ross: I spend a lot of time looking at the options market and unsurprisingly puts costs a lot more than calls at the moment. But this thing’s trading on implied vol around about 50 at the money. I want to have a slightly longer term view on this, but I also want to pick it up with a short equity position .

Chris: Raj, let’s go over to you then. What have you got?

Raj: Yeah. Ross mentioned some interesting stuff about valuation and rates. I played golf with the chief economist at a big firm this weekend, and he knows Powell well. He said Powell really wants to fight inflation, like Volcker did. They feel they can be aggressive because the S&P is close to 4000. They want to nip inflation in the bud to maintain credibility.

The market seems to accept this, despite high-level valuations. The S&P is down about 20%, but individual stocks are down much more. This creates a situation where growth and value stocks are trading at reasonable valuations overall. Earnings have been negative but better than expected in many cases, which has led to positive stock reactions, even for companies like Microsoft and Google, whose earnings were worse than expected.

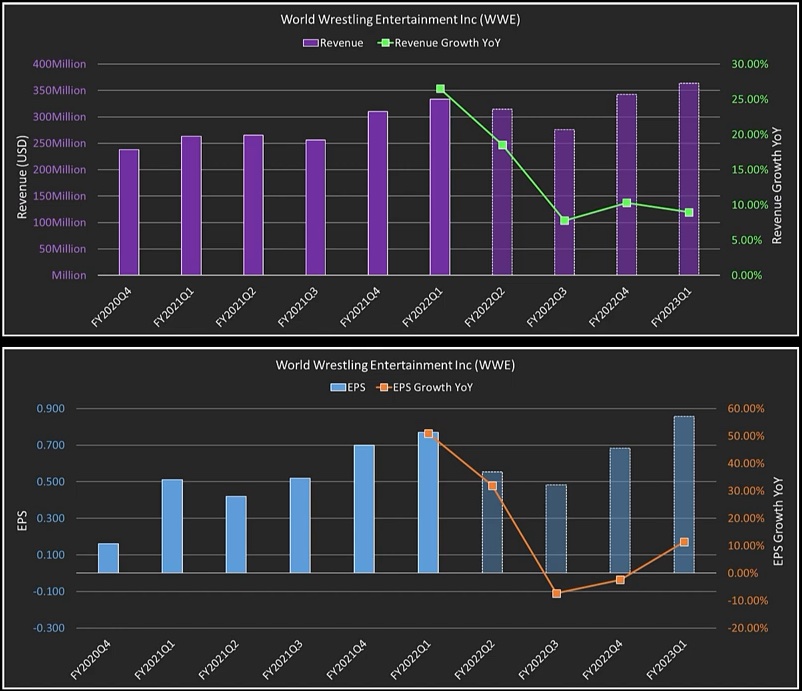

Expectations for earnings have shifted. Now, meeting expectations is seen as positive, whereas before, even beating expectations wasn’t enough for a rally. As for specific stocks, WWE might be an acquisition target, given its unique brand and diverse revenue streams. Despite its higher valuation compared to peers, it has performed well and is expected to continue doing so.

Looking at its Q1 earnings, WWE performed better than expected, with revenues up 26% year over year. Q2 earnings are expected to be solid as well, with potential for more clarity in the business plan. However, there has been some turmoil within the company, including the retirement of Vince McMahon from the board due to financial discrepancies related to sexual harassment suits.

Now, it’s a big deal in WWE’s history. He was the face of the brand, the most famous figure. The company’s moved on without him in recent years. He’s been out of the loop. There won’t be any major disruptions. The co-CEOs have been running things for the past year and a half.

They’ve made significant moves to propel the company forward. They forecasted $328 million in revenue, a 24% increase from last year. That’s way above expectations. Other positive developments are likely to come up this quarter.

Vince stepping down increases the chances of a business sale. There will be plenty of interested buyers. Netflix, with its global reach, might consider it. Amazon and Disney are also potential buyers, along with Comcast.

Their TV rights for Raw and Smackdown have grown both internationally and domestically. Buying the business could offer significant international expansion opportunities. The stock isn’t cheap, but takeover speculation keeps it high.

Their growth, especially in a weaker economy, has been impressive. They have a unique brand with little competition. WrestleMania 38 was the highest-grossing and most attended event in history.

Recent big deals have boosted their earnings. They have a loyal fan base and little competition for top talent. Live events are surpassing 2019 levels.

Their fan base isn’t likely to skip events due to COVID fears. Partnerships with Peacock Network and Fox have been impressive. TV rights for sports and entertainment are booming.

