Chris Quill: Today I’m lucky enough to be joined by Ross Williams and Jason McDonald. Gents, always fantastic to have you guys on and looking forward to what you’ve got to discuss today. And Ross, why don’t we start with you today?

Ross: We’re shooting this on Wednesday, August 10th, a few hours before the CPI is released. For those interested in the markets, it’s an important number, much like the last one. But anything we say now could change in the next 24 hours.

We’re pretty much in the middle of the second quarter earnings season. This one seems clearer than usual. Companies beating expectations are doing well, while even those missing lowered expectations aren’t tanking too hard.

What’s really catching my eye is the recent crash in some speculative business models. Companies that took big hits in 2020 are bouncing back hard.

Goldman Sachs mentioned last week’s huge long sales and short coverings, second largest in five years. And this thing they call “deep grossing,” which is hedge funds dumping shorts and selling longs, it’s one of the top five in the past decade. It basically means hedge funds are ditching risky bets they thought would fail, probably because they can’t handle the losses anymore.

While this is happening, retail investors might be piling onto these rising stocks, making things even crazier. It’s been tough for many hedge funds. It’s a good reminder that markets don’t always move in a straight line. When we’re in earnings season, individual stocks move based on their results. But once that’s over, the market focuses more on big picture stuff like CPI and job numbers. So, things might get less predictable soon, with macro factors likely becoming more important than micro ones.

Jason: we’ve seen it many times before, especially during the global financial crisis and more recently. There’s a lot of info out there relevant to how we’ll shape our portfolios.

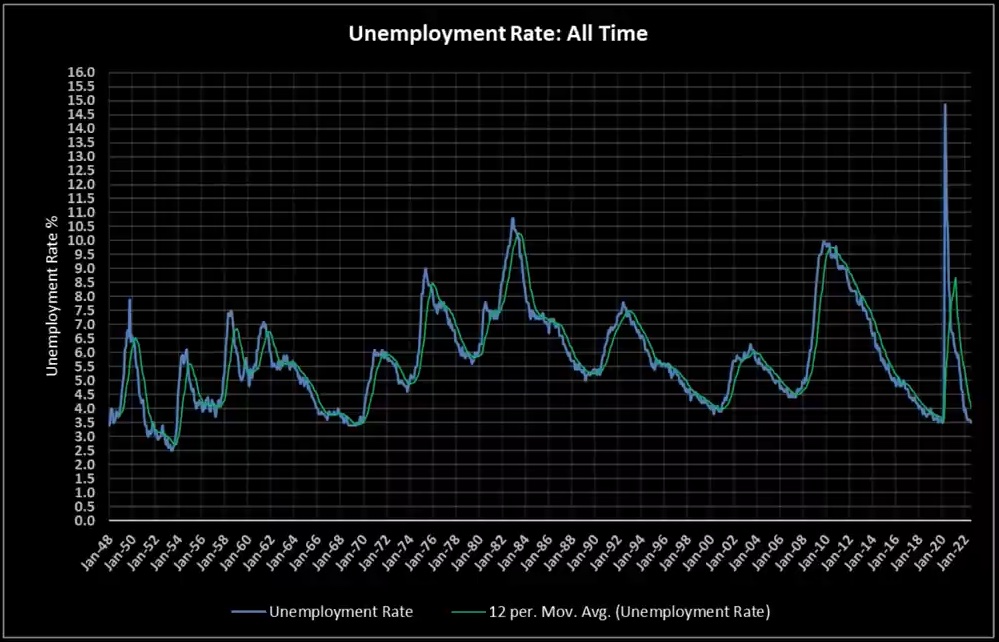

But it’s also summer trading now, so liquidity has dropped, which can lead to even bigger moves. Speaking of important figures, let’s talk about the non-farm payroll number from last Friday. Job growth hit 528,000 against expectations of 250,000, bringing us back to pre-pandemic levels of around 152 million total payrolls.

That’s quite something. Unemployment’s down to 3%, the lowest since the sixties. However, average hourly earnings are up 5.2% year-on-year, higher than expected. The issue here is that it exceeds the 2.2% inflation target. What’s interesting are the nuances within the report.

For instance, the participation rate, which is the number of eligible workers divided by the population over 16, is still low. So, there’s a shortage of labor, which could lead to future bottlenecks. Additionally, the labor force participation rate fell to 63.1%, indicating less labor supply.

