Chris: This time I’ve got Edward Shek and Anthony Iser joining me. These guys have over 50 years of professional trading experience between them. So we’re in luck today. Anthony, take it away.

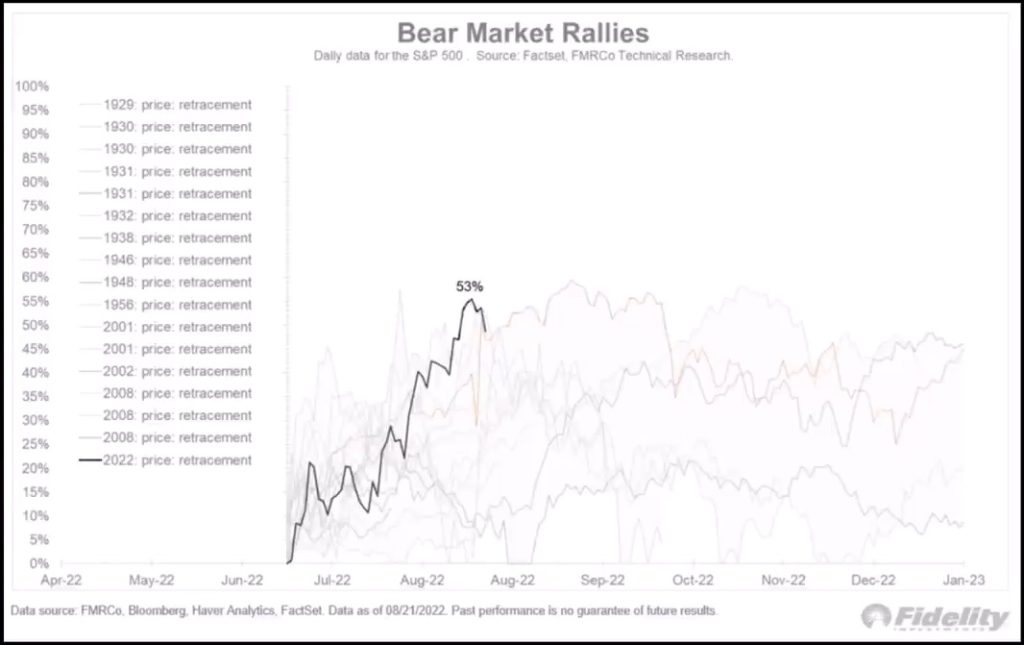

Anthony: Firstly, I see the recent market rally as a bear market one. Looking at historical patterns, it’s pretty standard for bear market rallies to retrace about 50% of their initial decline. And that’s what we’re seeing now since June.

The main reason I’m still bearish is because of factors like interest rates and inflation. Real rates are still very low, historically signaling recessions. If this trend continues, we could end up in a full-blown recession, which would hurt earnings and the market.

The market seems to be betting on lower inflation, but I think it won’t drop as quickly as expected. This means the Fed might have to raise rates faster than anticipated. The market currently expects rates to peak around 3.6% by December, but I believe it could go higher and later, putting pressure on both the economy and the markets.

Looking at historical data, when CPI levels were similar to now, bond yields were much higher. So either inflation drops dramatically, or rates need to go up more, which could be bad news for the economy and the markets.

Even if inflation remains low for a few months, it’ll still be high by Christmas. This makes it unlikely that the Fed will consider cutting rates. Of course, these forecasts might be wrong, but for now, I’m leaning towards higher rates for longer.