Cricket rights recently sold for triple their previous value. Similar stories happened in American football and soccer. TV rights renegotiations could greatly benefit the stock.

I estimate the stock could easily reach $80 to $85 without a buyer, potentially $100 if acquired. Amazon seems like a probable buyer, given their capabilities and fan base merchandising potential.

The stock might seem pricey now, but earnings could double to $5 per share by 2025. In the long term, this acquisition may not be expensive after all.

In terms of structure, I’m eyeing a full spread. One note on the setup right now is the October 1795 call spread. The idea here is to extend the typical 1 to 3-month horizon, considering acquisitions usually take longer.

Looking at the spread, you’d pay $5 for the October 70 call and sell the October 95 calls for $0.50. That nets a debit of about four and a half dollars for that call spread. In terms of risk-reward, you could potentially make $22 while risking four and a half.

So, it’s roughly a 4.551 risk-reward ratio, something that, in my view, has potential upside in an acquisition scenario and could unfold relatively quickly. That’s my take on it

Chris: That’s a great one. Ross I will go back to you. You mentioned earlier that you sort of had a short that you were looking at that might work with the Netflix trade. What was that?

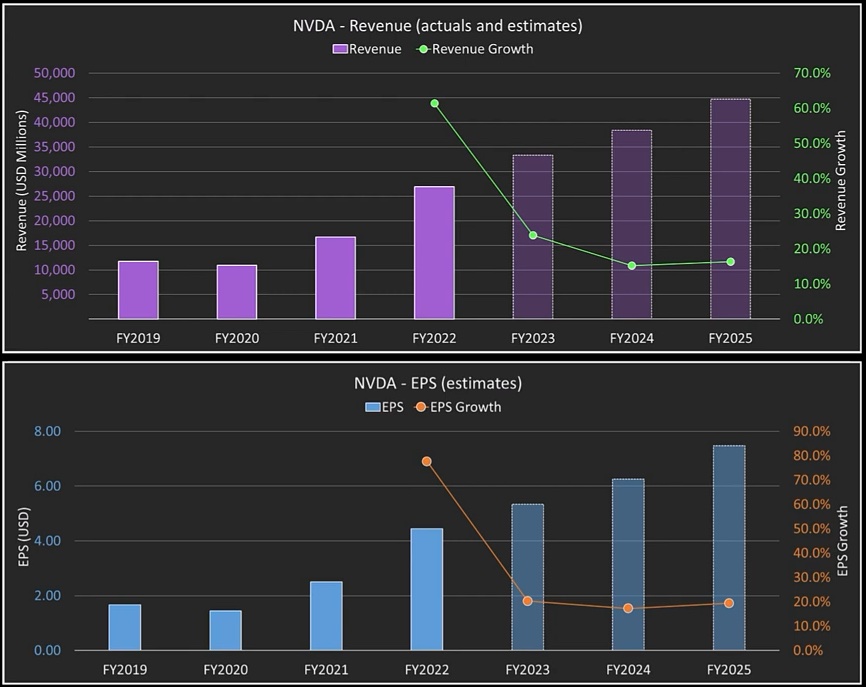

Ross: The company I’m interested in is Nvidia, a big player in the market. I’m leaning towards larger companies lately because I’m worried about liquidity issues with smaller ones. I had some promising options on my watchlist, but they haven’t performed well. I’ve seen them drop to prices where I thought of buying, but I’m unsure about their bottom, so I’m holding off.

Nvidia is known for making affordable graphics cards, which have been in demand during the pandemic. Now that things are returning to normal, their earnings are stabilizing. Some industries, like physical retail, saw a boost in earnings due to COVID-related factors, but those gains haven’t lasted.