Leisure and hospitality saw growth, as did government job creation, which isn’t necessarily a positive sign. There’s also a big difference between the household survey and the BLS survey, with the former showing more pessimism and a record deviation. The composition of job creation isn’t as optimistic either, with full-time workers decreasing while part-time and multiple job holders are increasing.

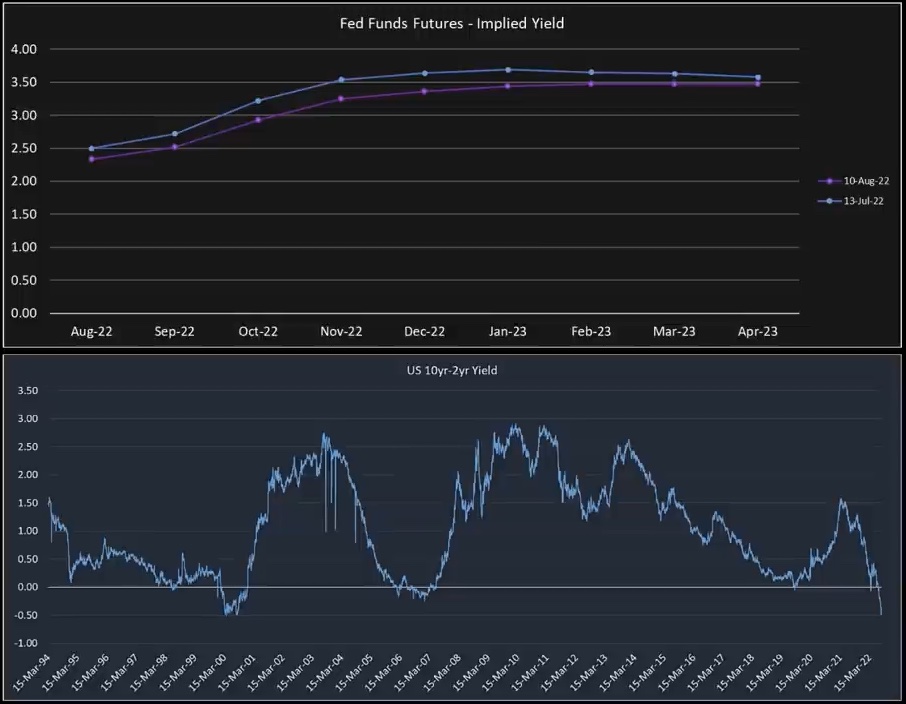

What’s the significance? Well, it could impact the Fed’s decisions. The strong rallies we’ve seen are partly due to speculation about a Fed pivot. But with these labor numbers, that’s likely off the table. Interest rate futures are now predicting a rise in Fed funds to 3.6% early next year, compared to the current range of two and a quarter to two and a half percent.

There’s also a greater inversion between the two-year and ten-year yields, with the two-year now yielding three and a quarter percent, almost half a percent higher than the ten-year. That’s my take on the macro front. And as Ross mentioned, we might see some excitement this afternoon when the CPI comes out.

Chris: cheers for that, Jason. There is there is plenty kind of to look at on that side. So that was really interesting. Kind of bright down on jobs and other economic factors. Ross, we can go back to you, can comment on that or we can go over to one of your stock ideas if you have it.

Ross: Yeah, I agree with Jason’s point. Now’s a crucial time to keep an eye on fixed income, currency, and commodities. The curve inversion, though it’s getting a lot of press, shouldn’t be brushed off.

Looking at the futures curve, it suggests a short, intense hiking cycle into 2023, followed by rate cuts. Some investors are banking on this, thinking it’ll bring short-term pain but ease next year. However, there could be a recession then, so I’m cautious about making long-term calls. While the bond market is usually reliable, it can still be wrong.

I don’t see any sectors with strong tailwinds for the second half of the year, which makes it tough to get excited. Normally, I’d look for a sector with favorable conditions and find ways to get exposure to it. But right now, besides utilities, nothing stands out.

So, I’ve got a long trade and a short trade. Whether to leave it as a short or pair it up is up to you. In terms of the spread, I believe the short side will be the main driver.