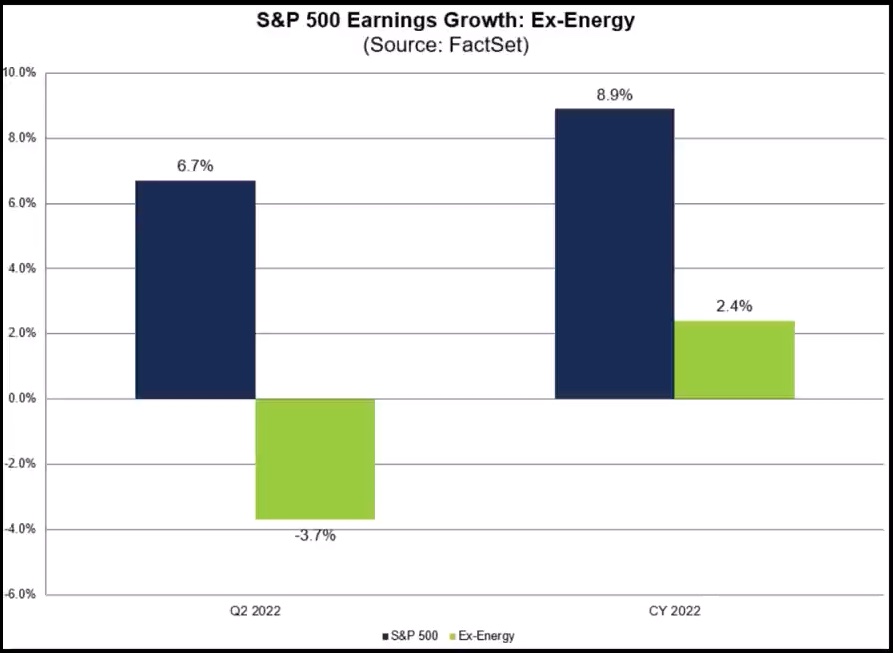

This sets the stage for potential earnings and market risks. Last quarter, S&P earnings growth was driven mostly by energy. Excluding energy, there was a decline, hinting at underlying issues. With energy prices falling, this tailwind for earnings could vanish, leading to downside risks for both earnings and the market.

Historically, a rule suggests that a market bottom needs the sum of the S&P’s P/E ratio and CPI to be below 20. Right now, we’re above that level, indicating further potential downside.

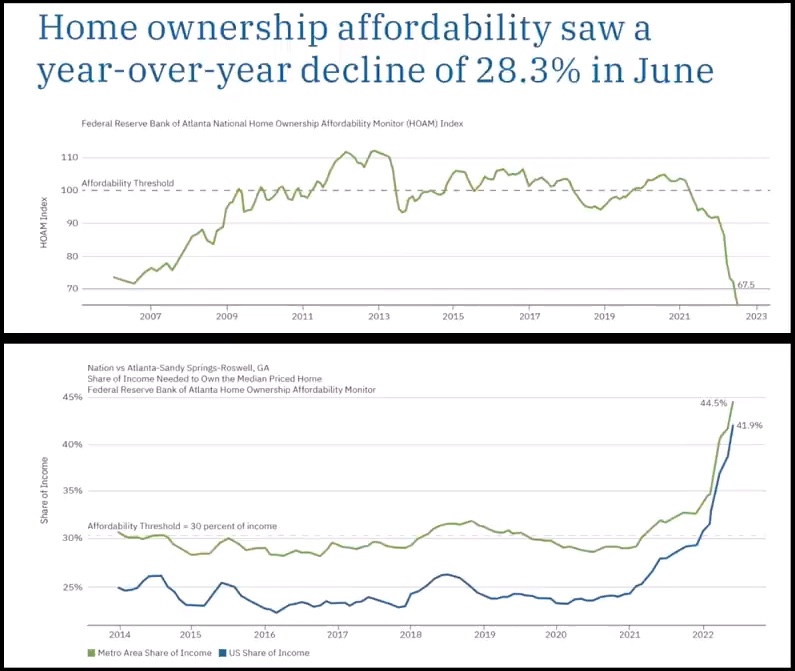

Now, onto a more specific idea: housing. US housing is facing pressure, mainly because mortgage rates are rising. Most mortgages are set below 4%, discouraging people from upgrading their homes. Instead, they might opt for smaller upgrades to avoid higher rates. This reduced demand is causing home prices to fall, with many builders already slashing prices.

Given these macro trends, I’m considering shorting a homebuilder like Lennar. Their recent data shows a decline in new home sales and rising costs, which could further pressure margins. Other catalysts, like the Fed’s upcoming meeting and economic indicators, also point to potential downside risks for the housing market.

So, in summary, I’m looking at a macro trade here, potentially shorting Lennar due to the broader housing market challenges and specific company factors.