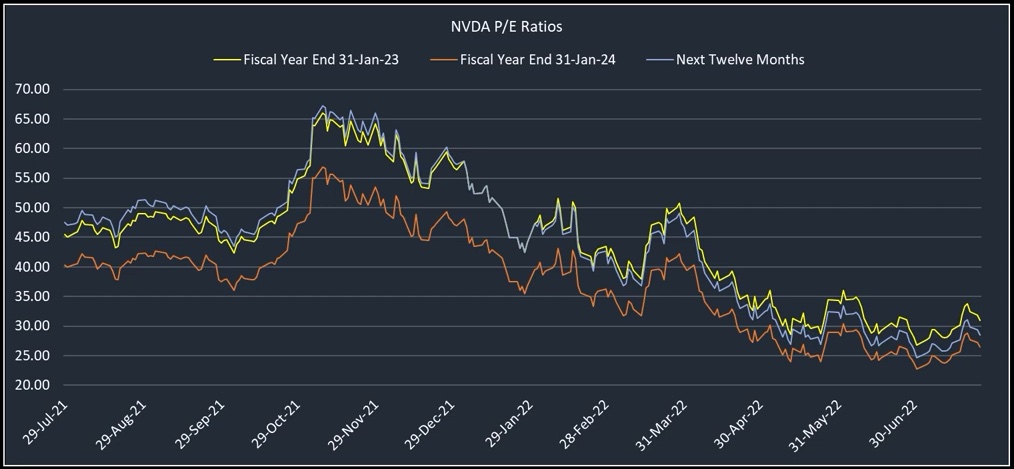

Nvidia’s stock has taken a hit, down by about half from its peak. Its current valuation, at 31 times earnings from January 2023, seems uncertain. Looking back, it was trading at 60 times earnings from January 2022. This suggests the market expects a downturn.

There are several reasons for this. Firstly, Nvidia may have been over-earning, especially with the surge in crypto mining, which drove up demand for their graphics cards. However, crypto mining demand is declining, with new methods emerging that don’t require powerful GPUs.

Additionally, the work-from-home trend that boosted Nvidia’s sales during the pandemic seems to be fading.

The recent profit warnings from Logitech and Seagate indicate a shift. Taiwanese sources suggest the chip shortage is less severe now. Korean companies no longer face anticipated inventory issues. Graphics card values are declining rapidly. PC demand is weak; prices dropped by at least 30% since last year.

Crypto mining is less profitable due to decreased trade value and production costs. Semiconductors, once unremarkable, saw a boom until 2018. Datacenter expansion, crypto mining, and cobalt boosted earnings. Now, chip shortages are easing, affecting stock ratios significantly.

Despite recent challenges, a long-term view shows a 600% outperformance by Netflix over in video. This informs my decision to take a long equity position. Similar to Raj’s perspective on WWE’s potential takeover, timing isn’t crucial. A few profit cycles could boost Netflix and in video, shifting the ratio significantly.

My long-short idea focuses on big, liquid names to mitigate risk in volatile markets.

The root of the subject, is intriguing when we discuss ratings. Something I’ve noticed recently is the potential for actual returns in bonds after a while. This could be an early sign of what I’m considering here: shorting a company that sells cheap products, like a consumer staple with a high price-to-earnings ratio, which usually does well during an economic slowdown.

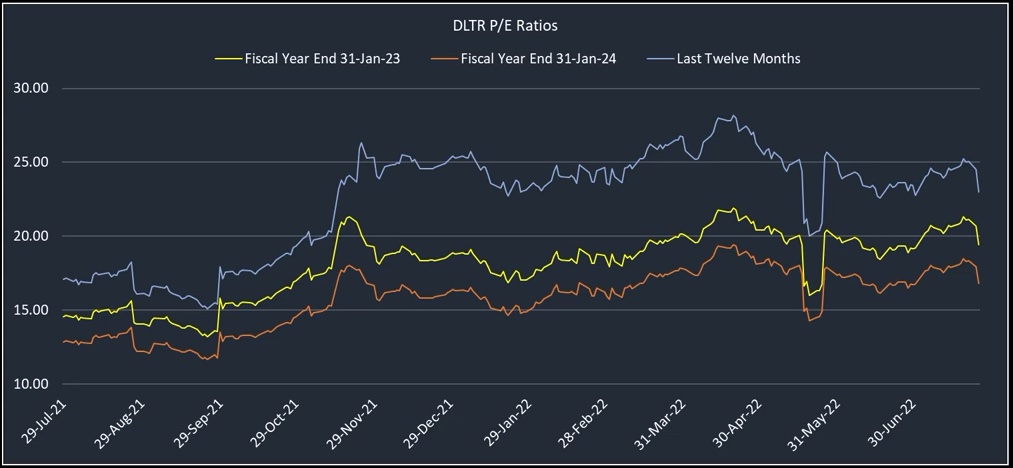

Now, regarding valuations, they seem to have peaked. Let’s delve into it. The company I’m eyeing is Dollar Tree Delta R, a discount retailer, as you’re probably aware. It’s part of Dollar Tree, known for its dollar stores including Family Dollar. This company targets the lowest end of the market, where most items are priced at a dollar.

Looking at the company’s metrics, its stock is at around $158 with a market cap of $35.5 billion. However, its price-to-earnings ratio sits at about 24, which is quite high for a retailer. Comparatively, many competitors trade in single digits or even lower.