Let’s start with the short. I’m looking at restaurants, especially at the lower end. I see them facing challenges from all sides, with potentially weaker revenues and rising costs like labor and rent.

Inflation hits lower-income consumers harder, as they spend more on essentials like food and fuel. Meanwhile, higher-income brackets seem to be doing fine. That’s why I’m eyeing Domino’s Pizza, a familiar brand with a $14 billion market cap. But trading at 31 times earnings, it’s a tough sell for a company not showing much growth.

Domino’s has about 375 stores in the US, along with 6,000 franchises, mainly in the US and Canada. Their international franchising involves a master franchisee system, which affects revenue figures. Recently, they announced pulling out of Italy, which didn’t seem like a smart move in the first place.

Financially, their revenue for 2022 is expected to rise around 5% to $4.6 billion. But their cost of goods sold is growing twice as fast, potentially lowering profits by 7%. Given the competitive nature of the industry and changing consumer preferences, especially post-pandemic, I see challenges ahead for Domino’s.

If I take a longer-term view, could I see the stock trading at around $240? Maybe, but it’s a bit aggressive. So, I’m looking at buying a $370 put option expiring in December as a hedge or simply shorting the stock. Either way, it’s a cautious play considering the uncertainties ahead.

Chris: Awesome. On that note, Jason, let’s go over to you.

Jason: Yeah, sure. Actually, I have to say, on the subject of Domino’s, I remember going to Milan at the end of 2020 and it’s the first time I’d ever seen a Domino’s in Italy. And I had exactly the same thought process as Ross. It’s like, seriously, who the hell is going to buy Domino’s? But anyway.

So maybe I should have taken the cue earlier, although we’ve had some ups and downs. My focus is on a company called Mosaic. They have a market cap of $19 billion and closed at just above $54 per share. They’re big in fertilizers, leading in concentrated phosphate and potash for agriculture globally.

It’s a result of a merger between Cargill’s fertilizer business and IMC Global. They’re a major player, supplying customers in 40 countries and accounting for 13% of global phosphate and 11% of potash production. Most of their mining happens in North America, with phosphate rock from central Florida and potash from five North American mines. They process these into fertilizers and distribute them worldwide.

In early 2018, they bought a fertilizer business in Brazil for $2.5 billion, making them a top player in Brazil’s agri market. Their business is split into three segments: phosphates (40%), fertilizers (40%), and potash (20%) of sales.

Their earnings per share (EPS) are expected to grow significantly this year, from $5.04 to $13.30, a 164% increase. However, next year, there’s an expected drop to $10.50. Their price-to-earnings (PE) ratios are low, with a 3.9 times multiple this year and 4.9 times for next year. They offer a dividend yield of just over 8%.

The fertilizer sector is growing strongly this year, over 200% on average, but it’s expected to decline by 22% next year, slightly more than what Mosaic is expected to drop by. Compared to other big players like Nutrien and C.F., Mosaic has been a bit slow, which is why I’m focusing on it.

I’ve been buying their stock lately because of several factors. Even before the Russia-Ukraine situation, global fertilizer markets were facing disruptions due to rising natural gas and coal prices, especially in Europe and China. The war in Ukraine further impacted global fertilizer markets, affecting potash supply from Russia and Belarus.

Long-term, there have been improvements in productivity, partly due to better crop genetics and increased fertilizer use. Fertilizer prices have soared in the last two years, but farmers in industrial countries can still afford them, so availability becomes the main issue.

Mosaic remains optimistic about tight grain markets, which encourage continued fertilizer use despite rising costs. Financially, they’re doing well, generating $800 million in free cash flow in Q2, with $600 million spent on buybacks. They plan to continue share repurchases and may offer special dividends.

The stock was part of a consensus trade earlier in the year, but it lost momentum afterward. I still believe in its fundamentals and see its valuation as attractive. My short-term price target is $65, and while options aren’t appealing, I’ve started buying stock.

Chris: Cool. Good stuff. Thanks for that one, Jason. Let’s go back to you, Ross, and see if you have another idea on the other side of that Domino’s trade.

Ross: Yeah, I do. But I want to comment on Jason’s idea too. When commodity companies start buying back their stock and paying out special dividends, it’s a strong signal. It’s like saying, “Okay, we’ve got a lot of money here.”