Ed: Yeah. Nicely explained. I agree completely. Let’s discuss the big picture. I’m focusing on short-term global trading right now, but I’ll approach it from a different angle than Anthony. He’s starting at the right place.

Keep in mind, if the Consumer Price Index (CPI) stays flat for a year or four months, by December it’ll be around 6%. Assuming the Fed keeps the funds rate at 3.5%, that’s a 2.5% gap. Currently, it’s at 6%, so 2.5%.

Right now, it’s at 2%. Jerome would be happy because he could claim we’re nearing neutrality. However, the risk, in my view, is inflation going up. Unlike Jan Hatzius and Goldman’s view, I think the market is too focused on terminal rates.

One of the drivers of the recent market rally was poor results being as expected, which is different from upgrades. Also, extreme positioning and covering positions. Despite some correction, there’s still this idea that the Fed might cut rates next year, sparking a risk-on rally.

Part of it is because the ten-year yield has gone above 3%. If inflation remains around 3.5%, and the market remains stable, why is that good for profits? The market is forgetting that QE and cheap money were the main drivers of the rally for the last 15 years.

If things get tough, sure, maybe the Fed will cut rates. But if they do, do you really want to buy into that market? To me, it signals a hard landing. Look at 2017-18: the Fed raised rates to 2.5%, stayed there for four months, then had to reverse course due to economic problems and COVID.

Now, rates could go up to 3.5% or higher. We also have structural supply-side inflation, which limits the Fed’s ability to cut rates. Plus, there’s more debt in the system. So, if the Fed does cut rates, it’s not a good sign for risk assets. I’m bearish and selling rallies.”

It’s important to remember why I’m bearish and what could change my view. If there’s a rally based on some dovish news, just stick to the plan. Be patient and wait for the market to turn. I need to see positive changes in wages, productivity, investment quality, job creation, and inflation for my view to change.

Buying into the market because it’s not as bad as it could be is different from starting a new bull market, which requires real value-added job creation, increased purchasing power, and lower yields. None of that seems likely based on current data.

I recently looked into a $14 billion agriculture services company. It’s global and has three segments: insecticides, herbicides, and fungicides. Climate change is a big issue affecting crop yields globally, which is a tailwind for this business.

Food inflation, driven by climate change, is a concern for governments and growers. This company is positioned well in the market, but its growth prospects are moderate. It’s a low-beta stock with steady growth potential.

Patents give the company a competitive advantage, but it faces risks like a strong dollar and input price fluctuations. From a valuation perspective, it’s slightly premium, but justified given its growth potential and catalysts.”

I’m considering a holding position on this stock, waiting for November options to become available. If the position starts losing money, I’ll cut it and enter a new position. Rolling the position without being up or flat doesn’t make sense. Overall, I’m aligned with Anthony’s macro view, seeing downside risks in the current market environment.

Chris: Good stuff, fantastic depth from from both of you in those ideas so far. What about on the long side? Are you thinking of anything that?

Anthony: I’m curious about companies with steady earnings in volatile times. My short idea is related to construction companies facing headwinds. But I’m more interested in Fortinet, a cybersecurity company.

Fortinet is a $40 billion company with a share price of $50.59. Its valuation is high, with sales growth of 30%, 20%, and 20%, and EPS growth of 32%, 23%, and 23% for the next couple of years.

The stock fell 20% recently due to missed expectations and service revenue decline. But the reasons for the decline make sense: issues in Russia, delayed service contracts, and supply chain problems.

Despite the decline, analysts upgraded sales and revenue, which gives me confidence in the company’s explanation. Fortinet offers both hardware and software solutions for cybersecurity, serving various industries and countries.

The cybersecurity market is worth $150 billion and growing by 10%. Fortinet is a major player, especially in hardware, where it has a significant market share.

Their growth is driven by increasing complexity in cybersecurity threats and a focus on reducing complexity for customers. They invest heavily in R&D and have strong customer retention and expansion.

I’m optimistic about Fortinet’s future growth prospects, especially with their focus on operational leverage and expanding customer base. My trading strategy involves buying December $55 calls and selling October $50 calls to capture potential earnings and market movement.

