Chris Quill: Today, we have Edward Shek and Ross Williams with us. They’ll talk about financial markets and some specific stocks they’re considering. Let’s get into it and maybe you can start the ball rolling, Ross, today with your thoughts.

Ross: Last time, I mentioned I focus on businesses linked to the public sector or government. They seem more stable due to recent fiscal support. I also prefer big companies over small ones, but I’m exploring some exceptions. One interesting small-cap stock I’ve been eyeing is Cadre Holdings, worth just under $1 billion. It’s been on my watchlist for two months. Despite market turbulence, it’s been holding strong, up about 9.5% this year. What do they do? They make and distribute safety gear for first responders, like body armor, helmets, and handcuffs.

And, you know, if you’re going to go out and rough up some bad guys, this is the stuff that you would you would buy them. The company has been around for a long time, but they IPO’d in November of last year. They’re based in the US and sell into over 100 countries. Last year, they made $0.80 of earnings per share. It looks like this year that’s going to pull back to $0.53 of EPS. But looking through that, it’s because they heavily compensated management by virtue of stock. Despite this, the underlying earnings trends are still pretty good. They’re actually planning to issue some equity in the secondary market to increase liquidity in the stock. They’ve had two broker upgrades in the last month, which was on the back of them upping their own guidance at their first quarter earnings call.

Why do I want to own a thing in this sector? What am I looking to get the top down exposure to? Well, number one, all these European countries are upping their defense budgets now. The average NATO country at the moment spends only 2% of their GDP on defense, which is not a lot. And it looks like we’ve now got Finland and Sweden coming in as well. The American Rescue Plan has allocated $350 billion towards hiring and retaining police officers in the US. So that part of their spending is clearly, clearly going in the right direction.

Now, onto Albemarle, a $30 billion market cap company in the materials sector, specializing in chemicals for various industries. They have three business segments, with lithium being a significant part. This segment is expected to double to 86% of their total revenues by 2026. Lithium is crucial for batteries, especially for electric vehicles. The lithium market faces challenges due to limited reserves and processing capacity, mostly concentrated in a few countries. However, demand is expected to increase significantly in the coming years, driven by the shift towards electric vehicles and energy storage solutions. Albemarle has seen substantial earnings upgrades recently, driven by strong demand for lithium and the repricing of contracts. They plan to double their capacity by 2025 to meet growing demand.

Value is the main point here. Right now, they’re doing 100,000 tonnes out of 650,000. In 2025, it’ll be 200 out of 1.5 million, so their market share will drop from 16% to 13%. There’s been a rough week for a couple of reasons. One, governments are pessimistic about lithium, saying there might be a supply shortage from 2025 to 2031. Argentina also set a price cap last Friday, causing a big drop in the sector. This affects Albemarle too, even though they don’t operate in Argentina. China leads in processing, and with high demand, they could become a strong competitor. The lithium price hike affects battery pack prices, making electric vehicles less affordable. A global recession would decrease car sales, impacting lithium prices. Despite this, there’s ongoing investment downstream in battery production, indicating potential.

Regarding the company’s valuation, it’s trading at a PE of 18 times next year’s earnings and 22 times this year’s. Given the strong prospects, a target of 22 times earnings seems reasonable. Earnings are expected to be at the upper end of the range at $15. This puts the stock at around $330. Even after recent market movements, it’s holding steady, which is a positive sign.

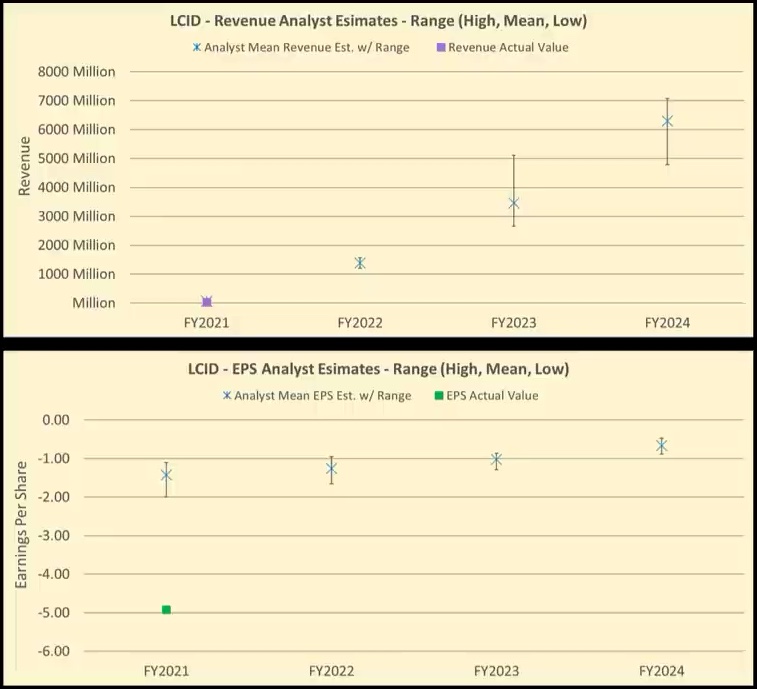

Now, onto another equity idea. Lucid Motors offers a fantastic product, but their business viability is uncertain. Their sedan, priced at $150,000, looks amazing, but their financials are shaky. Their valuation doesn’t match their performance, and they’re not making a profit yet. Despite having 30,000 reservations, their production capacity is limited, and their finances are draining fast. With the biggest shareholder being the Saudi Arabian Investment Authority, there’s skepticism about their future. They might run out of cash or need to raise equity soon. A put spread strategy could be an option for traders, given the uncertainty surrounding the company’s future. Overall, it reflects the trend of investors disregarding valuation for speculative bets in 2021.

The picture has clearly changed. That’s my view.

Ed: Now, I’ll talk about macro market stuff. It’s a very uncertain time. The market’s spinning its wheels. Many macro elements are uncertain. It’s hard to have a clear bias. We need fund managers to make decisions. There’s a lot of uncertainty.

Retail results show a mix of inflationary and deflationary factors. Job reports were strong, but the unemployment rate didn’t change much. Bond markets have shifted. Inflation is rising in Europe. The narrative of peak inflation is unrealistic.

It’s challenging to have a clear view. The markets are reacting to various factors. I haven’t made much money lately. I’ve been skeptical about energy and commodities, but I’ve been wrong. There might be a consumer-led recession, but it might not be a big deal.

Tech companies might not be cyclical, but the market is. Money went into tech funds, but it’s coming out due to performance. Trading long and short can still work, but it’s about avoiding risky moves.

Chris: Thanks for the insightful discussion. It’s been a pleasure.