While I don’t have a particular view on gas prices, if they were to go back to normal, this company’s earnings would shoot up. If that happens while this year’s EPS is shrinking, it’s really interesting.

Earlier, I mentioned I wasn’t excited about any sector. Trying to pick one felt like a struggle. It was like a reverse beauty contest, looking for the least ugly stock. Not a fan of that.

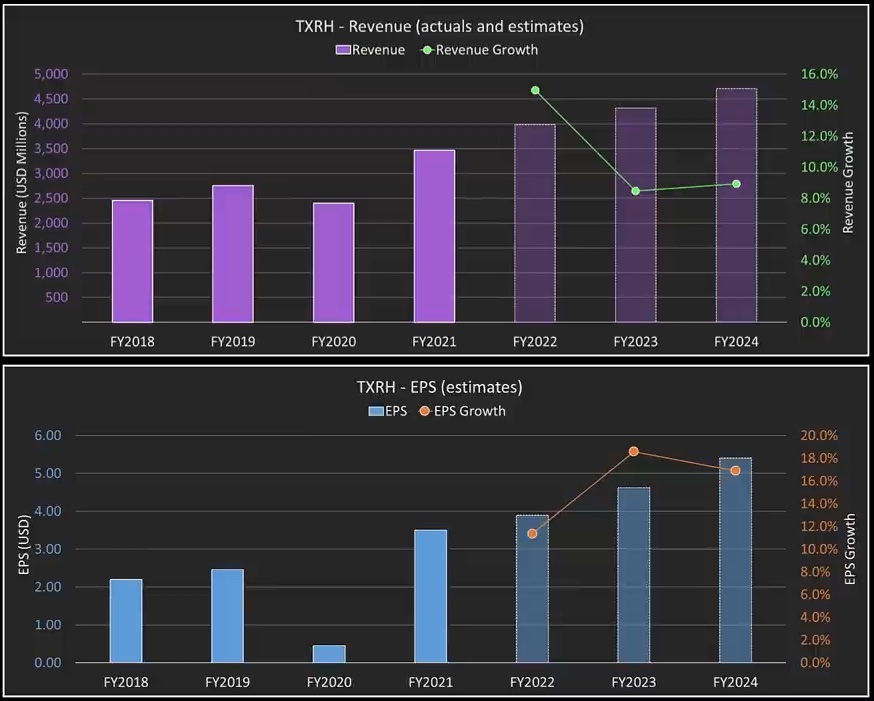

The one I settled on was Texas Roadhouse. I expect this trade to be driven more by shorting than buying. It doesn’t matter much what the long side does as long as there’s outperformance. Staying neutral is key.

If a sector has a big sell-off, you shouldn’t get hurt too much. But the restaurant sector is tough to figure out. Texas Roadhouse has three divisions: the steak restaurants, the sports bar concept Up Threes, and Jaguars, which I think is chicken-based.

The company struggled a bit over the years, mainly being a dine-in place. Last year, they made $3.50 in earnings. If we look at EPS from 2021 to 2024, earnings are growing by about 70%. Not quite doubling, but still good.

With that growth, even if the market is under pressure, the short side might go down more. So, short Domino’s, long Texas Roadhouse could be a good trade. Maybe the long side isn’t as convincing, but that’s the way it goes.

Chris: Sure, sure. Jason, anything more to to add?

Jason: Well, I think Ross brings up a really interesting point about comparing companies in a struggling sector. It’s like a race to the bottom, but who hits it first?

Looking at the Texas side of things, there’s a decent amount of people betting against the stock, which could actually work in its favor. Short interest is over 9% of the free flow with six days to cover.

In the restaurant industry, especially casual dining, there are a lot of pressures. But these guys seem to be the best among them. It’s like they say, for every downside, there’s an upside.

One reason for the high short interest might be their operating expenses, especially wages. Last year, 35% of their expenses went to wages, with employees making just over $26,000 a year on average.

Despite being in a struggling sector, they trade at a premium, closer to McDonald’s valuation. That’s interesting because you’d expect fast food to be less economically vulnerable than casual dining.

They’re priced at a big discount compared to companies like Darden and Brinker. The question is, what will happen to their margins going forward? But as Ross said, you’re looking for something that can hold its own even if the sector takes a hit.

Chris: guys thank you for your insight today.