Considering these factors, it seems overvalued to me, especially with no dividend yield. Despite its year-to-date outperformance, rising by about 12%, the current valuation appears steep.

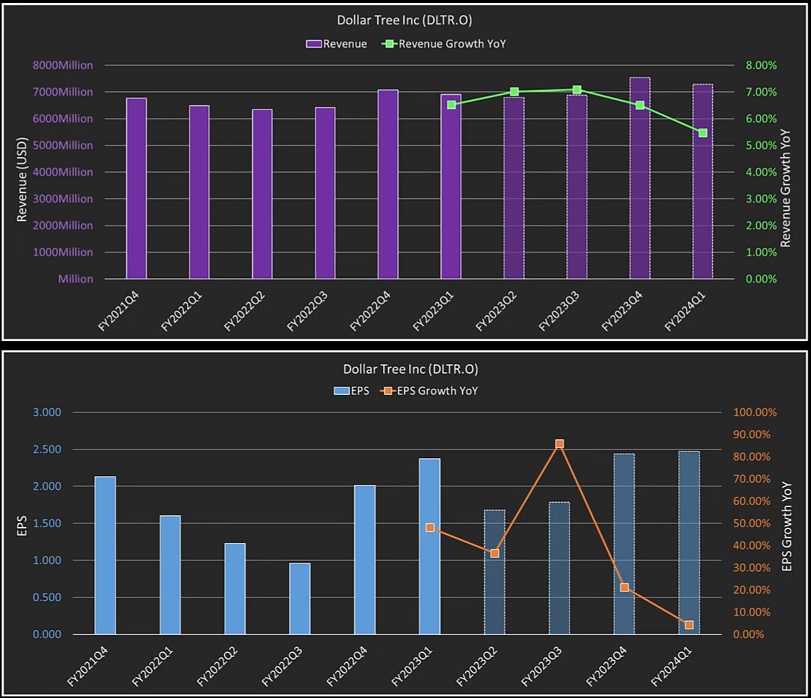

Now, shifting focus to the last quarter’s earnings report. They posted earnings per share of $2.37, slightly above the expected $2.10. Revenue also slightly exceeded expectations, reaching $6.9 billion compared to the anticipated $6.8 billion, showing a 69% year-over-year growth.

The company’s performance in the market wasn’t too impressive to me as it just kept pace with inflation. In the upcoming quarter, they’re expecting $1.68 compared to $1.23 previously, with slightly lower revenues at $6.77 billion.

Why should I bet against this company that consistently outperforms the broader market, especially during times of consumer confidence? It comes down to valuation and the potential for margin compression, as highlighted in recent earnings reports from Walmart and others.

The stock is trading at a significant premium compared to other consumer discretionary companies. Despite discount stores typically performing better during recessions, I believe macroeconomic headwinds and a potential market turnaround could lead to disappointment. Factors like higher commodity prices, transport costs, and supply chain disruptions could squeeze margins, especially since Dollar Tree has limited pricing power.

Looking at the company’s metrics, its forward P/E ratio is around 19, much higher than the sector average of around 11. While it may outperform slightly, I believe this overvaluation is unwarranted. The upcoming earnings report could serve as a catalyst for a reassessment.

Considering the current economic conditions and challenges like supply chain disruptions and high energy prices, I anticipate a slowdown in consumer spending, which could impact Dollar Tree’s performance negatively. Even if demand for their products remains high, I doubt we’ll see the same level of growth as before.

Historically, Dollar Tree has performed well during recessions, but this time, factors like higher commodity prices and supply chain disruptions pose significant challenges. The company’s lack of cash allocation strategies, such as dividend payments or stock buybacks, also raises concerns about its financial health.

In summary, I believe Dollar Tree is overvalued, and the current economic conditions don’t support its high stock price. Even in a flat market, I foresee a potential 15 to 20% decline in the stock price, which would still leave it overvalued compared to similar companies in the sector.

My strategy for the upcoming earnings report on August 25th is to buy September 155 puts and sell August 140 puts in a certain ratio. Alternatively, a simpler approach could be a one 3150 put spread in September, which offers a favorable risk-reward ratio given the current valuation concerns.

Dollar Tree is not immune to the challenges facing other retailers, and I believe its stock price could face downward pressure due to its inflated valuation.

Chris: It’s been a pleasure, as always. Thank you both for coming on the show. Sharing your market and of course, the ideas that you’ve been looking at for your portfolios as well. And look forward to catching up with you guys another time.