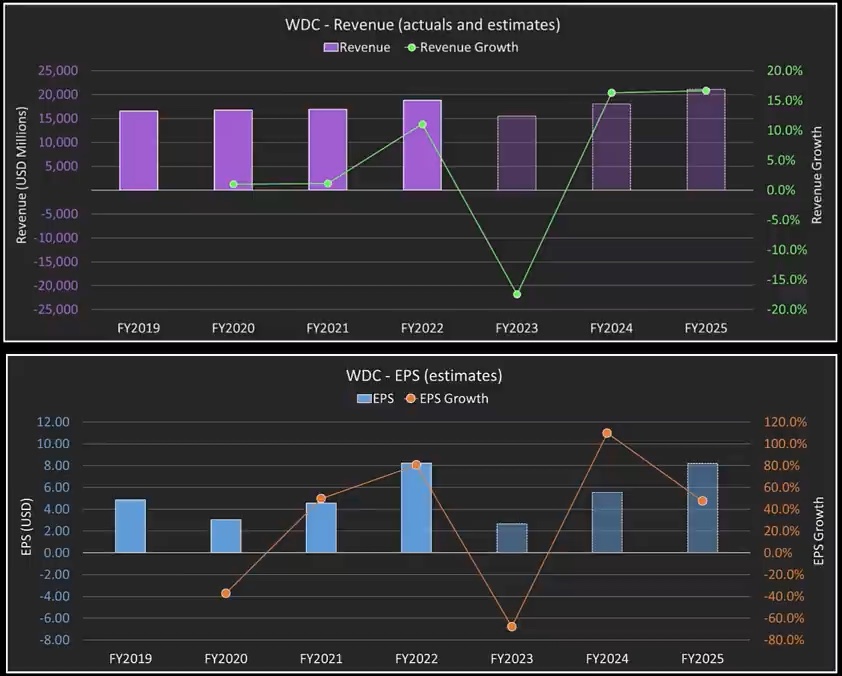

Ed: Excellent. Thank you, Anthony. I’ll quickly go through this. Western Digital Corp, valued at $16 billion, deals with IT hardware, storage, and peripherals. They make and sell data storage devices like hard disk drives and solid-state drives for various devices like computers, notebooks, PCs, gaming consoles, set-top boxes, mobile phones, tablets, wearables, and data centers.

Their cloud business is doing well, especially with exposure to automotive, Internet of Things, consumer products, industrials, and connected home applications. They sell their products through OEMs, distributors, and retailers. The company is divided into three segments: cloud business, business to business, and business to consumer. Their clients include AMD, Broadcom, Microsoft, Oracle, SMP, and S&P Marvel.

Their competitors include Intel, Micron, Samsung, Seagate, and Toshiba. They had a decent Q4 in 2022, with revenue up by 11% and earnings also up. However, looking at 2023, there’s been a significant downgrade in revenue, down by 18%, and earnings down by 70%.

Though they’re expected to recover slightly in 2024, it’s not much of an improvement. This indicates weakness in their business. Their cloud business saw an 18% increase quarter-on-quarter but only a 5% increase year-on-year. While the cloud business is still solid, the overall hardware business is underperforming, which could be hard to turn around.

Their client business is down by 5% quarter-on-quarter and 14% year-on-year, indicating a deceleration in growth. The consumer business is also down by 9% quarter-on-quarter and was down by 23% year-on-year, showing a continual decline.

The CEO previously mentioned optimism about demand for storage and new products driving growth, but recent performance suggests otherwise. With all these factors pointing towards a downward trend, it’s hard to see the stock rallying anytime soon.

Their enterprise value investment in cloud storage and data management might not help them grow their market share, especially with large competitors and declining average selling prices.

Their balance sheet shows some strain, with negative cash flow in the last earnings report and limited ability to do more acquisitions due to leverage. Overall, it seems unlikely that they’ll be able to trade their way out of their current situation.

Considering all this, it’s doubtful that a transformational deal could turn things around for them. The stock has fallen below my previous price target, and future earnings don’t look promising either. So, it might be wise to consider options strategies to capitalize on the expected decline in stock value.

Chris: Good stuff guys. Let’s let’s finish up there. Thank you both for coming on today.